Investment managers raised a minimum of US$26.2 billion for real estate investment into non-listed real estate in Asia-Pacific last year, indicating continuing strong investor appetite for the asset class despite the Covid-19 pandemic, a new survey shows.

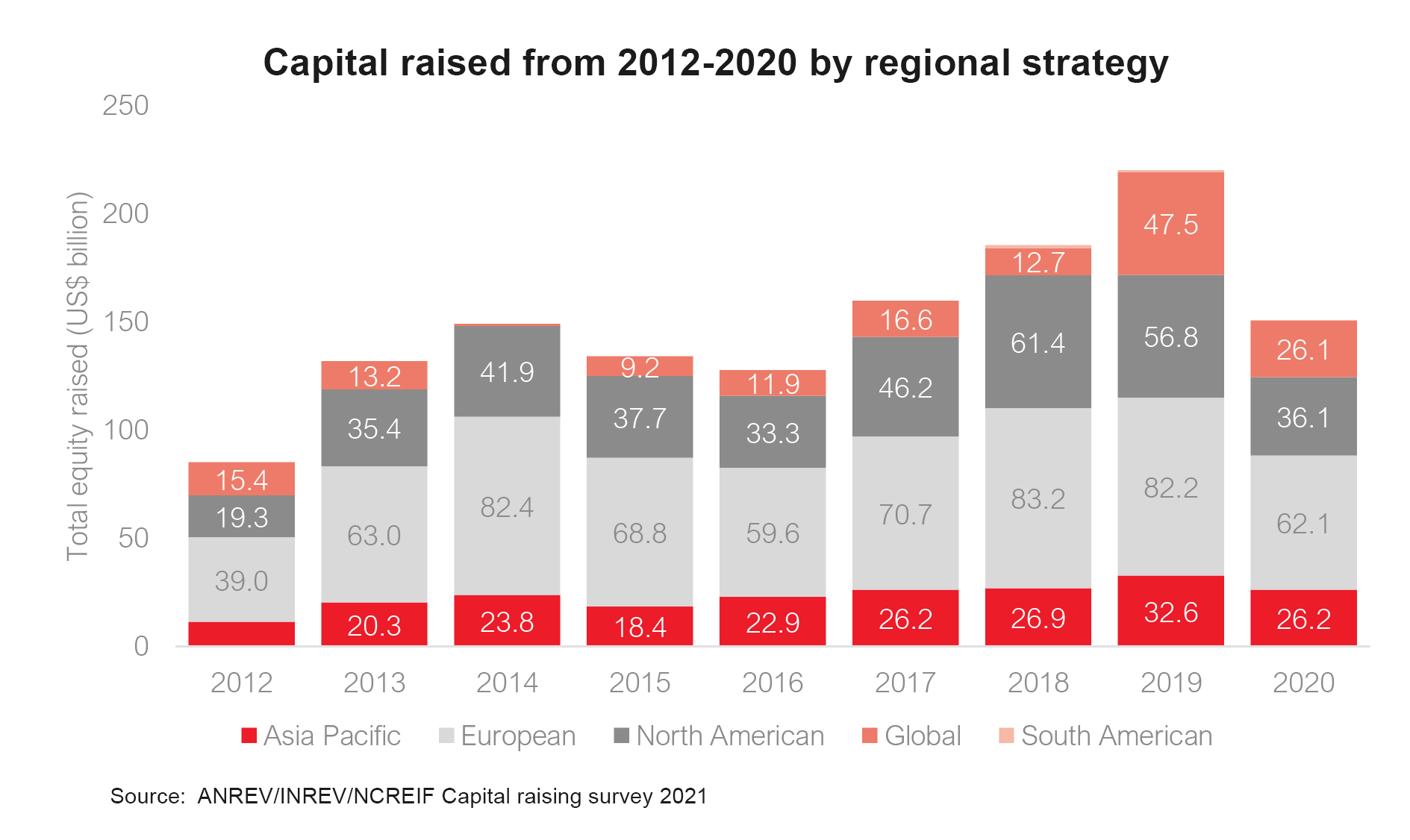

Although marking a decrease from the record US$32.6 billion raised in 2019, the amount reflects the high levels of capital raised in the immediate years before the global crisis (US$26.2 billion in 2017 and US$26.9 billion in 2018), according to the annual capital-raising survey by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), the European Association for Investors in Non-Listed Real Estate Vehicles (INREV) and the National Council of Real Estate Investment Fiduciaries (NCREIF).

Globally, US$150.7 billion was raised for investment into non-listed real estate across the world in 2020. Nearly a third of the managers surveyed said they had not raised any new capital during the year, which is not surprising considering the record level of capital raised in the preceding years.

Investment managers are more positive about raising capital in 2021 and 2022. More than two-thirds (76%) of investment managers expect an increase in near-term capital-raising activity, the highest proportion since 2015 and compares to 69% in early 2020.

On average the capital raised by individual vehicles was higher than in 2019 except for those with a North American regional strategy. This is more striking for global strategies, where an average of US$1.0 billion was raised compared with US$0.6 billion in 2019, clearly indicating a concentration of the capital raising activity on fewer vehicles from fewer managers, the survey finds.

As a proportion of new capital raised, 17% were assigned to Asia-Pacific vehicles, while 41% went to Europe and 24% went to North America. The remaining 17% was targeting global strategies and tended to raise a notably larger amount of capital per vehicle than the 2021 average.

Despite this, Asia-Pacific investors became the second largest source of global capital in 2020, reaching a share of 30%. European investors made up 48% of the total, while North American investors slid into third position making up 22% of total capital raised, the lowest level since 2015.

Of the total capital raised globally, a record 60% (US$90.7 billion) was destined for non-listed real estate funds. For Asia-Pacific strategies, the proportion was 63% (US$16.4 billion). This preference for non-listed real estate funds might have been reinforced by the travel restrictions in place due to the Covid-19 pandemic.

Amélie Delaunay, ANREV director of research and professional standards, comments: “This year’s capital-raising survey shows incredibly encouraging data on investor appetite for non-listed real estate in Asia-Pacific and globally. Although the amount raised for strategies in Asia-Pacific and globally fell in 2020, it should be seen in the context of recent years, which indicate a normalization of capital-raising activity in 2020 rather than a sharp dip in appetite.

“To raise similar levels of capital as in previous years during one of the most tumultuous years in living memory speaks volumes about the level of interest and healthy appetite for non-listed real estate as a component of investor’s portfolio. With more than two-thirds of investors anticipating an increase in near-term capital raising activity, we can expect to see fund-raising figures hold up well for the foreseeable future.”