ONCE vibrant, in recent years the market for renminbi-denominated bonds issued outside China has seen a fall in issuance as well as a lack of liquidity, while at the same time the onshore market boasts greater liquidity and higher yields. However, a recent increase in CNH issuances this year underpins the role the offshore market continues to play as an alternative to the onshore market.

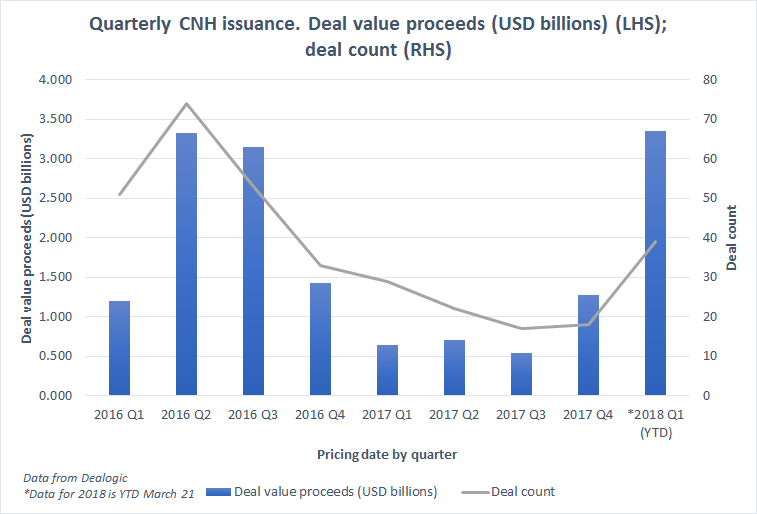

Total issuance in the offshore market fell from US$3.32 billion in the second quarter of 2016 to US$700 million in the second quarter of 2017, according to Dealogic data. This was partly due to the restrictions on cross-border cash flows by the People’s Bank of China (PBoC) since 2015, which meant a drop in the availability of renminbi held offshore.

However, the market recovered in 2018. There have been 39 issuances in CNH bonds year-to-date with deal proceeds of US$3.35 billion, including the first dim sum green bond issued by a Chinese corporate (Beijing Capital Polaris Investment).

With the launch of foreign access schemes such as CIBM Direct in early 2016 and more recently the Bond Connect in mid-2017, foreign investors are also now more easily able to invest in onshore renminbi bonds directly rather than gaining exposure to renminbi-denominated assets via CNH. “Global investors want access to the onshore market, not the dim sum market,” a fund manager at a large international fund house in Hong Kong puts plainly, speaking to Asset Benchmark Research (ABR) as part of The Asian Local Currency Bond Benchmark Review.

The onshore bond market is seen as more liquid and more able to capture a wide spectrum of issuers, particularly larger size and longer maturity issuances. A trading head in Singapore sees liquidity as the main driver: “I think in terms of relevance, the offshore market will definitely lose out over time because more and more participants are able to go onshore where liquidity is obviously much deeper,” he says.

In addition to having better liquidity, the onshore market has better yields. “Onshore bonds are more attractive as they yield higher,” says one fixed income head based in Malaysia.

The optimism around onshore renminbi bonds was also evident at a press conference held by Pictet Asset Management on Monday March 19. “We find the Chinese bond market quite attractive, we’re still receiving a real yield which is positive,” says Shaniel Ramjee, a senior investment manager at the firm.

However, the majority of Asian investors surveyed by ABR said they are not not writing off the dim sum bond market just yet. According to one Hong Kong-based fund manager, it has an entirely different target audience. “[It has a] different regulatory environment, different investor base and serves as a shadow market during onshore tightening and deleveraging,” he explains.

And although the onshore market has its advantages, it’s also harder to access. “We don't have an account to trade onshore bonds,” says a trader at a large private bank who invests in CNH. With Bond Connect still in its infancy many are also not able to use this access channel. Common complaints include that the scheme is too expensive and still doesn’t support delivery-versus-payment settlement.

On the regulatory side, until China opens its capital account fully investors say there is still a space for the dim sum market. “The offshore funding market will be kept alive by the authorities, until the full internationalisation of the renminbi,” says a portfolio manager based in Singapore.

The stability of the renminbi in recent months also bodes well. One Taiwan-based investor is optimistic. “I think the low issuance of CNH bonds is one of the reasons why this bond market remains inactive. However, the situation might change as it seems like CNH issuances have increased this year,” she says.

These data are part of ABR’s ongoing Asian Local Currency Bond Benchmark Review 2018. To participate, please click here.

Methodology

The Asian Local Currency Bond Benchmark Review is conducted in the first quarter of the year. Over 300 local currency bond investors including asset managers, hedge funds, private banks, insurance funds and commercial banks from 11 Asian markets namely China, CNH, Hong Kong, India, Indonesia, Korea, Malaysia, Philippines, Singapore, Taiwan and Thailand take part.

Data sets include market penetration, market share/wallet share, buying criteria/client satisfaction, research content and the top individuals. To learn more about the Asian Local Currency Bond Benchmark Review please click here.