.jpg)

Behavioural finance has shown us that investors are not always rational, and that greed and fear can be powerful investing emotions. Certainly, when investors are uncertain, they flock to safety. Prime commercial property markets in cities like London, Paris, Berlin, Munich, and Hamburg remain perennial favourites. The theory is that assets in these markets will fall less in value than their non-prime peers during a downturn. However, in this cycle, investors need to exercise caution. An awareness of behavioural biases can be useful in avoiding dangerous traps.

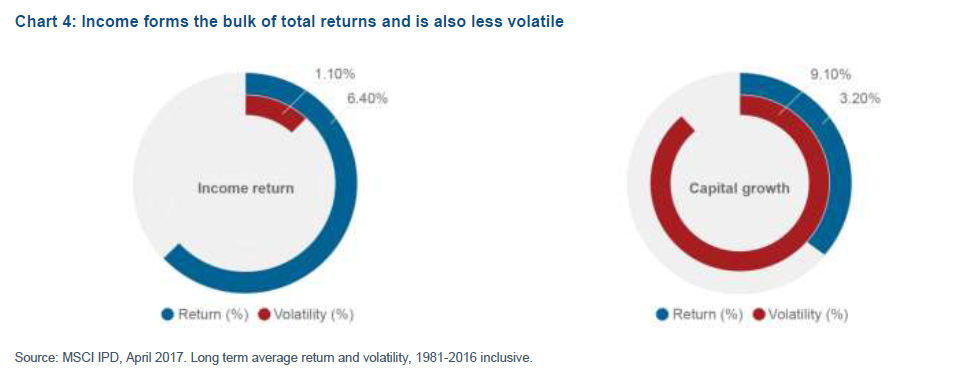

A flight to prime property would have been prudent in 2007, when such assets were less overvalued than the rest of the market. But this time, investors seeking refuge in prime may be exposing themselves unwittingly to increased risk. Income forms the bulk of long term total real estate returns. Capital gains, in contrast, make a smaller - and more volatile - contribution to total returns. Thus, investors who buy ultra low-yielding assets have greater exposure to future price fluctuations.

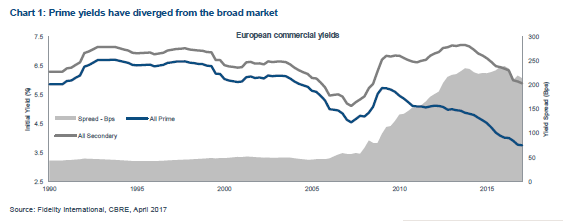

Across much of Europe, prime assets currently trade at a very significant premium to the rest of the market, and prime yields are lower than they have been at any point since 1990 (Chart 1). In contrast, secondary markets have not yet returned to their 2007 values. In effect, investors are paying a significant premium for wealth protection which is increasingly difficult to justify at these prices.

A behavioural finance perspective

In our note, “All that glitters is not gold” (June 2017), we argued that French life insurance schemes are the driving force behind low yields in Paris, and that current valuations are unsustainable. We suggested that investors ensure that they are not overexposed to eurozone prime property and that they seek better yields in secondary assets.

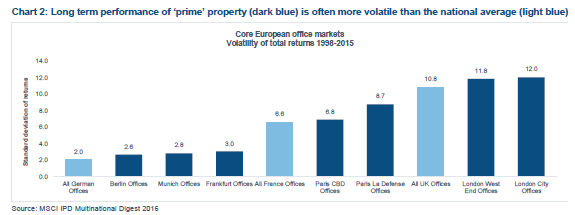

Our thesis contradicts the received wisdom that prime properties are inherently and always less volatile than their non-prime peers. They are not (Chart 2). Yield is a more important determinant of volatility, because income returns are more stable than price fluctuations. Cognitive errors nonetheless lure investors into making two key mistakes: assuming that the broad labels “prime” and “secondary” reflect properties’ true risk, and fixating on capital gains at the expense of income. The anchoring and framing biases are to blame.

