The repeated cycle of tightening-relaxation-tightening of restrictions in response to the resurgence in Covid-19 infections is expected to result in a steady but bumpy recovery for the real estate market for the rest of 2021.

On the other hand, the pandemic has accelerated some megatrends that are expected to have varying repercussions across all real estate sectors, from positive for industrial/logistics to disruptive for traditional retail.

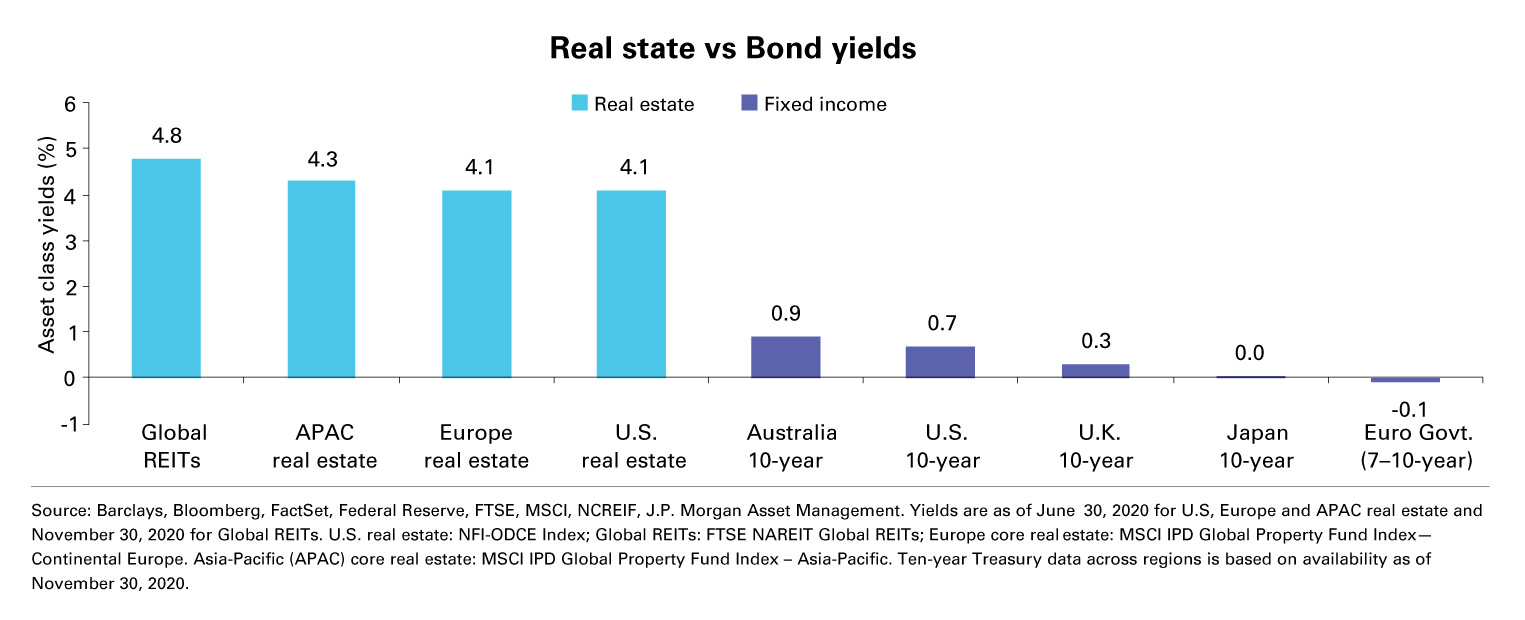

Real estate asset managers believe that in this kind of market environment, informed asset selection is more important than ever in building diversified real estate allocations. Also, real estate is expected to do much better than fixed income assets.

Logistics

In terms of investment opportunities one sector that is expected to do well post-pandemic is industrial/logistics as it rides on rising domestic consumption and a recovery in global trade.

“Asia-Pacific logistics rents are expected to rise across all markets in 2021. Tier-1 cities in Mainland China will edge out Greater Tokyo and Singapore as the drivers of regional logistics rental growth, with the rate of increase in Beijing, Guangzhou and Shenzhen set to accelerate on the back of a recovery in leasing demand and limited urban supply,” according to the CBRE “APAC Real Estate Market Outlook 2021".

This view is echoed by J.P. Morgan Asset Management in its “2021 Global Alternatives Outlook” where it says the growth of industrial/logistics assets at the expense of retail is not new but has been fast-tracked by the pandemic.

“In a low-rate environment, this expanding opportunity set can offer long-duration, stable cash flows and the potential for yield enhancement over core bonds,” according to J.P. Morgan AM. “The industrial/logistics sector appears to be the greatest beneficiary of accelerating megatrends. The continuing shift to e-commerce, along with technological leaps in connectivity, cloud computing and the internet of things (IoT), is creating demand not only for traditional industrial assets but also for specialized core assets, including data centres, cold storage and truck terminals.”

Growth in the retail property sector is expected to be slower than in the logistics sector depending on the geogrpahic market.

Retail

Although retail properties have suffered significantly as Covid-19 has hastened the trend toward online purchases, J.P. Morgan AM says it is not time to abandon the sector but rather to take a more discerning look at its variety of property types and to be laser-focused on diligent asset selection.

