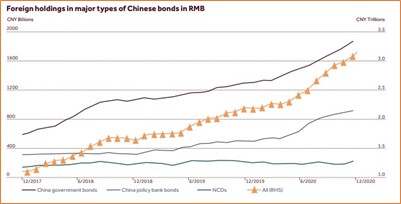

Foreign holdings of China’s bonds ended 2020 at 3.25 trillion yuan (US$504 billion), having increased by a record 1.15 trillion yuan during the year. The inclusion of China’s sovereign bonds in the Financial Times Stock Exchange (FTSE) Russell World Government Bond Index (WGBI) from October should add fresh impetus to foreign inflows.

This inclusion is a major step towards full representation in the global bond market. It is likely to justify additional allocations from foreign money managers and asset owners with roughly US$2.5 trillion in assets under management that follow the WGBI.

However, FTSE Russell’s decision to build up to the total weighting of 5.25% over a period of three years rather than one year, as originally intended, signals that the index provider – and the investors it consulted – still have some reservations about the regulatory and operational effectiveness of the market.

FTSE Russell is now the third global index provider to incorporate Chinese government bonds. The Bloomberg Barclays Global Aggregate Index was the first to incorporate onshore renminbi (CNY) bonds in April 2019 and took 20 months to build up to a 7% weighting. The JPMorgan Government Bond Index-Emerging Markets (GBI-EM) inclusion followed in February 2020, with a 10-month time frame to reach China’s 10% weighting.

These forerunners have been a factor in the continued rise in foreign ownership of Chinese government bonds since 2019 (see Chart). Though at around 10 percent at year-end of 2020, foreign ownership is still only about a third of the 30 percent foreign holdings of United States treasuries.

Foreign holdings of Chinese bonds (December 2017 - December 2020)

With primarily passive investors following the benchmark, the FTSE Russell inclusion may change this trend and is likely to steadily increase their weighting of China’s bonds to the required level. For example, Japan’s institutional investors are known to follow WGBI, including the likes of life insurers and large pension funds.

If passive investors simply follow the recommended weighting, it implies a total inflow of around US$150 billion. Also, if central banks increase their reserve holdings to reflect the yuan’s 10.9% weighting in Special Drawing Rights (SDR), it would add a further inflow of US$311 billion. A report from the Institute of International Finance predicts that should global yuan reserves reach 3% of China’s gross domestic product (GDP) over the next 10 years, it would imply annual inflow of more than US$400 billion.

China also has fundamentals in its favour, with most of the world’s major economies still mired in zero interest rates and negative short-term government bond yields. China’s 10-year yield is almost double that of US treasuries and still offers an attractive premium even after foreign exchange (FX) hedging costs are stripped out.

Combined with the relatively shorter duration of its market indices, China’s sovereign credit rating of A+ is in clear contrast with G7 bonds, which helps improve the risk-reward ratio that is paramount to institutional investors. To date, China’s bond market has shown a low correlation to global fixed-income markets, adding another benefit of diversity to an already attractive market.

Difficulties with FX hedging have continued to be a significant drawback for investors as it has an important bearing on the net yield. These issues ranged from operational, with the separate onshore and offshore currencies having the same International Organization for Standardization (ISO) currency code, to executional, with a lack of pricing counterparties and transparency.

To help resolve the issue, the Hong Kong Monetary Authority enhanced the flexibility of yuan transactions in March 2021 by allowing asset managers of up to three banks to conduct competitive FX pricing. The greater liquidity and transparency from the ability to compare prices brings up the yuan to a global standard and is an important improvement for foreign institutional investors that have to show provable best execution for trades.

Banks that have China foreign exchange trade system (CFETS) overseas bank membership and FX Settlement Bank status will be best positioned to offer ample yuan liquidity in spot, forward and swap markets that clients need for their trading and hedging requirements.

However, investors are still only allowed to conduct currency and hedging transactions as long as they are supported by genuine and reasonable bond transactions, with a tolerance of 15%. This restriction – aimed at curbing speculative activity – may still prove a hurdle for those active managers that want to make short-term profits from a bond issue by oversubscribing for their desired amount, and therefore need excess cash in advance. Whereas for more cost-conscious passive funds, competitive pricing removes their biggest impediment.

International bond indices are sending a clear message to investors worldwide that they believe China is ready to become a full-fledged member of the world’s sovereign bond community. Yet global fund managers have remained circumspect, even as government reforms steadily lower operational hurdles and open up China’s bond market to foreign players. The arrival of the FTSE Russell Index, combined with a significant step forward in FX execution and competitiveness, may finally be the invitation the rest of the world accepts.

Shen Li is head of global markets China & head of indirect FX and Street FX, Asia-Pacific, State Street.