A new “repo” commodity finance model is taking shape in China driven by commodity companies’ demand for asset liquidity and to dispose inventory off-balance sheet at the end of the year.

Large commodity companies such as Aluminium Corporation of China, the largest aluminium manufacturer in China, hold large amounts of commodity inventory on their balance sheets. In general, commodity companies want to avoid this situation at the end of the financial year as the inventory is subject to market price fluctuations which affects the balance sheet of the company.

In addition, the nature of the commodity business sometimes imposes a large working capital pressure on commodity companies. So, in a bid to reduce exposure to price fluctuations and manage working capital, a novel “commodity repo” model was born to solve this inventory challenge.

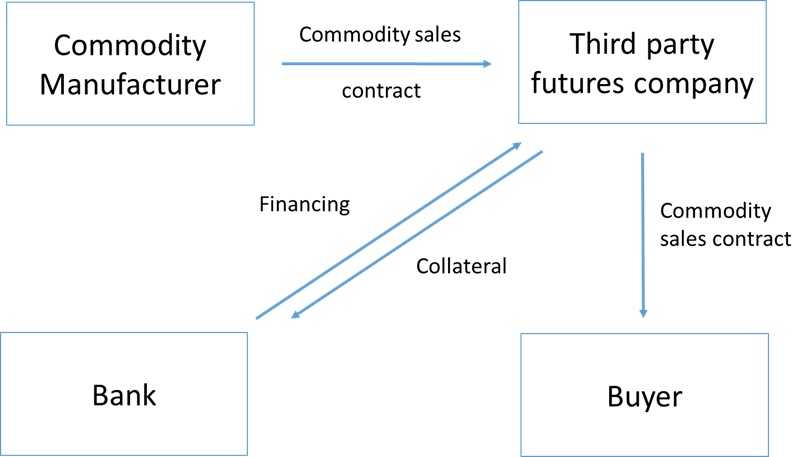

A commodity repo transaction works like this. A third-party futures company acquires the commodity inventory from the manufacturer at a discount. A bank helps fund this transaction, secured by the purchased inventory acting as collateral. After a period, say three months, a client of the manufacturer will repurchase the inventory from the futures company. With this type of repo transaction, the commodity manufacturer is able to reduce its inventory level while increasing its asset liquidity. The inventory will then be moved from the manufacturer to the futures company.

Source: Asset Data

In terms of the default risk, the commodity products accepted by the third-party futures companies are all standardized products tradeable on China’s commodity exchanges. In the case that the buyer fails to meet its payment obligations, the third-party futures company still has the option to sell the commodities on the commodity exchange.

In the western market, commodity repo is not a new banking product and some banks call it “commodity inventory purchase obligations” or CIPOs. However, the Chinese version of the commodity repo model is distinct from CIPOs in the sense that a third-party futures company, instead of a bank, acts as a commodity trader to acquire the inventory from the manufacturer. This is because in China banks are not allowed to purchase commodities directly.

In addition, the “repo” element also fulfils the off-balance sheet requirement of the manufacturer which traditional commodity finance approaches in China (e.g. collateralized loans) are unable to address.

The repo model was first introduced to the Chinese market in 2017 by the China Construction Bank, one of the big four banks in China, marking another development in the Chinese financial market. In 2014, China’s state council issued guidance on futures market, which encourage futures companies to launch more innovative products to serve the real economy.

The past few years have also seen China’s efforts in pushing forward the commodity and derivative markets. In March 2018, the first renminbi-denominated oil futures contract was officially launched and became tradable on the Shanghai International Energy Exchange.