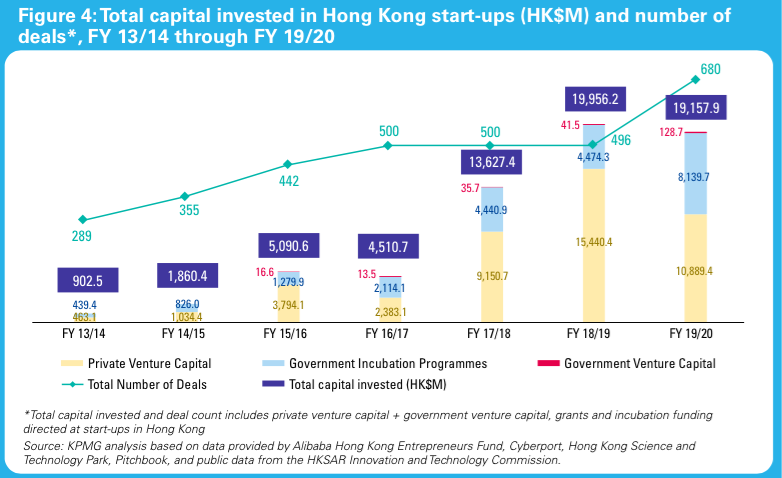

Despite the highly volatile environment resulting from the Covid-19 pandemic, Hong Kong-based startups continue to attract steady interest from investors. A new report released by KPMG and Alibaba Entrepreneurs Fund (AEF) shows that funding for startups in the city in 2019/20 was roughly the same as in the last financial year.

Startups in Hong Kong were able to raise a combined HK$19.16 billion (US$2.5 billion) off 680 deals. Most notably, support from government incubation programmes almost doubled, growing to HK$8.13 billion in FY19/20 from HK$4.47 billion in FY18/19.

“To build on the efforts that both the public and private sectors have been making over the last few years to support the entrepreneurial ecosystem in Hong Kong, it is very important to continue to support growth-stage startups,” explains AEF executive director Cindy Chow. “In particular, we need to attract more investors who are interested in providing beyond Series A venture capital funding and supporting startups to expand to the Greater Bay Area. We should also think about different ways of financing, including venture debt, which is still not very common in Hong Kong.”

As the social and economic impacts of the raging pandemic continue to be felt, a growing number of companies are looking to use products and services of startups. According to the survey, 34% of respondents have an increased interest in the business offerings of startups, compared with only 19% for corporates. Moreover, respondents think startups are likely to face less disruption from Covid-19 than corporates, the report says.

While the local startup scene appears to have weathered the initial storm of the pandemic, Hong Kong needs to address several hurdles facing startups looking to continue operating in the city. Specifically, creating a welcoming environment for entrepreneurs is important. While tax and government incentives remain the top reasons for entrepreneurs in deciding to set up in Hong Kong, a significant portion of them also say that high costs and poor access to talent are hindering the city from cementing its position as an innovation hub.

Entrepreneurs also cite the lack of support in such areas as innovation and technology, noting that it is not enough for the city to just provide a location for fintech startups.

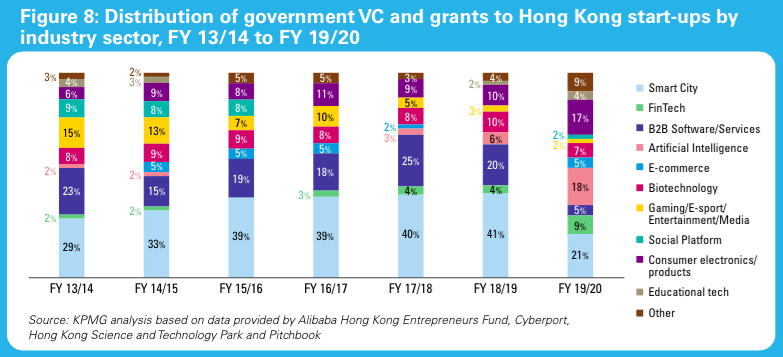

“While fintech continues to dominate Hong Kong’s entrepreneur scene, we believe other priority innovation sectors, including biotechnology, smart city, artificial intelligence and robotics, could be better supported,” says Irene Chu, partner, head of new economy & life sciences, Hong Kong, at KPMG China.

“More attention should also be given to developing a more robust technology transfer infrastructure to help commercialize Hong Kong’s strong academic research capabilities. Government regulation also has a key role to play in creating optimal conditions for Hong Kong startups to thrive,” she adds.

Nevertheless, Hong Kong’s ecosystem of entrepreneurs continues to evolve. According to KPMG, there has been some diversification as regards the types of startups operating in the city since the fintech trend started taking root globally in the early 2010s.