The Asset 2nd ETF Asia Summit 2016

Finding value in a bear market

#assetetf Tweets

Summary

ETFs are increasingly becoming an important component of investment portfolios amid market volatility. Last year, the ETF industry has grown 13% to US$350 billion and product offerings have expanded to include all major asset classes. Falling commodity prices, FX volatility, reduced bond liquidity and turbulent equity markets are expected to further push the growth of ETFs as investors seek stable returns. Demand for innovative ETF products has also risen. On the institutional front, factor-based ETFs are becoming more popular, while the increasing popularity of robo-advisory is expected to propel demand of ETF in the retail market. Amidst the prevailing low-yield environment, how can investors utilize ETFs to generate returns and enhance their portfolios? How can they choose the ETFs that meet their requirements? How do investors manage the risks involved in investing in ETFs? What criteria do they use in choosing a provider?

The Asset Events is pleased to organize 2nd ETF Asia Summit 2016, a strategic one-day event which will bring together investors, asset managers and product providers to discuss and debate the factors likely to drive the development of the ETF market in Asia.

Don't miss your chance to be part of the year's most exciting event.

Co-hosts

Gold Sponsor

Silver Sponsor

Exhibitors

Keynote Speakers

Venue

Social Media

Speakers / Agenda

Sponsoring

Sponsoring or exhibiting at The Asset 2nd ETF Asia Summit 2016 is a prime opportunity to put your products and services in front of key industry players and decision makers.

Depending on your goals and level of sponsorship required, a benefits package can be designed to target a particular audience or broad group. Features include prime speaking positions on the main programme, a large exhibition in the main networking room offering suppliers a platform to network and showcase their solutions and intimate roundtable discussions, enabling vendors to promote their services and expertise in interactive sessions.

If you offer services or solutions in this space and would like to showcase your expertise, please contact our Sponsorship team.

The Asset Events

Supporting Partner

As our Event Partner you have the opportunity to create new industry connections and generate new business opportunities. You meet relevant decision makers, professionals and finance industry leaders.

If you offer services or solutions in this space and would like to showcase your expertise, please contact us.

The Asset Events

Previous Event

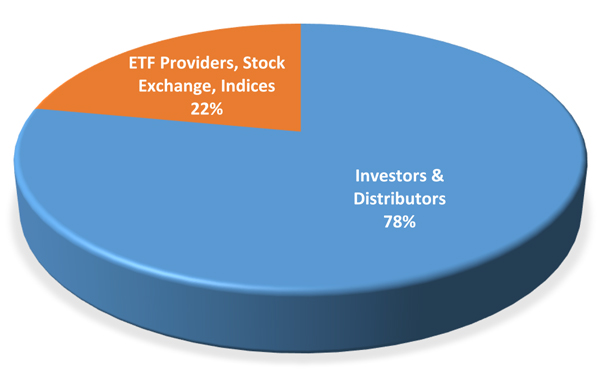

Delegates

Who should attend

- Chief Investment Officers

- Head of Investment Management

- Head of Portfolio Analysis

- Head of Asset Allocation

- Head of Fund Selection

- Head of Product Distribution

- Head of ETF / ETF Sales

- Head of Fund Distribution

- Head of Business Development

- Head of Institutional Sales

- Head of Equity / Equity Derivatives Sales / Trading

- Head of Fixed Income / FI Derivatives Sales / Trading

- Head of Commodity / Commodity Derivatives Sales / Trading

Registration

Save US$200

Save US$200