Few can doubt that Indonesia was one of the most severely affected countries in Asia during the latest episode in emerging market sell-off. The Indonesian rupiah slid to a 3-year low against the US dollar. Since the start of the year, the local currency (LCY) government bond yields in Indonesia have increased, resulting in the entire yield curve shifting upward. The yields across the curve gained an average of 66 bps. According to Asia Bond Monitor, Indonesia's debt sales (issuance) also fell more than half (54.5%) on a q-o-q basis and more than a quarter (26.3%) on a y-o-y basis.

Despite the contagion sparked by worries over the impact of the trade war and a strong US dollar, which brought the rupiah to a 20-year low in early September, some investors are still seeing relative value in the Indonesian high-yield (HY) corporate bond. "Some Indonesia HY bonds are pricing in too high default probability, e.g. coal sector bonds, especially when coal prices are high and well supported by demand growth," comments an investor in China Merchants Securities Investment Management, when asked whether he sees relative value in Asian G3 high yield bonds.

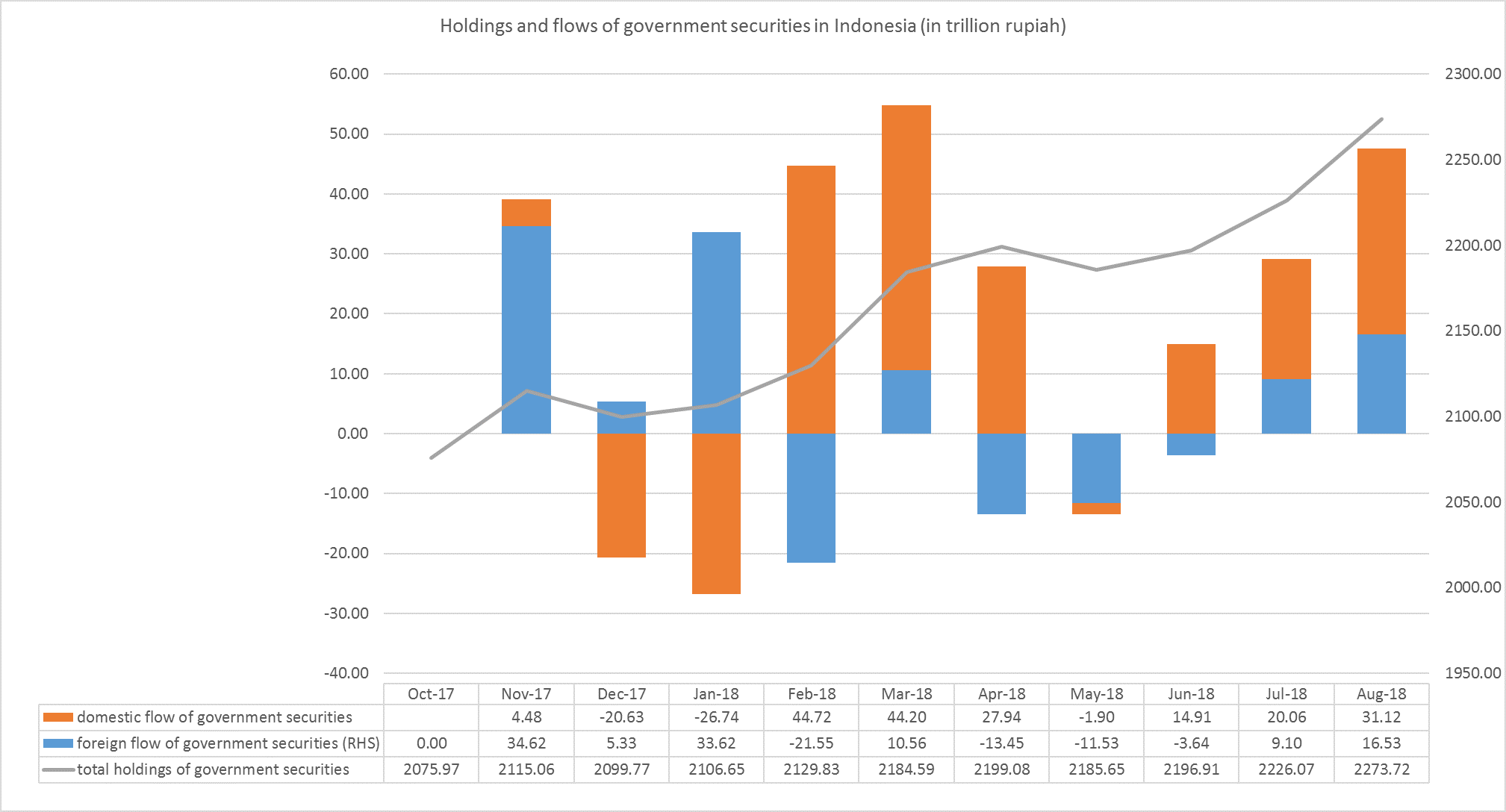

The increasing appetite for Indonesia fixed income is also found in government securities. The foreign holdings have recovered from an outflow of 3.64 trillion rupiah in June to an inflow of 9.10 trillion rupiah in July. The domestic holdings have picked up from an outflow of 1.90 trillion rupiah in May to an inflow of 14.91 trillion rupiah in June, according to the latest data gathered by Department of Budget Financing and Risk Management, Ministry of Finance.

Source: Asia Bond Monitor

The rupiah's fall prompted Bank Indonesia to raise its benchmark interest rate on 14 August by 25 bps to 5.5%. It marked the fourth hike in the last 4 months for a cumulative increase of 125 bps since the start of the year, which went against market expectations.

On 23 July, Bank Indonesia resumed issuance of 9-month and 12-month Sertifikat Bank Indonesia (SBI). There were 4.2 trillion (rupiah) of 9-month SBI and 1.8 trillion (rupiah) of 12-month SBI during the auction. The issuance is expected to help attract foreign portfolio investment and provide more diversity in the government securities. On 1 August, the central bank also launched a new interbank overnight reference rate called the Indonesia Overnight Index Average (IndONIA), which will provide a more reliable market-based reference pricing for loan rates and financial instruments.

Despite these recent initiatives by the government to stabilize the Indonesian bond market, are the banks in Indonesia ready for renewed investor demand? It is in this background that ABR is announcing the result of ACB top sellside firms.