Covid-19 has accelerated the digital transformation of businesses. The good news is that even before the crisis, regulators in Asia have been proactive in launching new digital payments infrastructure. These payment rails, which offer 24/7 seamless capability, are uncovering new possibilities, creating new products, and enhancing clients’ experience that brings engagement to a whole new level.

Hong Kong is among the economies experiencing accelerated adoption of digital payments with the availability of the Faster Payment System (FPS). Launched by the Hong Kong Monetary Authority in September 2018, the FPS has seen transaction volume grow from less than 51,000 to more than 24.3 million at the end of September 2021.

Progressive companies are now deploying FPS not only as a means to enable faster payments and collections, but also as a part of a digital business strategy to enhance consumer experience and build brand loyalty.

Hong Kong Broadband Network (HKBN), a leading integrated telecom and technology solutions provider that offers a range of information and communications technology services to both the enterprise and residential markets, is among the Hong Kong businesses embracing digital collection channels.

Working with its service provider, Standard Chartered, HKBN implemented phase one on its own app promoting FPS QR-code-based collections for billing dues instantly. The successful implementation of the FPS QR code set HKBN to additionally implement App-to-App payments, becoming among the first in Hong Kong to consider launching the features on a merchant app.

Global adoption

App-to-App, also known as Request to Pay (RTP), is a global standard overlay service that has evolved from closed to open loop and has recently witnessed growth in adoption globally. It utilizes instant payment schemes, such as FPS, to enable businesses/merchants to initiate payment requests, providing real-time access to bank accounts in a flexible and convenient way.

Businesses can send an electronic payment request through a secure messaging service with details like payment amount, purpose, destination account, timing, a unique reference field and optional invoice details, simplifying authentication by payer and reconciliation for payee.

The payer will receive the request as a secure message – via an electronic interface such as a mobile banking app. Typical use cases include bill payment, invoice payment, e-commerce transactions, payments at point of sale and repayment of installments. RTP operates in real time and works both for single or ad hoc payments. It also does not require the payer to set up a mandate ahead of time to pull funds from their bank account, which significantly reduces process and cost inefficiencies for businesses.

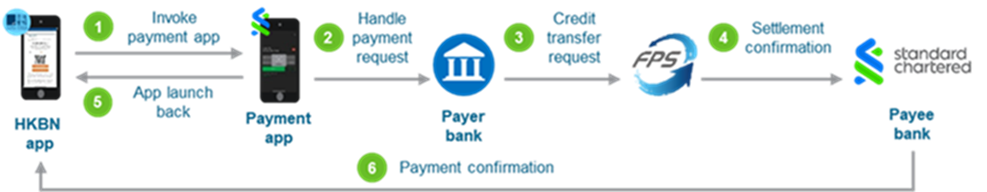

With App-to-App in place, merchants can instantly collect funds from an individual consumer with a mobile device via FPS. The mobile banking app and merchant app can be used on the same mobile device to complete the payment journey instantly for consumers through any of the supported consumer mobile bank apps.

When a consumer initiates a payment using the HKBN merchant app, the app triggers a payment request that includes the FPS ID, a proxy identifier. Embedded in the FPS dynamic QR code string, the FPS ID sends a payment request to a list of mobile apps on Android/IOS mobile apps with the App-to-App feature enabled. The customer can select from this list to complete the payment.

HKBN subscribers can make payments via an FPS credit transfer on any mobile banking app supporting the App-to-App feature. The payer will then receive an SMS notification from their retail bank confirming a successful transaction status. The merchant receives the funds instantly with a successful payment notification for the instant credit via API and the subscriber’s payment record is updated in real time.

App-to-App (Request to Pay) feature

Since the launch of HKBN’s App-to-App features in Android/IOS stores in April 2021, transaction volumes have grown 10x with enablement of FPS collections and volumes continuing to grow substantially. App-to-App volumes contribute a third of FPS payments through merchant app within three months of the launch.

“HKBN’s launch of this feature is a great example of the advantages of the early adoption of FPS by corporates. We see a growing number of clients in key markets across Asia using RTP, leveraging instant payment infrastructure integrated with advanced APIs,” shares Ricky Kaura, head of transaction banking for Asia, Africa and the Middle East at Standard Chartered. “As a core component of an overall cash and liquidity management solution, these approaches towards digitally enabled solutions are significantly enhancing our client’s overall proposition to their underlying clients, and creating competitive advantage.”