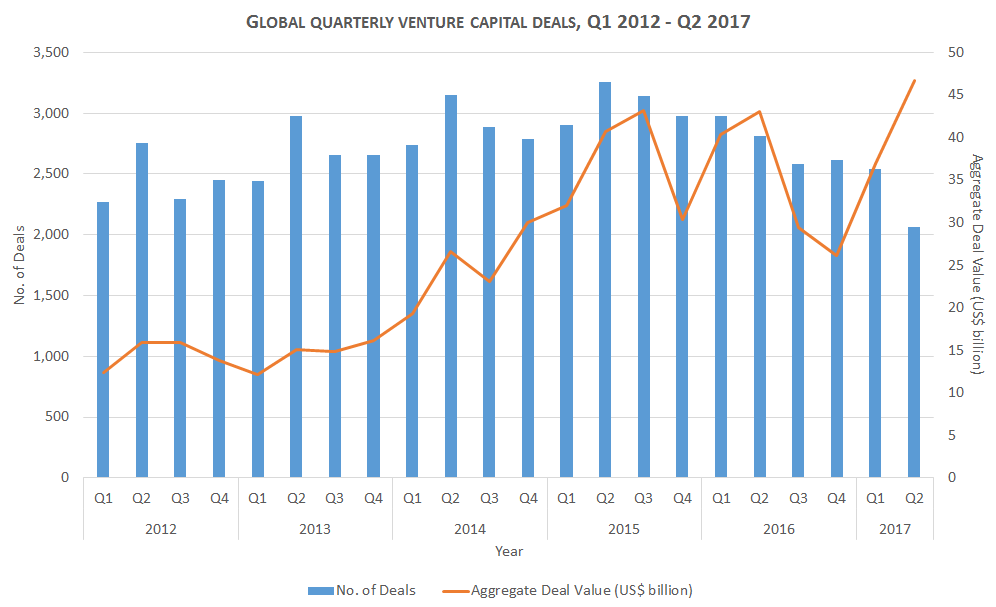

The venture capital backed-deals market recorded its largest quarter ever in Q2 2017, driven by record activity in Asia. This quarter saw 2,062 venture capital-backed deals with a combined value of US$47 billion, surpassing the previous record of US$42 billion seen in Q3 2015, according to a recent Preqin report.

Data from Preqin.

“The second quarter of 2017 has seen a record amount of capital deployed into venture capital-backed deals. This is particularly notable following the slowdown we saw in the second half of 2016, and reflects the changing nature of the global venture capital landscape,” says Felice Egidio, head of venture capital products at Preqin.

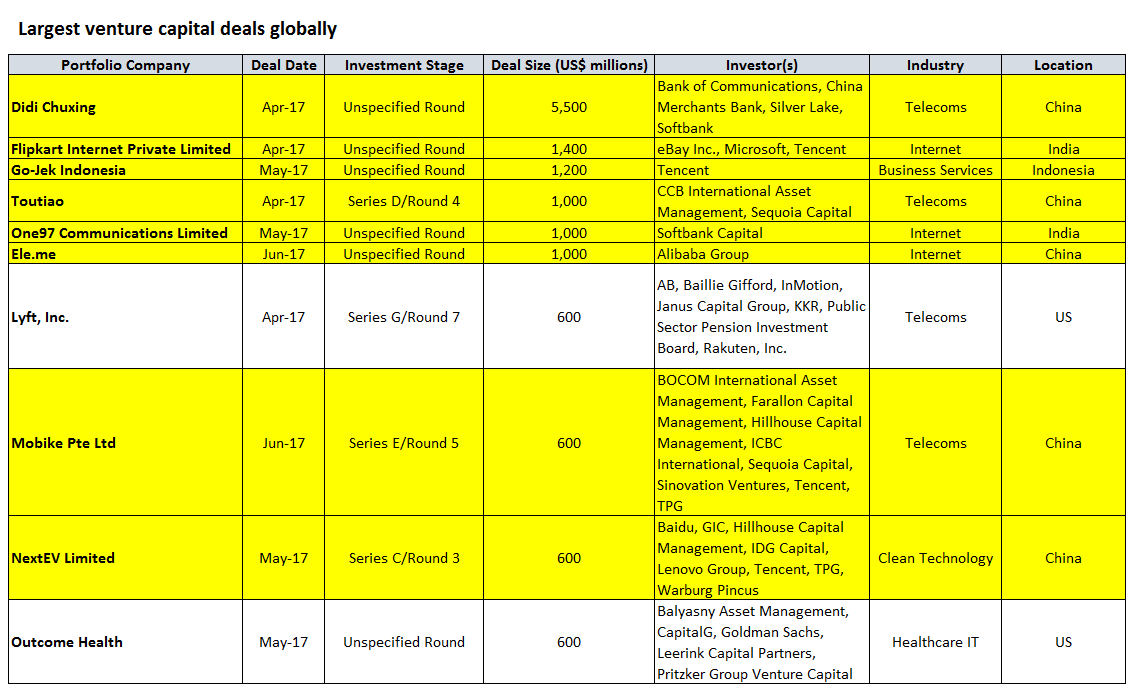

Asia saw 550 deals worth a total of US$22 billion, surpassing US$19 billion across 936 deals in North America. This is the fourth time in six quarters that Asia has recorded the highest deal value of any region.

Asia also saw the largest venture capital-backed deal ever recorded, with the US$5.5 billion financing of Didi Chuxing in April. Moreover, Asia saw the top six largest venture capital deals, and eight of the top ten deals, globally.

Data from Preqin.

“Asia accounted for the largest share of deal value for the fourth time in the last six quarters, and the largest venture capital deal ever recorded was in China. While the number of financings does not yet approach North America, the region has now come into its own as an epicentre of the industry,” adds Egidio.

However, exit activity faltered in Q2: just 244 exits were recorded globally, worth a combined US$14 billion. This is down from 293 exits which were worth $18bn the previous quarter.

“The exit market for venture capital-backed companies does not seem to be enjoying the same level of success. With an increasing number of companies choosing to stay private rather than being sold or going public, it is perhaps not surprising that we have seen a slowdown in the volume of exits since they last peaked in the latter part of 2015,” adds Egidio.