With the rise of China as an economic powerhouse, comes the rise of Chinese financial institutions to challenge their global counterparts in arranging Chinese-related capital markets deals. After all, Chinese issuers and borrowers account for significant portions of the transactions in Asia. A senior debt capital markets banker, for instance, estimates that 53% of the bond offerings from non-Japan Asia, ex- Australia and New Zealand, in 2016 are arranged for Chinese issuers and borrowers.

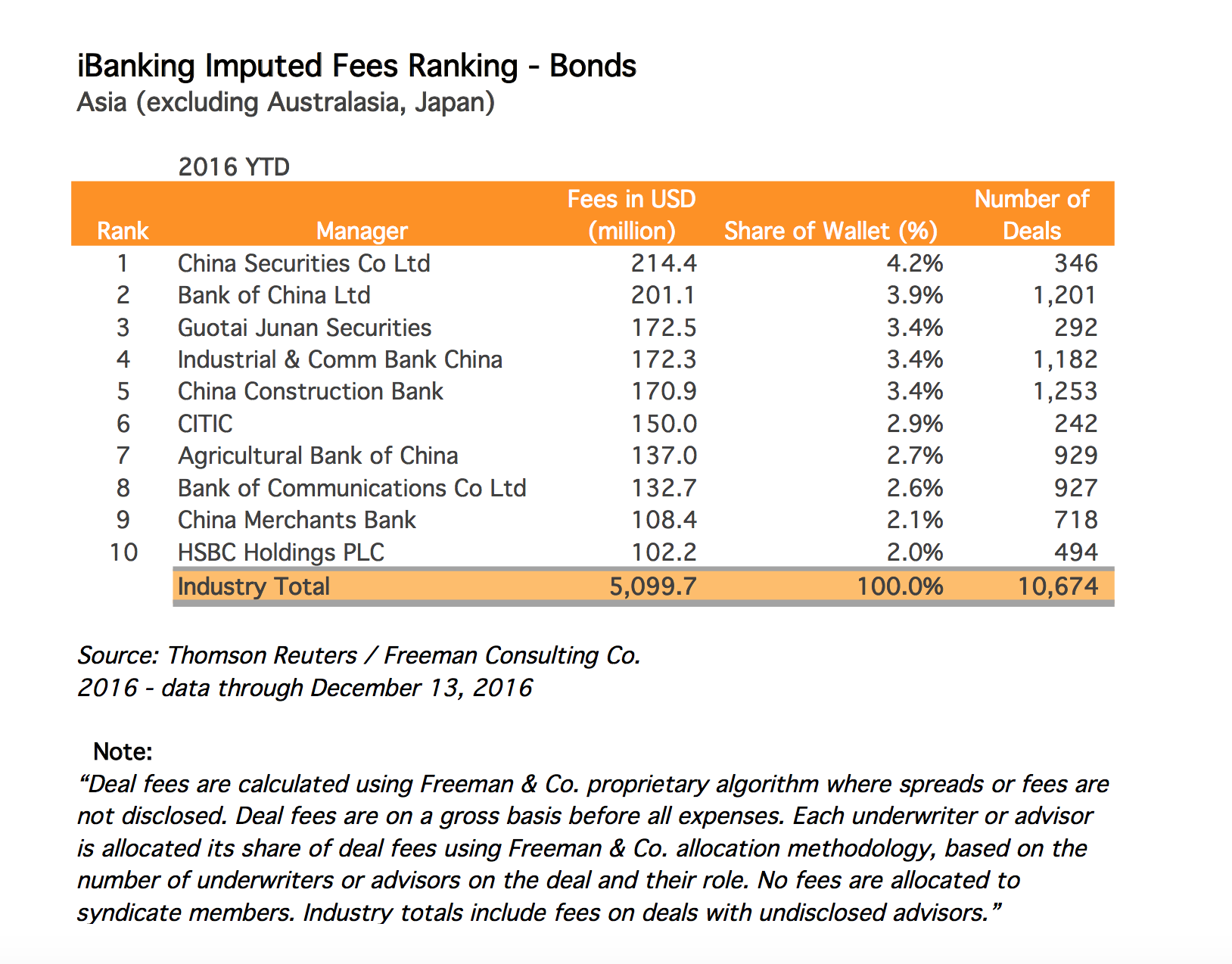

This landscape is being reflected in terms of wallet share. Figures supplied by Thomson Reuters/Freeman Consulting Company showed that year-to-date to December 13, nine Chinese financial institutions dominated the league table in terms of having the largest share in terms of investment banking imputed fees for bonds, with only HSBC barging into the top 10 ranking – and in 10th position at that.

Excluding Australasia and Japan, the total bond fees amounted to US$5.10 billion with China Securities Company accounting for the largest market share at 4.2% or US$214.4 million. It was followed by Bank of China (BoC) with 3.9% or US$201.1 million and Guotai Junan Securities, Industrial and Commercial Bank of China (ICBC) and China Construction Bank with 3.4% each – equivalent to US$172.5 million, US$172.3 million and US$170.9 million, respectively.

HSBC managed to break the complete Chinese dominance with a market share of 2% for total fees equivalent to US$102.2 million.

This was a far cry from the 2008 league table when only two Chinese financial institutions were among the largest fee earners from debt capital markets’ transactions, which totaled US$434 million. CITIC has the largest wallet share then at 13.8% or US$59.70 million, while China International Capital Corporation (CICC) had the fourth largest share at 4.3% or US$18.63 million. The eight other largest fee earners were global and domestic banks with Axis Bank coming in second with a market share of 4.7% or US$20.38 million followed by HSBC in 3rd spot with 4.5% or US$19.44 million.

