© 2021 Asset Publishing and Research Limited. All Rights Reserved.

After a frightful and dreadful start to 2020, China has emerged as the only major economy to have posted a modest GDP growth for the year at 2.3%. As a result of the sharp V-shaped recovery, foreign investors’ appetite for Chinese bonds remain undiminished, which was already elevated in recent years following market-opening reforms and now relatively better returns compared to the developed markets.

Meanwhile, index inclusion will push China’s market further into the mainstream. FTSE Russell became the latest adding Chinese government bonds to its much-tracked World Government Bond Index over a period of 36 months from 29 October 2021. Estimates suggest an inflow of over US$100 billion. It is not only the onshore market that’s tweaking international investors’ interest. Asia’s offshore bond market, largely denominated in US dollars, is also a hunting ground for Chinese credits.

With China committing to carbon neutrality by 2060 during the United Nations General Assembly in September last year, this is expected to cast a vibrant patina of green hue to the bond market in the foreseeable future. Already, among the most active issuers of green bonds in the offshore market are Chinese financial institutions and real estate companies. Chinese issuers also are coming to the market with social and sustainability bonds, in response to the Covid-19 pandemic.

How are international investors approaching opportunities in China’s bond markets? What is the interplay between onshore vs offshore bonds? With a spate of defaults in 2020, including SOE names, how are these affecting investors’ sentiment into 2021? Given the lower-for-longer mantra among the central banks in the developed markets, are Chinese bonds a good bet especially given its low correlation? As the markets grow in maturity, what would be expected by investors in terms of liquidity, credit quality rating, and disclosures?

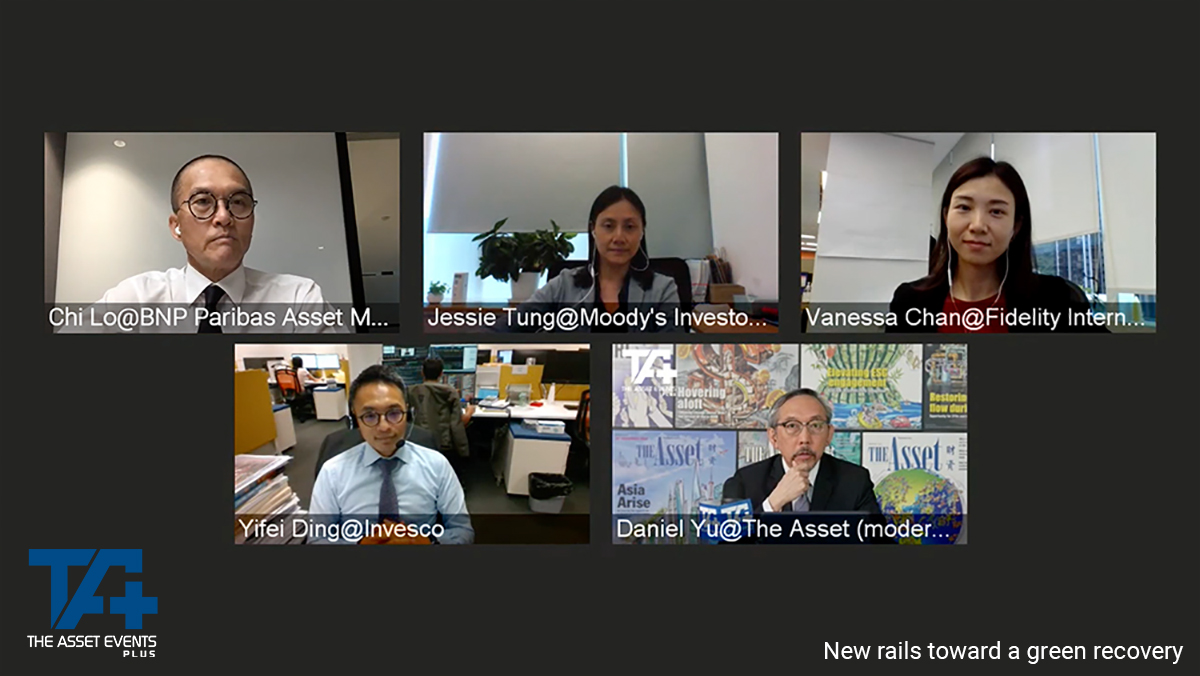

The Asset Events+, in partnership with leading financial and credit institutions, are pleased to be hosting the annual Asia Bond Markets Summit, China. Now in its second decade, the Asia Bond Markets Summit is the region’s pre-eminent fixed income conference bringing together issuers, investors, policymakers and other stakeholders involved in Asia’s bond markets.