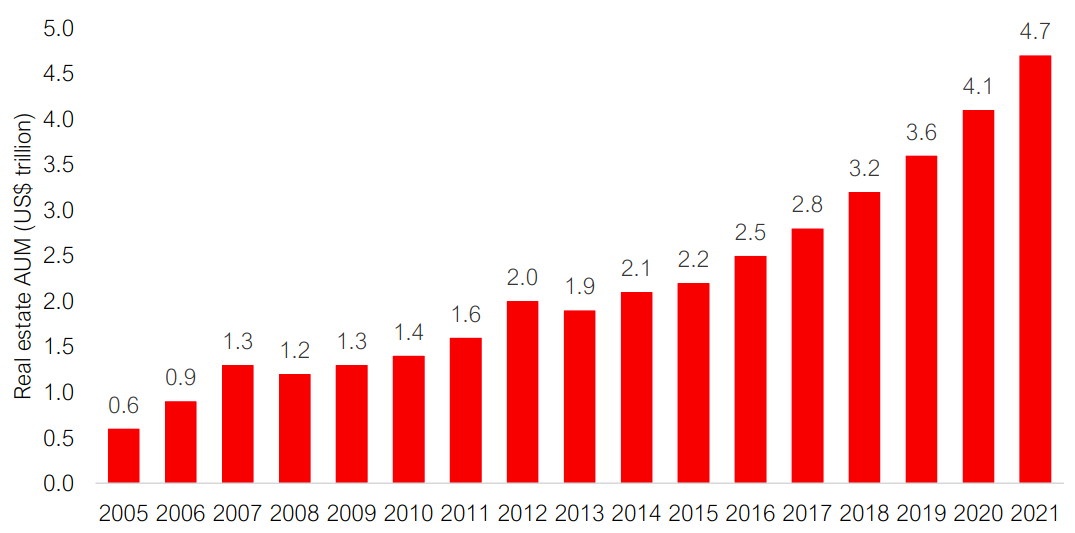

Institutional investor appetite for real estate remains strong, with assets under management growing by 14% to a record US$4.7 trillion in 2021, from US$4.1 trillion in the previous year.

Growth was across the board with the average AuM for each manager reaching US$32.5 billion, up from US$26 billion in 2020, according to the Fund Manager Survey 2022, published by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), the European Association for Investors in Non-Listed Real Estate Vehicles (INREV), and the National Council of Real Estate Investment Fiduciaries (NCREIF).

Source: ANREV

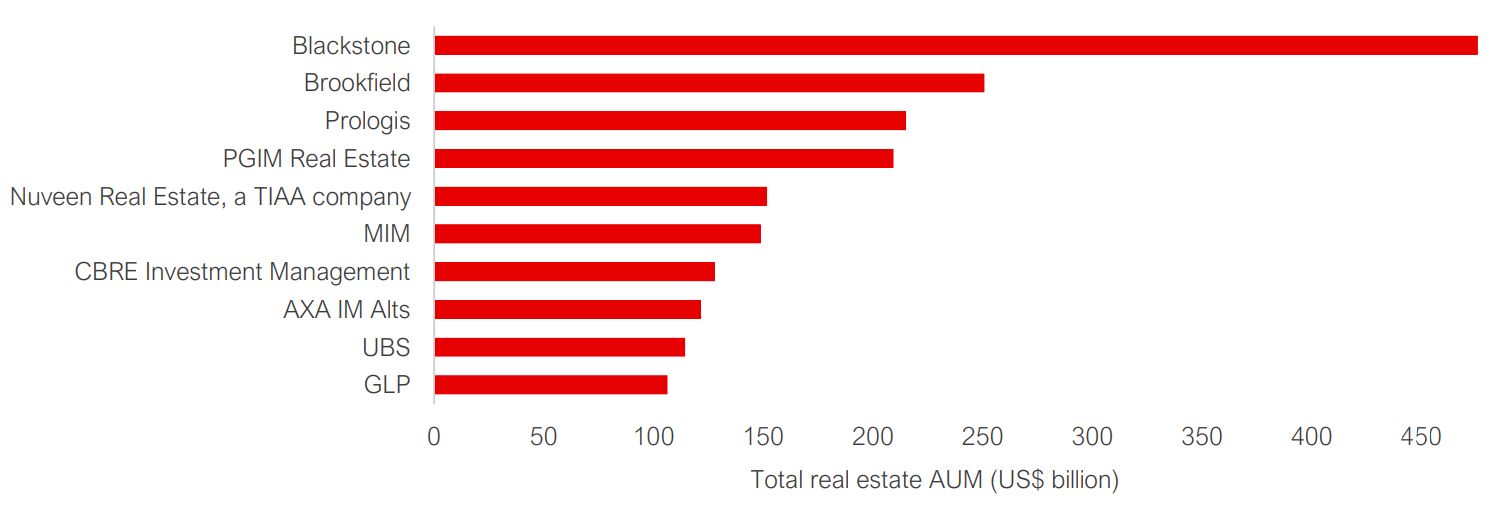

The top 10 global managers account for 41% of the total AuM (up from 37% in 2020), with the average at US$192.2 billion. Their combined AuM stands at US$1.9 trillion, a 28% increase year-on-year.

The rankings of the top five managers remained unchanged from 2020. They are Blackstone, US$475.5 billion; Brookfield, US$250.8 billion; Prologis, US$215 billion; PGIM, US$209.3 billion; and Nuveen, US$157.7 billion.

Source: ANREV

In the Asia-Pacific region, GLP has become the largest in terms of AuM, moving from the third position to replace CapitaLand in the overall top 10 list. This is a reflection of the strong fundamentals in the industrial/logistics sector, which is one of the most active in the region, according to the report.

Non-listed real estate represents the largest share of the total AuM, accounting for more than 84% or US$3.9 trillion. More than half of that amount (US$2.3 trillion) is invested through non-listed real estate funds.

By style, core represents 69% of total AuM of fund managers globally, with the lowest percentage being in Asia-Pacific at 55%, and opportunistic strategies representing 33% of the fund’s AuM in the region.

Amélie Delaunay, director of research and professional standards at ANREV, comments: "It is another record for real estate AuM globally, giving further evidence of institutional investors' appetite for real estate. The findings reaffirm that Asia-Pacific continues to attract a healthy and growing share of global real estate AuM, reflecting great confidence in the long-term outlook of the region's property. Growth of AuM of single-sector industrial-focused managers has been particularly striking with GLP entering the top 10 at the last position and Prologis confirming its third rank."