Chinese firms are taking advantage of the asset disposal programmes of oil majors Chevron and BP. In April Himalaya Energy acquired three gas fields in Bangladesh from Chevron, while Sinopec bought out its 50% joint venture partner BP to assume full control of upstream petrochemicals company Shanghai SECCO.

In recent years both oil giants have been conducting asset sales in order to improve their balance sheets, reduce debt, concentrate on core markets, and position themselves better in an environment of low oil prices. And in the case of BP, it is now coming to the end of a vast asset disposal programme, which was necessitated by the losses associated with the 2010 Deepwater Horizon oil spill in the Gulf of Mexico.

California-based Chevron Corporation announced the closing of its deal on 24 April, saying that its wholly-owned subsidiary, Chevron Global Ventures, has entered into an agreement to sell the shares of its wholly-owned indirect subsidiaries operating in Bangladesh. Chevron Bangladesh operates Block 12 (Bibiyana Field) and Blocks 13 and 14 (Jalalabad and Moulavi Bazar fields). Chevron did not disclose the terms of the deal, but local press reports estimate a sale price of around US$2 billion.

Himalaya Energy is owned by a consortium comprising state-owned China ZhenHua Oil and investment firm CNIC Corp. CNIC was established in Hong Kong in 2012, and is a government investment platform that focuses on supporting Chinese companies' overseas investment.

The three gas fields account for more than half of Bangladesh's total output. Chinese ownership will increase its influence in Bangladesh, where India and Japan are also trying to strengthen their positions.

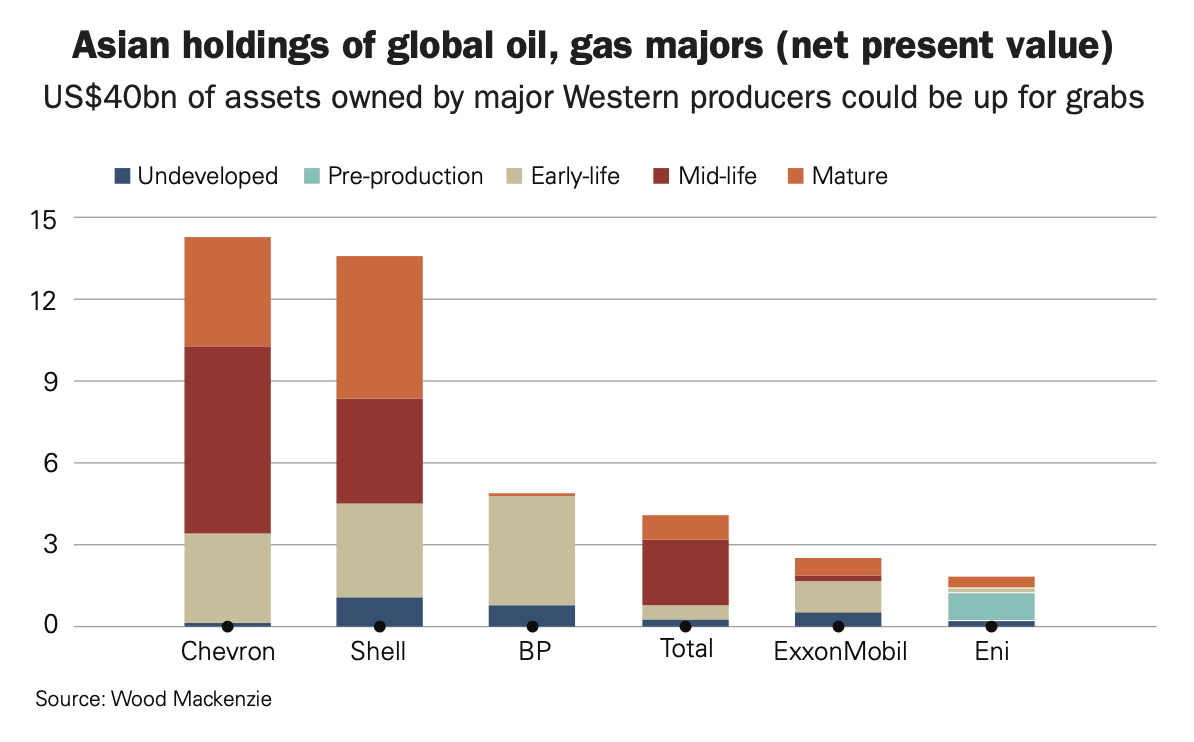

Oil prices have recovered from lows of below US$28 in January 2016. They are now in the low US$50s, and the outlook for 2017 profits is good. Nonetheless, the steep fall from levels above US$100 in 2014 has caused disruption both for the oil majors and oil producing states, and presented an opportunity for China to futher its One Belt, One Road ambitions. Countries such as Saudi Arabia and Algeria, which were previously financially self sufficient, are now turning to China to help with large infrastructure projects. And the scaling back of oil giants such as BP and Chevron has provided opportunities to increase the Chinese presence in global oil exploration and upstream activities.

Back in October 2015 Chevron announced that it planned to sell assets worth about US$10 billion by 2017, including the Bangladesh gas fields, and geothermal projects in Indonesia and the Philippines. The sale of Chevron’s geothermal business in Indonesia was completed on 31 March, to Indonesian independent energy company Star Energy Consortium. Chevron received the cash proceeds upon settlement on March 31, and will reflect the gain in first quarter 2017 results.

The conclusion of the sale of Chevron’s geothermal business in the Philippines, to local buyers, is expected later in 2017.

On 27 April BP announced that it has agreed to sell its 50% stake in the Shanghai SECCO Petrochemical Company Limited (SECCO) to Gaoqiao Petrochemical Co Ltd, a 100% subsidiary of China Petroleum & Chemical Corporation (Sinopec), BP’s joint venture partner, for a total consideration of US$1.68 billion.

The BP group's consolidated pre-tax profit for 2016 included its share of the net profits of SECCO, amounting to US$301 million. BP intends to use the proceeds from the disposal, most if not all of which are anticipated to be received in 2017 (subject to completion), for general corporate purposes

The transaction is subject to a number of regulatory approvals and other conditions, subject to which, it is currently anticipated to complete before the end of the year with the consideration payable in instalments.

SECCO is currently owned by BP (50%), Sinopec (30%) and Sinopec Shanghai Petrochemical Company Limited (20%), in which Sinopec holds a majority interest. Based in Shanghai, SECCO is a major producer of olefins - ethylene and propylene - together with polymers and other derivatives including polyethylene and polystyrene.

BP has two other petrochemical manufacturing joint ventures in China: purified terephthalic acid (PTA) production in Zhuhai; and acetic acid and other acetyls production with YARACO in Chongqing and BYACO in Nanjing. In March 2015, BP began production from Zhuhai Unit 3, the world’s largest single train PTA unit.

The company stressed that it remains committed to China. “This decision aligns our petrochemicals business in China with our global focus on areas where BP has leading proprietary technologies and competitive advantage," said Rita Griffin, chief operating officer, BP Global Petrochemicals.

"China is a key region for our chemicals business and BP will continue to look for opportunities to build on our position in the country."

BP has sold over US$50 billion in assets since the 2010 Gulf of Mexico spill, which led to the biggest losses in its history. The total cost to the company of the Deepwater Horizon spill is estimated at US$60 billion.