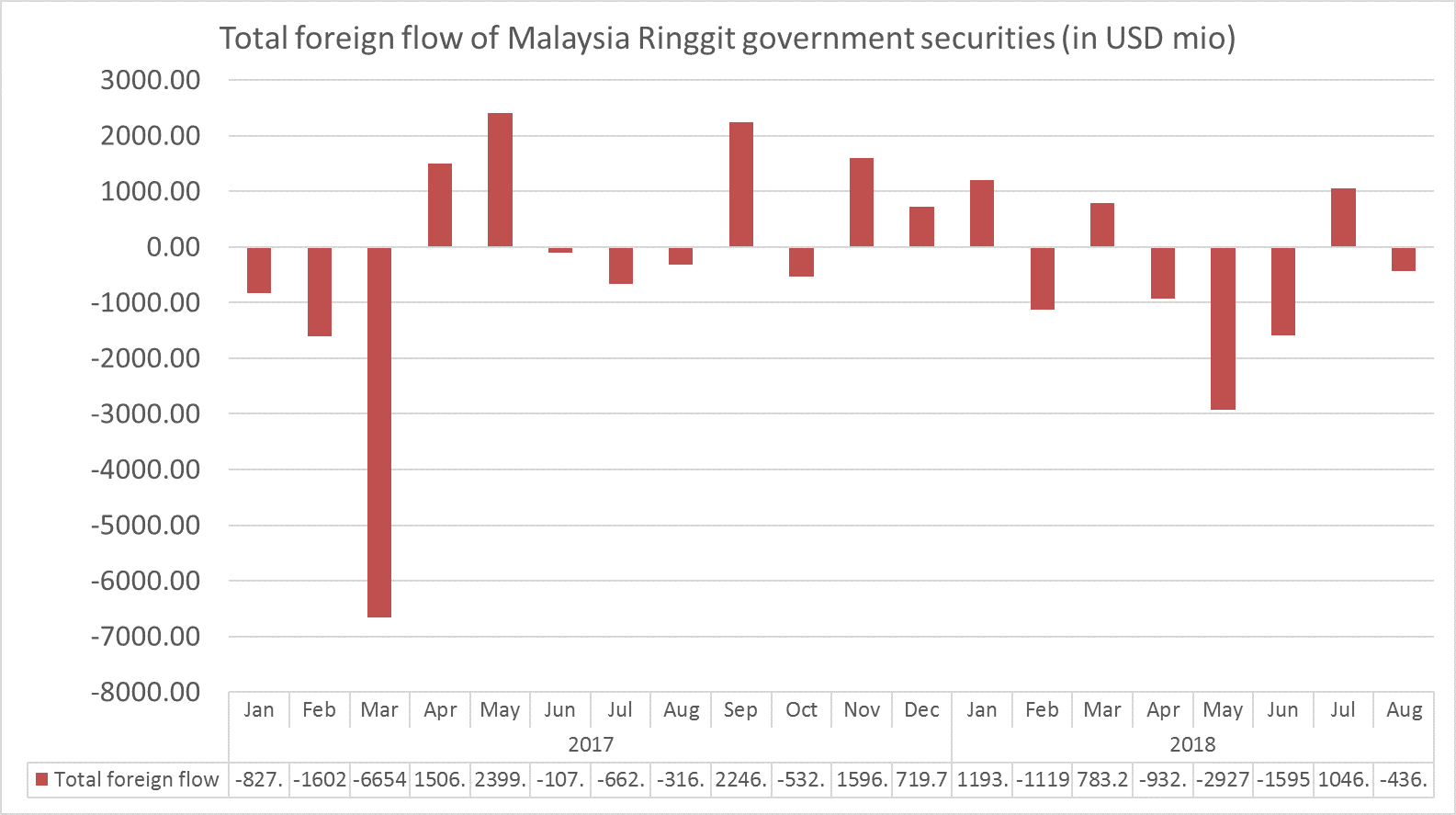

In earlier emerging market sell-off episodes, Malaysia was another market under the headwind. The capital outflow from fixed income market reached its peak on March 2017 (see Fig. 1). The market recorded rapid falls in the share of foreign holdings in the Malaysia ringgit bond during this period, whilst the ringgit continued to depreciate against the US dollar. However, the yield is not increasing significantly. In fact, the ringgit government bond yield curve even dropped slightly.

Fig 1. Total Foreign flow of Malaysia ringgit government securities, source: Bank Negara Malaysia

One of the reasons is the local banks have smoothened the transitions. According to Bank Negara Malaysia's latest monthly statistics, during the first two quarters of 2018, the foreign holdings of domestic sovereign debt dropped by US$5.3 billion. The drop is overcompensated by the increase of local banks holding of domestic government bonds, reaching US$7.25 billion.

Moreover, the economic fundamentals in Malaysia, though weaker, are still solid. Its GDP growth was 4.5% y-o-y in Q2 2018, softening slightly from the growth experienced during the previous quarter (Q1), which notched up 5.4% y-o-y.

The country has also remained as the largest sukuk (Islamic bond) market in Southeast Asia, with outstanding sukuk reaching US$817 billion at the end of June on growth of 2.7% q-o-q. All the mentioned factors combined have enabled Malaysia fixed income market to remain relatively stable.

It might also explain why Affin Hwang Investment Bank has improved the most in the past 12 months, according to the latest ABR ranking, which is also the first bank to be approved as a supplier and user under the Islamic Securities Selling and Buying Negotiated Transaction (ISSBNT) model.

In the foreseeable future, the competition in the primary issuance market would be more heated because of the fall in issuance, 9.3% q-o-q to US$22 billion, in the second quarter in 2018. The lower corporate issuance can be attributed to the new government's review of various infrastructure projects in line with fiscal management measures to restrain government debt, which may have also affected the debt sales of major corporate issuers. It is against this background that ABR is announcing the top sellside firms in the Malaysia ringgit bond market.

To view the rankings of the top banks in the secondary market and top bank arrangers for 2018 please click here.

Top Banks in Asian Currency Bonds 2018 methodology

The Asian Local Currency Bond Benchmark Review 2018 surveyed over 380 institutional fixed income investors who are active in 10 Asian currency bond markets: China (onshore and offshore i.e. CNH), Hong Kong, Indonesia, India, Malaysia, Philippines, Singapore, Taiwan and Thailand.

Survey participants included asset managers, banks, and insurance companies from both domestic and international institutions. They were asked to rate the best banks or securities companies across a series of buying criteria and identify their trading counterparties in the secondary market. The banks are ranked in each market according to their wallet share; the names of the top three are published. Additionally, investors nominated the best banks/securities houses as arrangers in the corporate and government primary markets in terms of the quantity and quality of the issues.