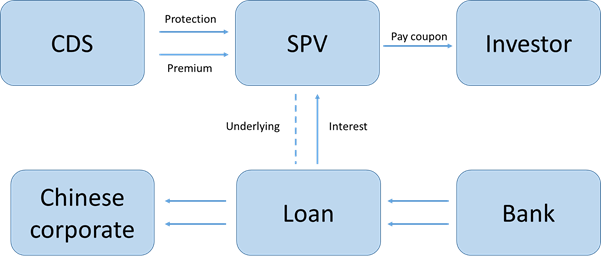

In a bid to broaden financing channels in China, banks have created an innovative product that embeds credit derivatives to fill the financing gap faced by Chinese onshore companies. Credit-linked notes (CLNs), with an onshore loan as the underlying asset, have become a feasible and flexible cross-border solution. The issuer gets a loan from a bank, which then sells the loan to a special purpose vehicle (SPV). The SPV packages the loan into CLNs and then sells them to offshore investors.

Note: CDS refers to credit default swap. Source: The Asset

While the loan market is much less liquid than the bond market, credit-linked notes enable Chinese corporates with no bonds outstanding to finance growth through loans. Providing comfort to issuers looking to tap the loan market, Chinese offshore investors are becoming more sophisticated and have greater understanding of credit derivatives and onshore credit.

With traditional offshore bond financing, Chinese corporates need to get approval from the National Development and Reform Commission (NDRC). This typically takes a few months. Yet for corporate loans in US dollars, corporates only need to get the foreign debt quota and register the transaction at State Administration of Foreign Exchange (SAFE).

Some offshore institutional investors (especially banks) cannot buy loans directly due to internal restrictions. Thus, a note product such as a CLN is the only way for these investors to get exposure to the target credit. Plus, issuers are not required to have an offshore rating. This reduces costs for the issuer and increases investor returns.

One hurdle: the initial loan master agreement requires lengthy negotiations, with a number of terms to be discussed. "We just put in place a master agreement. The negotiation is painful. But once the template is there for the drawdown, it is efficient. Therefore, it satisfies the needs of both sides," says a senior banker involved in this CLN transaction in an interview with The Asset.