Investment in Asia-Pacific commercial real estate decreased by 17% year-on-year to US$70.9 billion in the first half of 2022, as a tightening rate cycle and inflationary concerns began affecting transaction activity, a new report shows.

The office sector remained the region’s most liquid asset class, drawing US$30.6 billion in investments during the period, down a modest 8% year-on-year from last year’s high base, according to data and analysis published in the JLL Q2 2022 Capital Tracker.

Industrial and logistics investments (US$14.6 billion) dropped by 37% from record volumes in 2021, while deployments into retail assets fell 31% y-o-y to US$14.0 billion. Investments into alternative assets (US$1.4 billion), such as data centres, declined 12% y-o-y to US$1.4 billion.

Real estate transaction volumes

Source: JLL

“Investment volumes in the first half declined moderately from the high base set in 2021 as external factors emerged, resulting in investors adjusting capital deployment strategies to align with a more aggressive rate tightening cycle," says Stuart Crow, CEO, capital markets, Asia-Pacific, at JLL. “Encouragingly, dry powder levels remain high, and we are seeing that the appetite for real assets remains strong. Clear opportunities exist and we’re advising clients to expect a new price discovery phase to remain a dominant theme for the remainder of 2022, as macroeconomic headwinds and ongoing inflationary pressures influence decisions.”

Asia-Pacific-dedicated fund raising maintained its momentum despite falls in global activity. In a sign of the longer-term positivity in the region’s real estate sector, development-focused funds in logistics, living, and data centres in India and Southeast Asia continue to secure financial commitments from global and regional institutional investors.

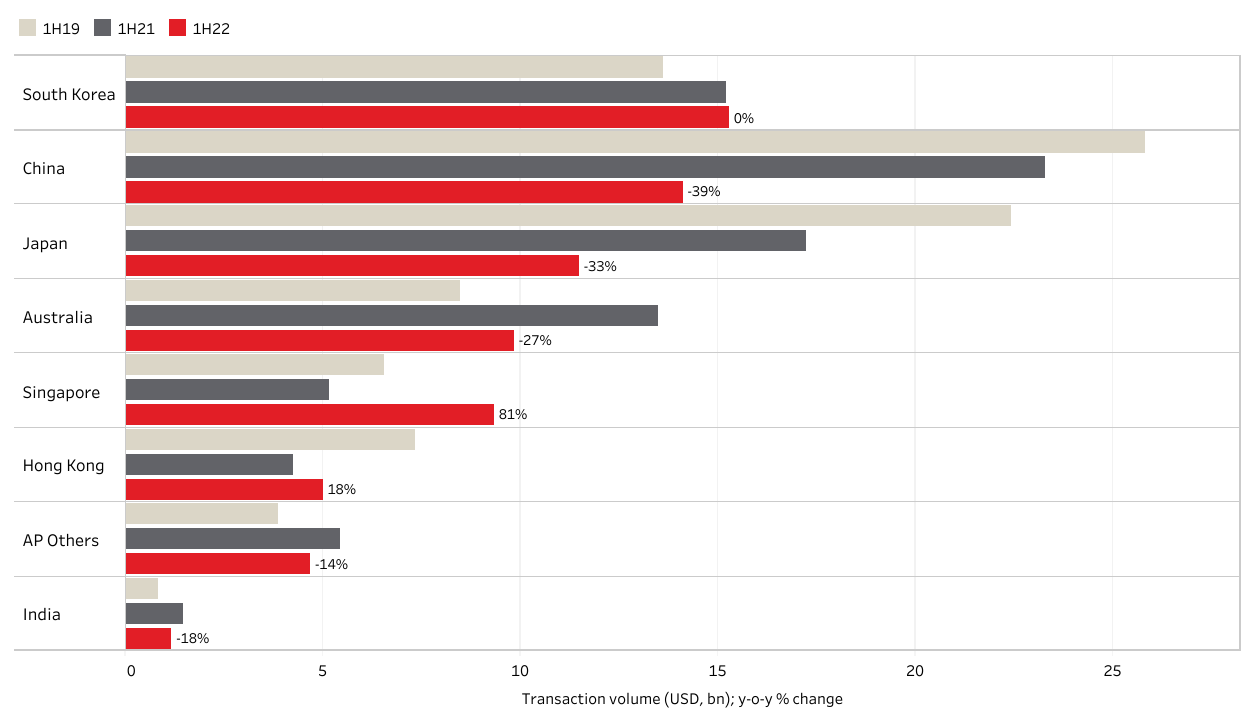

The impact of pandemic-related lockdowns weighed on China in the first half with investments falling by 39% y-o-y to US$14.1 billion. Japan volumes dropped 33% to US$11.5 billion due to a lack of logistics transactions. Activity in Australia declined 27% y-o-y to end the half at US$9.8 billion.

South Korea (US$15.3 billion) emerged as the region’s largest market by volume in the first half, remaining flat year-on-year, buoyed by office transactions including SK U-Tower and A+ Asset Tower in Seoul.

Singapore reported an 81% y-o-y growth at US$9.3 billion, supported by large-ticket office and mixed-use transactions including Income@Raffles, while Hong Kong was up 18% at US$5.0 billion, driven by a number of en-bloc industrial sales.

Sustainability frameworks were high on the agenda for investment committees, influencing acquisition decisions, according to the report. JLL expects investors to deploy more capital into value-add strategies by refurbishing old offices into green buildings as occupiers increasingly choose higher-quality space post-pandemic.

“The market adjusted to new realities over the first half, which was reflected in more muted investment activity,” says Pamela Ambler, head of investor intelligence and strategy, capital markets, Asia-Pacific, at JLL. “Capital remains committed to the Asia-Pacific real estate market but deployments will be more selective as investors play the long game and price in financial market tightening to any investments for the foreseeable future.”