Private equity fundraising vehicles are raising more capital in shorter timeframes, and in Asia, although funds are still closing in a similar timeframe, they are also closing at a higher average size. Fund managers which have previously raised significant amounts of capital are also much more likely to close funds quicker and at a larger size.

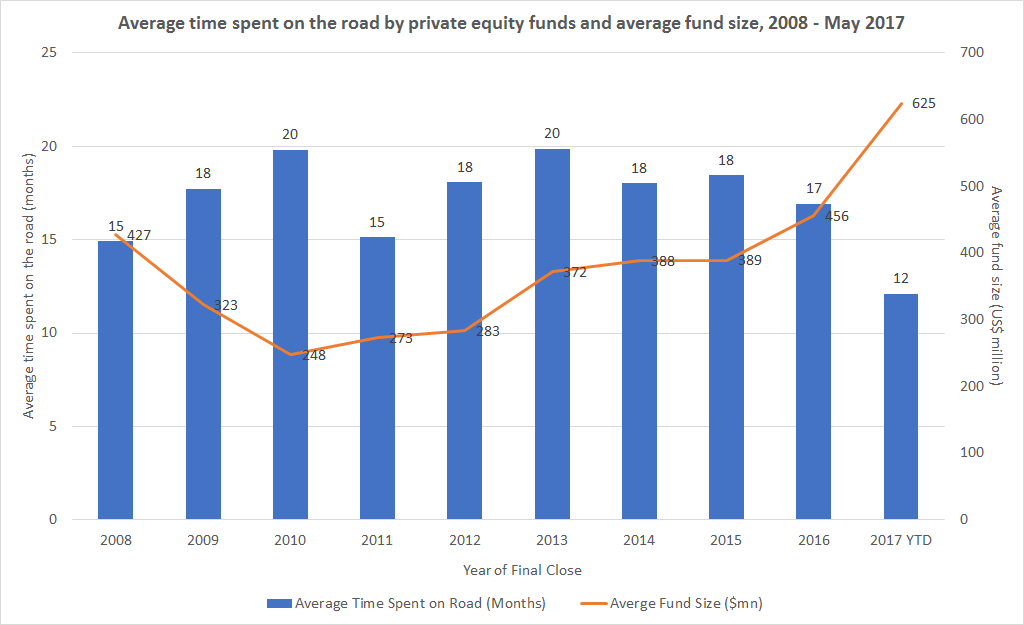

The findings are noted in a recent private equity report from intelligence company Preqin. The report found that in 2013 private equity funds spent an average of 20 months in the market and closed at an average size of US$372 million. In 2017, private equity funds now spent an average 12 months in the market and closed at an average of US$625 million.

Data from Preqin.

“Record distributions from private equity funds in recent years have spurred extremely high levels of investor satisfaction with the performance of the asset class,” comments Christopher Elvin, head of private equity products. “Much of the capital returned to investors has been redeployed in private equity, as investors seek to fulfil their allocation plans. This has resulted in an extremely active fundraising environment in which fund managers are seeking to capitalize on huge investor demand for funds.”

In Asia, funds are closing at a larger size, but not necessarily faster. In 2017 private equity funds spent an average of 17 months in the market, remaining similar to the average timeframe of funds closed between 2008 to 2017, which is 18 months. However, the average size of funds closed in Asia since 2008 sits at only US$248 million. In 2017, the average private equity fund in Asia closed at nearly double that size, at US$482 million.

Experience also goes a long way. Funds which were raised by the largest fund managers and from consistent top performing firms were most likely for fundraise quickly and successfully. Funds run by managers which have already raised US$5 billion or more since 2013 stand a 75% chance of exceeding their target size. This compares to just 36% of funds with managers which have raised US$500 million or less. Further, almost half of funds raised by consistent top performers spend only six months or less in the market.

“It is clear that while investor appetite is high, it is also primarily focused on established fund managers with a successful track record. Fund managers which have previously raised significant amounts of capital are likely to be able to do so again, while firms which consistently perform well can raise vehicles far more quickly than the industry at large. For smaller fund managers, or those which have yet to build a track record, fundraising can remain a lengthy and difficult process,” adds Elvin.