Despite fears of the Covid-19 pandemic adversely impacting China’s commercial housing market, it has posted record area and volume sales during the September-October period. However, one local government has cast a shadow over this good news by adopting a new policy of encouraging price cuts.

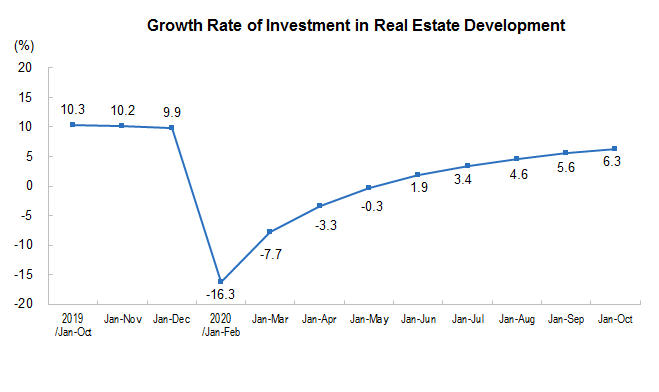

During the first 10 months of this year, total investment in real estate development in China totalled 11.66 trillion yuan (US$ 1.77 trillion), up 6.3% compared with the same period last year, according to data from China’s National Bureau of Statistics (NBS). The investment in residential projects, in particular, has increased by 7% year on year (yoy) during the same period, hitting the 8.63-trillion-yuan mark.

This year, the Chinese real estate market – always very active during the months of September and October – beat market predictions despite fears of a negative Covid-19 impact.

During these two months, which the market refers to as “golden September and silver October”, the total sales area of commercial housing was 348 million square metres, up 11% yoy, and the sales volume came in at 3.47 trillion yuan, up 20% yoy, according to NBS.

Source: NBS

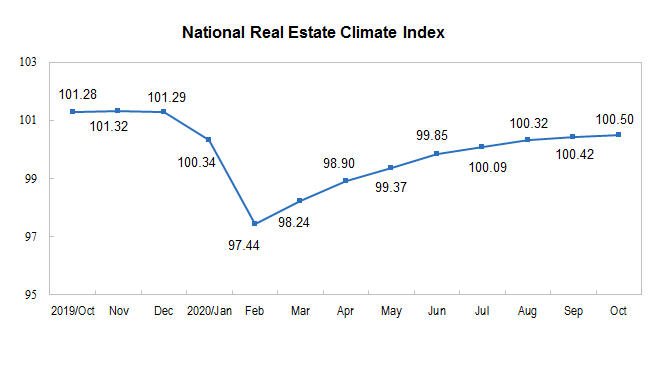

The market was especially hot in October, when the real estate development climate index reached 100.50, slightly lower than the 101.28 recorded for last October, notes NBS. But, given the pandemic’s expected impact, analysts are very positive on these numbers, calling this year’s golden September and silver October performance the best ever and voicing expectations that sales volumes for 2020 will come in at 17 trillion yuan.

Source: NBS

But the numbers may not tell the whole story. This week, a local government rolled out new rules designed to encourage property developers to cut prices. But going against the trend of record sales overall, the local government in Harbin, a city in northeastern China that has experienced population outflows during the past few years, issued 14 new rules designed to encourage and advise property developers to provide discounts when selling residential properties and apartments. The new rules also offer more relaxed policies to enable buyers to use housing provident funds.

Although the new rules may be related to the impact of the Covid-19 pandemic and the recent population outflows, whether they will kick off a trend of cutting housing prices in other second- and third-tier cities in China is subject to discussion.