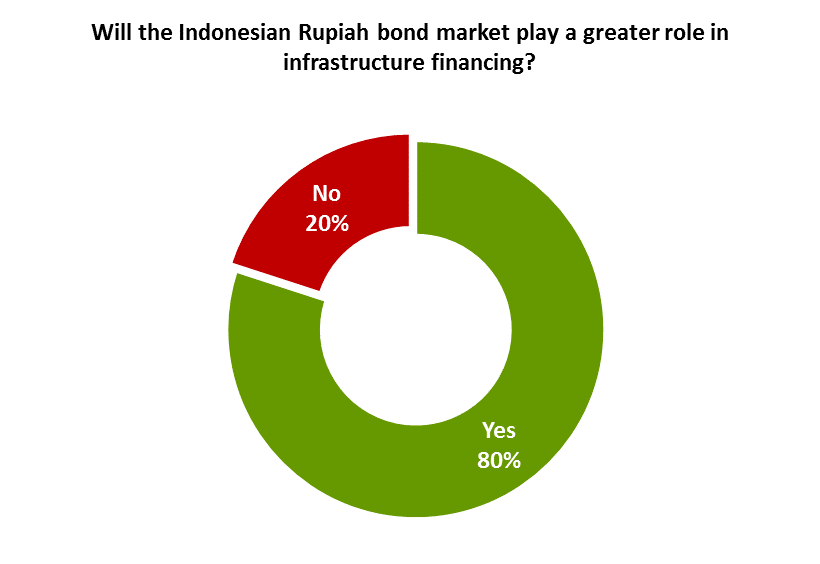

A majority (80%) of sellside individuals active in the rupiah bond market expects more local currency denominated infrastructure bonds to be issued, according to a recent survey conducted by Asset Benchmark Research (ABR) of 346 sellside professionals.

Despite political opponents contesting his win in the recent election, Joko Widodo’s presidency up to now suggests that more infrastructure projects will be launched in his second term. Under his presidency, a new US$400 billion infrastructure plan has already been drafted which includes building airports and power plants, creating imminent infrastructure needs for the next five years.

According to CEIC, Indonesia’s tax 2018 revenue was reported to be US$107 billion in December 2018[1], which is insufficient to support the infrastructure plan. Therefore, bond issuance will be the additional funding channel for the government to finance these infrastructure projects, apart from traditional bank loans. “There is definitively scope for Indonesia's bond market to grow to help finance infrastructure spend,” says Dain Sherborne, a trader at Toronto-Dominion Bank.

Moreover, the Indonesian government’s commitment to deepen the local capital market also sends a welcoming signal to the local sellside community. “Through the government has made it a priority to promote the capital market as a source of liquidity and also boost the role of the capital market in financing infrastructure projects. OJK is aware of the financing gap in the financial sector. Though the banking sector still has some room for higher loan growth, OJK will look to push the bond instrument liquidity role to be 50:50 with bank loans,” says a credit market trader at an Indonesian bank.

Considering the possible fluctuation of bond price as a result of high foreign ownership of government bonds, “SOE bonds will play a more important part in the development of Indonesia's infrastructure project for the next five years,” says a researcher at a securities firm.

Current infrastructure projects that are already funded by bonds include the Trans Java Toll Road and Trans Sumatra, which are being built and operated respectively by Waskita Karya and Hutama Karya, both state-owned enterprises.

[1] https://www.ceicdata.com/en/indicator/indonesia/tax-revenue