The difference in the fiscal positions of the central government of China and the country’s provincial governments gives each of them specific roles to play in the One Belt One Road (OBOR) initiative.

The central government, because of its stronger fiscal position, will take the lead by providing financing and direction for OBOR projects, while the provinces will support the OBOR initiative in terms of attracting investments to local jurisdictions and promoting trade.

An understanding of the fiscal structure of the central government and the provincial governments will be helpful in appreciating the difference in their respective roles in OBOR.

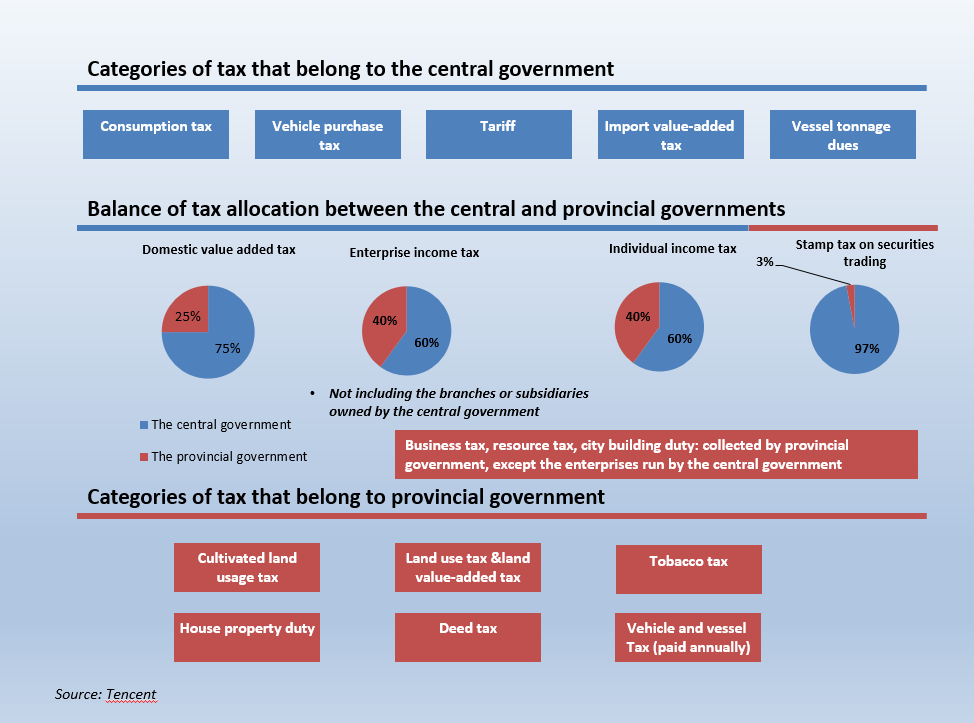

The central government includes central government-owned entities, such as state-owned enterprises and financial institutions. The categories of tax that belong to the central government include: consumption tax, vehicle purchase tax, tariffs, import value-added tax, and vessel tonnage tax. These taxes are collected nationwide through the customs department and designated entities.

The tax allocation system is important to the relationship between the central government and provinces. The tax system is complicated and a tax reform program is in progress, for example China is now trying to combine business tax with value added tax. However, it is still possible to draw some conclusions based on official statistics.

Provincial government

Although the situation in each province is different, the major sources of revenue that are generated from taxes include local value added tax, local enterprise income tax (not including some branches and subsidiaries of central owned companies), land value-added tax, land use tax, and business tax.

This means that provincial governments are eager to attract investment to their local jurisdictions, especially projects that will generate revenue in the form of real estate and value-added taxes. For example, in 2015, Guangdong collected a total of 737.7 billion yuan in tax revenue, with 18% coming from land or real estate related tax, including land value added tax, farm land occupation tax, deed tax and house property tax.

Provincial governments believe that by being designated as part of the OBOR initiative, their provinces will have better chances of attracting investments in the form of infrastructure projects that will generate additional revenues in the form of taxes as well as other benefits.

For example, tourism-related projects are one form of investment that can benefit the local economy and generate tax income directly and quickly. This is one reason why some provinces may be eager to participate in OBOR.

But in order to be competitive in OBOR, each province must first build up their own cultural brand. For instance, both Shaanxi province and Henan province are competing to be designated as the origin city of the Silk Road. On the other hand, Fujian, Zhejiang and Guangdong province are competing to be the origin city of the Maritime Silk Road.

