Risk mitigation will be a major topic for Asian fixed income investors in the coming year as they brace for a possible recession, a recent survey of 255 Astute Investors shows. In the survey, conducted by Asset Benchmark Research, 60% of respondents expect governance to be of increasing importance as credit selectivity becomes more paramount.

“Governance has always been an important rating driver and ESG risk factor for Asian issuers for an extended period of time, yet it appears to become more important,” says Jin Hur at First State Investments based in Hong Kong. “We have witnessed a few idiosyncratic credit events involving corporate governance issues, and a wider group of investors now appear to be gauging governance related risks in their credit selection process.”

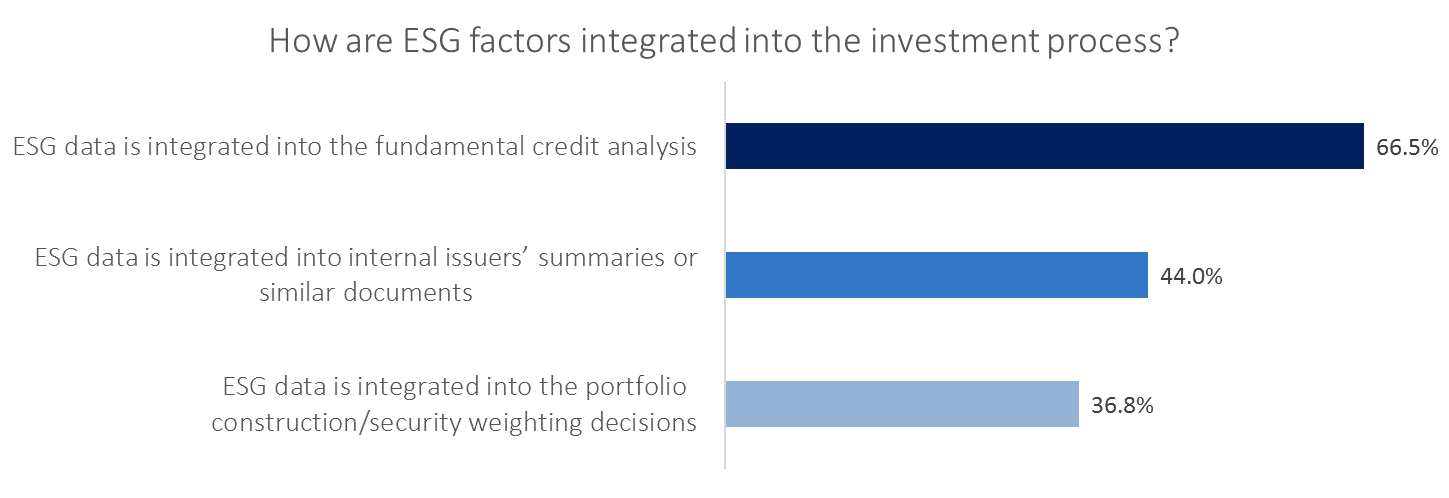

In the same study, two-thirds of Astute Investors reported that ESG data has already been integrated into their fundamental credit analysis. This reflects the industry consensus that ESG, especially corporate governance, has a material impact on creditworthiness.

Diwakar Vijayvergia at Alliance Bernstein says, “investors’ interest in ESG factors continues to rise as good ESG analysis may allow one to discern emerging risks that threaten credit quality and credit spreads. As highlighted by the recent Duniatex situation, a good ESG analysis can allow credit investors to avoid such names and avoid the downside.” Indonesian textile firm Duniatex failed to pay its bond interest in September.

While ESG principles have become more accepted as an industry norm, there are still some shortcomings. Only a third (35%) of Astute Investors are already integrating ESG factors into the portfolio construction process, suggesting that a minority of investors would adjust their weightings of securities after taking the company’s ESG performance into consideration.

Only a quarter (26%) of investors would regularly adjust their valuation models due to ESG consideration, while 28% of them would rarely or even never do so.

A chief investment officer, who always makes portfolio adjustments to reflect ESG evaluations, warns, “Asia is full of corporate governance disasters. Too often companies have the ability to repay but quite often not the willingness. It becomes clouded by succession plans and poor transparency.”

The lack of transparency also hinders the progress of ESG factor integration in credit risk analysis. More than half (58%) of the Astute Investors suggest that limitations in the visibility of ESG risks and the availability of comparative data are the top two difficulties they face when integrating ESG factors.

Abhishek Rawat, portfolio manager at Hong Kong Asset Management, believes that the frequent blow-ups in the Asian credit space are attributed to weak corporate governance of issuers. “If fund managers can navigate this issue by careful credit selection, they would outperform. Conversely, if regulatory frameworks can enforce better governance, the average credit spreads as well as volatility could be lower and the whole bond market will benefit.”

Pheona Tsang, chief investment officer at BEA Union Investment, points out that “investors have to identify default candidates beyond performing financial analysis as some red flags were not reflected in published financial statements or ratios.”

For a list of most astute investor, please click here.

For a list of top investment house, please click here