The prospects for municipal bonds – or muni bonds – in India look positive this time around due to the country’s huge infrastructure requirements and the government regulatory framework for making public issues of debt.

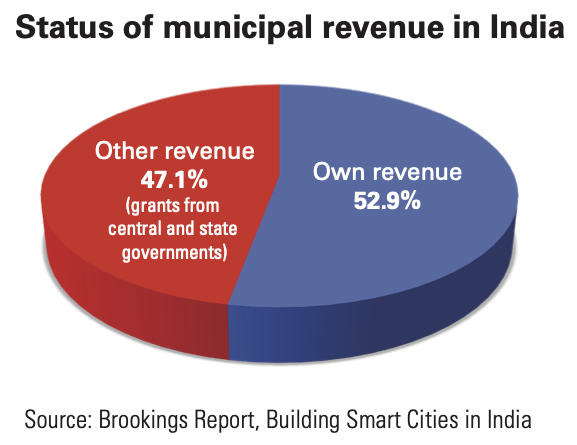

As Anuj Sethi, senior director at CRISIL Ratings points out, the Government of India has formulated three large schemes towards developing urban infrastructure – Swatcha Bharat, AMRUT (Atal Mission for Rejuvenation and Urban Transformation) and SMART City – with a total outlay of about US$40.25 billion. To date, investments in urban infrastructure have been largely funded through grants from central and state governments.

“Going forward, grants alone will not be sufficient on account of the large size of the investment requirements,” says Sethi. “Considering the above funding requirements in the next few years, urban local bodies (ULBs) will have to tap other sources of funds.”

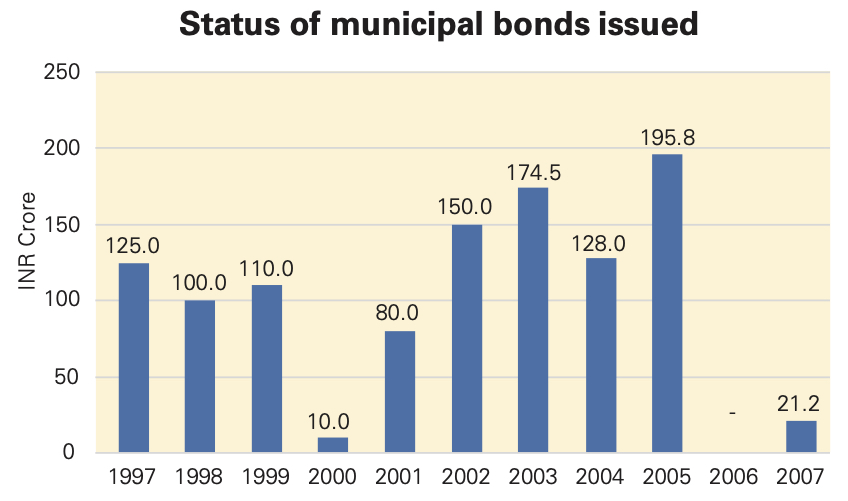

Muni bonds have made a comeback after the first standalone muni bond issue in India was done by Ahmedabad Municipal Corporation, which was rated by CRISIL in 1998. Since then, only about US$240 million has been mobilized by ULBs through the issuance of muni bonds and the issuances were primarily from higher-rated ULBs.

In June, Pune Municipal Corporation (PMC) raised the equivalent of US$31 million through the first tranche of the five-year bond programme. The AA+ rated bonds offer 7.59% interest, which was about 30bp-40bp more than the bonds arranged by the state government. A banker describes the pricing as pretty tight, though this was helped by the relatively small issue size.

The deal was 6x oversubscribed, with orders coming from domestic insurance and pension funds as well as large state-owned banks. Proceeds from the transaction will be used for PMC’s water metering project.