In Asia-Pacific, which is leading the Covid-19 recovery globally, the oversupply of mall space is not as significant a headwind relative to other regions, and distressed properties are fewer.

“Here, much of the pain has been due to tighter social distancing measures and a loss of tourist demand, which should rebound when travel restrictions are lifted. Retail sales have bounced back to the pre-pandemic levels of 2019,” according to J.P. Morgan.

Retail leasing demand is expected to pick up over the course of 2021, with half of respondents to CBRE Asia Pacific’s October 2020 Retail Occupier Flash Survey stating that they intend to proceed with new store openings this year.

“Gateway cities will remain the primary focus for international retailers, with many groups focusing on Asia-Pacific for business growth due to the region’s relative success in containing the pandemic. Mainland China, where brick-and-mortar retail operations are largely back to normal, will see the strongest interest. While European and US retailers retain a strong appetite for expansion, travel restrictions continue to hinder site visits and leasing decisions,” according to CBRE.

Office

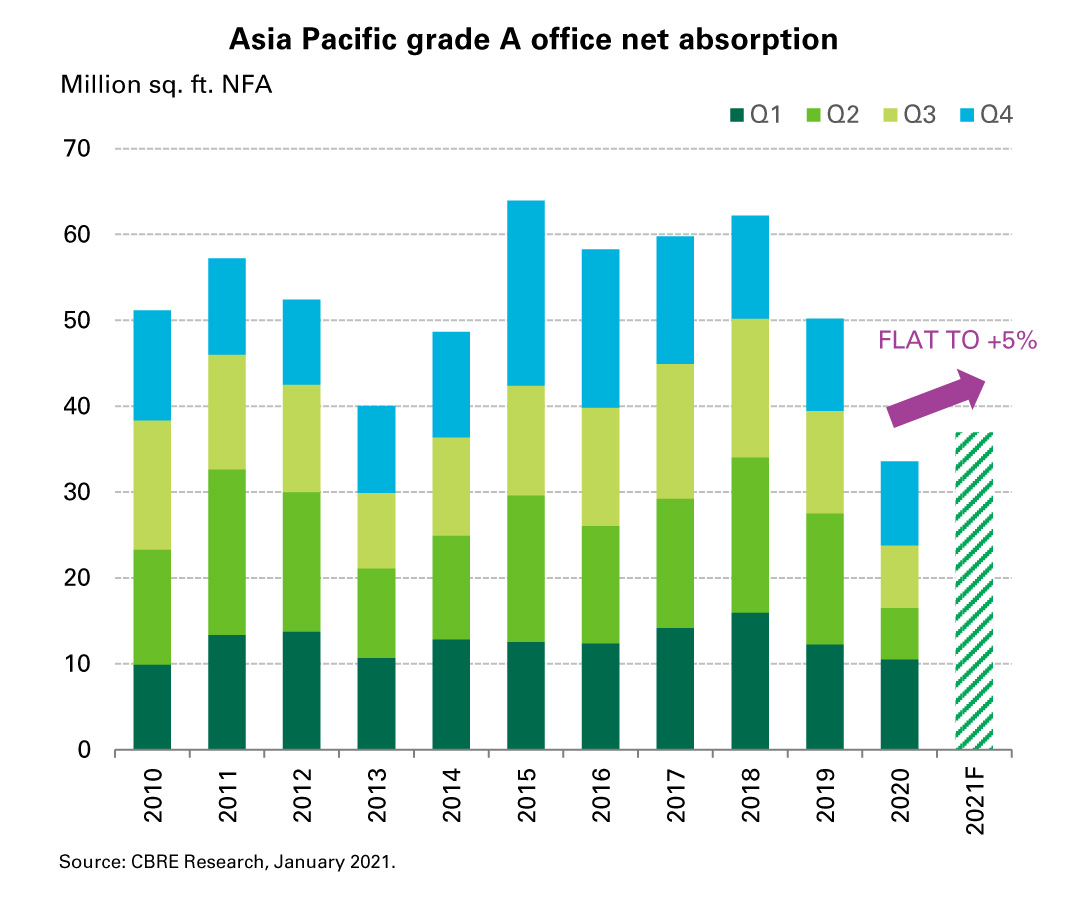

In Asia-Pacific, J.P. Morgan AM argues that the office leasing space is expected to remain stable as more workers return from their work-from-home (WFH) environments more quickly than in other markets.

“The Covid-19-induced recession has impacted the APAC office market as well, tempering demand, increasing competition for tenants and pressuring rents. Cyclical supply-demand dynamics, coupled with greater uncertainty around the timing of the recovery, requires increased scrutiny of markets, asset characteristics and tenant profiles. What’s more, given tighter living quarters in many markets and less historical adaptation to, and perhaps less cultural acceptance of, WFH, the trend has progressed more slowly and the return to the office has been generally swifter,” according to J.P. Morgan

CBRE, however, expects Asia-Pacific Grade-A office vacancy to rise to an all-time high of 16% by end-2021 due to the combined impact of subdued demand, large new supply and excess sublease/shadow space.

New Grade-A office supply in the region is projected to reach 58 million sq. ft. of net floor area (NFA) in 2021, a slight increase on the 55 million sq. ft. NFA registered in 2020. New supply will be concentrated in Mainland China, India and Southeast Asia (excluding Singapore and Vietnam), where completions due to come on stream this year will account for an average of 5-10% of existing Grade-A stock.