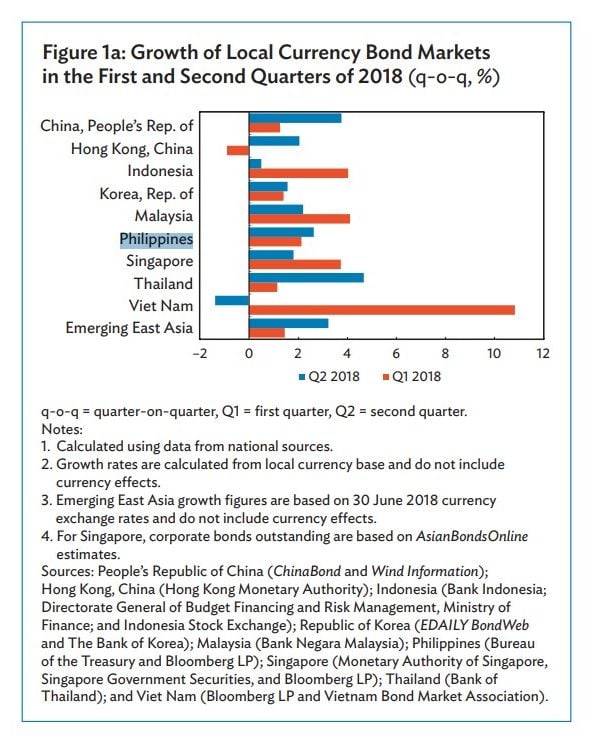

During the recent episode of market sell-off, the Philippines suffered less when compared to Indonesia and Malaysia. Between 1 June and 15 August, the yields of Philippine local currency (LCY) bonds of all tenors increased. Yet the yield movement was mild when compared to the upswing in the Indonesian yields. The Philippines was also one of the countries that recorded q-o-q growth in local currency bond during the first half of 2018 (Fig. 1a), with a slight increase in foreign holdings of government bond.

Source: Asia Bond Monitor

Source: Asia Bond Monitor

Despite this favourable backdrop, inflation and economic slowdown remained a headache keeping domestic investors cautious. The Bangko Sentral ng Pilipinas (BSP) has raised policy rates by 150 bps since April 2018 because a much steeper increase in inflation is expected. These inflationary pressures are largely down to rising supply prices that have been associated with the implementation of the tax reform program and rising fuel prices.

Various organizations like the Organisation for Economic Co-operation and Development (OECD), International Monetary Fund (IMF), and World Bank have all projected the country's 2018 gross domestic product growth to fall below the government's target range of 7.0%–8.0%. The Philippines' gross domestic product expanded 6.0% year-on-year (y-o-y) in Q2 2018, slightly down from 6.6% y-o-y growth recorded in the first (Q1) of 2018, due to slower growth in the services and mining sectors.

One concern is potential headwind in the primary market. The government raised its planned issuance for Q2 2018 by 35.0% from Q1 2018, particularly for short-term Treasury bills, due to the high demand for short-term paper observed in the previous quarter. However, the planned issuance volume was not reached because of a number of failed auctions as market participants sought higher yields. In Q2 2018, PHP48.0 billion worth of LCY corporate bonds were issued, down from the PHP63.2 billion issued in Q1 2018, a decline of 24.0% q-o-q. Uncertainties in domestic and international financial markets led to fewer companies issuing LCY corporate bonds.

In an environment where investors prefer short-dated Treasury bills and await the uncertain outcomes of domestic and international events, the coming twelve months will not be an easy time for local sellside firms and arrangers. It is in this background that ABR is announcing the top sellside firms in Philippines peso bond market.

To view the rankings of the top banks in the secondary market and top bank arrangers for 2018 please click here.

Top Banks in Asian Currency Bonds 2018 methodology

The Asian Local Currency Bond Benchmark Review 2018 surveyed over 380 institutional fixed income investors who are active in 10 Asian currency bond markets: China (onshore and offshore i.e. CNH), Hong Kong, Indonesia, India, Malaysia, Philippines, Singapore, Taiwan, and Thailand.

Survey participants included asset managers, banks, and insurance companies from both domestic and international institutions. They were asked to rate the best banks or securities companies across a series of buying criteria and identify their trading counterparties in the secondary market. The banks are ranked in each market according to their wallet share; the names of the top three are published. Additionally, investors nominated the best banks/securities houses as arrangers in the corporate and government primary markets in terms of the quantity and quality of the issues.