Sethi cites a number of factors on the inability of the muni bond market to really take off following the Ahmedabad offering. These include the limited investor interest as bond investors are comfortable only with what Sethi describes as high-safety category-rated issuances. Another factor was the need to improve the accounting practices since cash-based accounting, poor disclosure standards and lack of comparability across ULBs makes it difficult to assess the performance.

Sethi also notes the inability to effectively put credit enhancements in place such as escrowing of receivables, interception of State Finance Commission devolutions, and pooled finance mechanisms, among others. There was also lack of viable projects with strong cash flow visibility.

Indeed, the requirements for funding contributions to ULBs for urban infrastructure are quite high and many ULBs will have to tap external funding to meet their needs after using up the other sources of funds, such as land monetization.

Also, the Indian government has not extended tax concessions (as before), but has announced a 2% subsidy on the interest rates of muni bonds. “Additionally, the current benign interest rate regime will help in keeping the cost of borrowing low for ULBs rated in high-safety categories, making the bonds a more attractive option for ULBs,” says Sethi. “Low-cost borrowing will be advantageous for the ULBs as most of the projects have long gestation periods and low-to-moderate cost recovery due to the limited ability to generate revenues from projects, which are aimed at public welfare.”

Also, the Indian government has not extended tax concessions (as before), but has announced a 2% subsidy on the interest rates of muni bonds. “Additionally, the current benign interest rate regime will help in keeping the cost of borrowing low for ULBs rated in high-safety categories, making the bonds a more attractive option for ULBs,” says Sethi. “Low-cost borrowing will be advantageous for the ULBs as most of the projects have long gestation periods and low-to-moderate cost recovery due to the limited ability to generate revenues from projects, which are aimed at public welfare.”

Meanwhile, Shameek Ray, senior vice-president and head of debt capital markets at ICICI Securities Primary Dealership, says the prospects for muni bonds are looking fairly good for the very few higher-rated municipalities, provided that they space out their borrowings and do not crowd the market.

For the larger number of mid-rated municipalities, he says the process of finding investor acceptance will take time and will depend on these municipalities demonstrating their ability and openness to set-up creditworthy structures, update their financials and show their commitment to fiscal discipline.

“For the remaining and largest portion of lower-rated municipalities, further work has to be done on structures such as credit enhancements, pooled structures, etc., and it is still debatable how many of these would be able to find takers in the capital markets,” adds Ray.

In explaining the challenges faced by the muni bond market to take off the first time, Ray notes the need to borrow was firstly connected to the willingness to invest in infrastructure, which took some time. Further, the large amount of grants provided by the government under the Jawaharlal Nehru Urban Renewal Mission (JNURM), though beneficial and timely, easily met the funding needs of municipalities and left little requirement or willingness to come to the bond markets.

To make muni bonds more attractive to retail investors, Sethi says the government can grant them infra bond status, tax-free status or priority lending status. Pension and insurance funds, which currently are allowed to invest only in the AA-rated paper, should be permitted to buy bonds rated lower than AA to help expand the market for ULB bonds.

Ray agrees: “We need to further diversify the investor base. This could be done by enabling pension and provident funds to invest in muni bonds and specifically clarifying the enabling approvals for insurance companies, etc.”

The Securities and Exchange Board of India has set-up a regulatory framework for issuing muni bonds. ULBs with an investment grade rating – BBB- or higher – are allowed to do a public issue. Futher, they should not have defaulted in repayment of debt securities or loans obtained from banks or financial institutions during the past 365 days.

The municipal body must also comply with the state’s municipal account standards or the National Municipal Accounts Manual to be eligible for the issue. The Securities and Exchange Board of India allows ULBs having a surplus in their books in any of the three preceding financial years to issue bonds. All bond issuances must be rated by a recognized credit agency.

The regulations also provide for a 100% asset cover on the debt and provision of a buyback option and ULBs issuing bonds will have to provide audited financials for two years prior to the penultimate year from the issuance year.

Photo taken January 21 2017. Bridge under construction at Ghansoli. Credit GSK919 / Shutterstock.com