Aside from local infrastructure investment, the provincial governments may also support the provincial enterprises in finding projects outside China as well. However, since the provinces’ capacities for engineering and financing are far weaker than the central government’s capacities, the provinces are unlikely to take leading roles in OBOR in this respect.

Central government

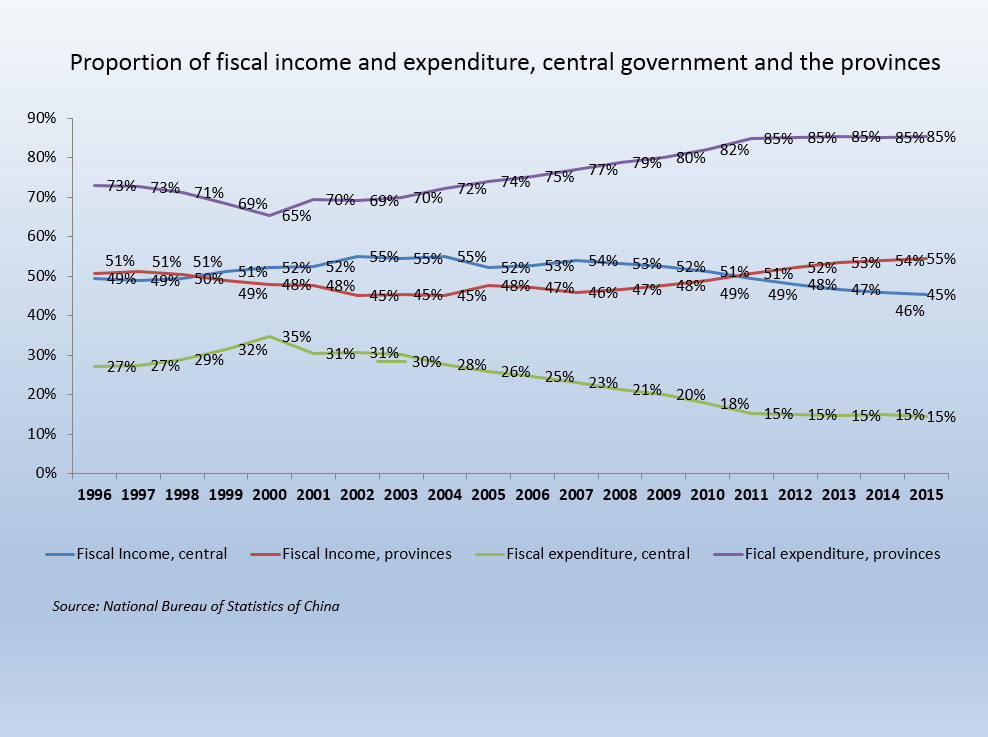

China’s existing system of fiscal income and expenditure leads to a situation of a wealthy central government and relatively poor provincial governments.

Data from the National Bureau of Statistics indicate that in the last ten years, the fiscal deficit of provincial governments was gradually expanded. The provinces generated only 55% of the nation’s fiscal income, but their fiscal expenditures amounted to 85%, leaving them with a huge deficit. In 2015, the local governments collected 8.3 trillion yuan (US$1.2 trillion) in fiscal income, while the total fiscal expenditure of the provinces was 15.03 trillion yuan (US$2.2 trillion).

The central government, on the other hand, generated 45% of the nation’s fiscal income, but its fiscal expenditure accounted for only 15%, leaving them with a huge surplus. In 2015, the central government collected fiscal income of 6.9 trillion yuan (US$1 trillion) but only spent 2.55 trillion yuan (US$372 billion).

Centrally owned government institutions or associated banks and financial institutions have to play a key role in financing OBOR projects, since they are financially stronger than the provincial enterprises in the infrastructure sector.

Reports indicate that four centrally owned government enterprises including CSCEC (China State Construction Engineering Corporation), CRCC (China Railway Corporation), CREC (China Railway Engineering Corporation) and China Communications Construction have significant advantages in terms of skill and size in China’s construction industry, which could make them major participants in OBOR.

The centrally owned government enterprises and financial institutions are likely to take the leading role in OBOR, while most of the provincial governments and enterprises will play supporting roles in terms of attracting local investments.