The anchoring bias

The first problem is that most investors anchor their performance expectations to capital gains rather than income. In doing so, they ignore the importance of income in providing consistent returns across the cycle and thus expose themselves to additional risk.

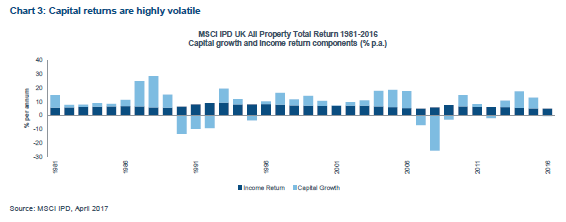

Analysis of the MSCI IPD indices clearly shows that total returns in real estate are primarily driven by income returns, which are relatively predictable. Capital gains are a much smaller component of total returns, and they are highly volatile.

For example, the UK market has exhibited significant price volatility since 1971 (Chart 3). The market overheated in the late 1980s, and again between 2003 and 2007. Both periods of outstanding capital gains were followed by significant drawdowns. In contrast, the income component of total returns has been consistently positive since 1971.

An explanation of these exuberant bubbles and painful bursts lies in the field of behavioural finance, which contends that emotions can supplant rational behaviour from time to time. In fact, the highly emotive nature of real estate means that movement in capital returns is predominantly explained by momentum and investor sentiment. Indeed, analysis of the MSCI IPD All Property Annual Index finds that over eight tenths of current returns can be explained by previous years’ performance (Brown and Matysiak).

Investors who buy prime property at low starting yields will realise few defensive benefits, because the majority of their total return will have to come from more volatile capital movements rather than income. Buying an asset at a low yield - even if it is a prime asset - means accepting an elevated amount of risk, because the heavy exposure to capital movements increases the property’s volatility and its susceptibility to a drawdown.

The framing bias

The second problem lies in the way that the industry frames the real estate asset class along sector, style, and geographic lines. The assumption is that all the properties in a certain category are relatively homogeneous and have similar risk-return characteristics.

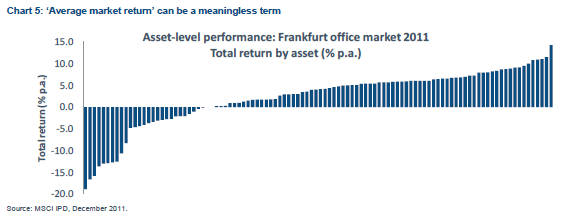

But the data show that this widely held assumption is a fallacy. The average market return is impossible to access - it is more a statistical quirk than an achievable investment target. In 2011, the average return on the Frankfurt office market was 2.4% - yet the difference between the best and worst-performing properties was a staggering 33 percentage points (Chart 5). Buying an office in Frankfurt does not provide the Frankfurt office market return - it provides exposure to an individual asset. To receive the average market return, an investor would need to own a fraction of every constituent. This is impossible in real estate, and as such, active management is essential.

Conclusion

Do not assume that all prime real estate will provide the defensive attributes typical of previous cycles. In reality, many of the most attractive properties - those with higher, sustainable income streams listed at reasonable prices - may lie beyond the prime segment of the market. Investors must not allow themselves to be misled by the industry’s arbitrary labels which mask the unique characteristics of individual properties.

As markets enter the “late cycle” and the pace of yield compression slows, income will form an ever-greater part of the total return. This should allow for greater certainty of performance. Investors would also do well to consider the protection afforded by a slightly higher yield, provided they can get comfortable with the lease length, quality of the tenant, and the ‘re-lettability’ of the asset.

Investors should not interpret this observation - that prime looks overextended relative to the broader market - as an argument to move indiscriminately up the real estate risk curve into secondary assets. Rather, the key takeaway for investors is to focus on goodquality secondary assets (or strategies which do so). A research-led approach can uncover select assets with a combination of yield pricing and stock-specific fundamentals that offer more robust protection than prime assets at current market levels.

Adrian Benedict is investment director, real estate, at Fidelity.