The Chinese dominance is also manifested in equity fees - which amounted to US$4.16 billion year-to-date to December 13 – with eight of them in the top 10 ranking. CITIC has largest wallet share with 6.8% or US$281.9 million followed by Morgan Stanley with 4.9% or US$203.6 million. The next seven biggest wallet share are accounted for by the Chinese financial institutions with Citi occupying the 10th slot with a 2.6% share or US$108.5 million.

CITIC likewise had the largest equity wallet share in 2008 with 7.4% or US$92.28 million, followed by CICC with 5.6% or US$69.67 million. The rest of the top 10 fee earners, though, were global banks.

The top three largest fee earners for loans in 2016 – which totaled over US$1.76 billion – were also the Chinese banks with ICBC topping the league table as it accounted for a wallet share of 11.7% or US$206 million, followed by BoC with 9.3% or US$164.1 million and China Development Bank with 6.5% or US$114.6 million.

HSBC has the largest wallet among the global banks at it earned total fees of US$76.9 million (4.4%) for the 5th spot, followed by DBS in 6th place with US$60.4 million (3.4%), Mitsubishi UFJ Financial Holding Group in 7th with US$44.2 million (2.5%), Sumitomo Mitsui Financial Group in 9th with US$39.1 million (2.2%) and Standard Chartered in 10th with US$38.9 million (2.2%).

In 2008, no Chinese banks were among the top 10 fee earners for loans with State Bank of India topping the league table with 11.2% or US$40.35 million, followed by Standard Chartered with 6.8% or US$24.38 million.

It was only in terms of M&A fees that the Chinese financial institutions failed to wrest the largest wallet share as Goldman Sachs showed the way with US$184.1 million (10%), followed by Morgan Stanley with US$108.9 million (5.9). In fact, only two of them managed to land in the top 10 largest fee earners with CICC coming in 3rd with US$101.6 million (5.5%) and ICBC in 6th with US$66.6 million (3.6%).

Similar to loans, Chinese banks were also absent in the 2008 league table with UBS having the largest market share at 2.4% or US$115.82 million, followed by Morgan Stanley with 2% or US$97.78 million.