Global issuance of green, social and sustainability bonds – or sustainable bonds, collectively – is expected to hit US$850 billion in 2021, a new annual record and a 59% jump from 2020, according to Moody’s Investors Service.

“Following record first-half issuance, we now forecast about US$450 billion of green bonds and US$200 billion each of social bonds and sustainability bonds this year,” says Matthew Kuchtyak, assistant vice president-analyst at Moody’s. “We still expect sustainable bonds to account for around 8 to 10% of global debt issuance in 2021, as issuers across all segments of the market continue to explore how they can link their capital markets activities with their sustainability objectives.”

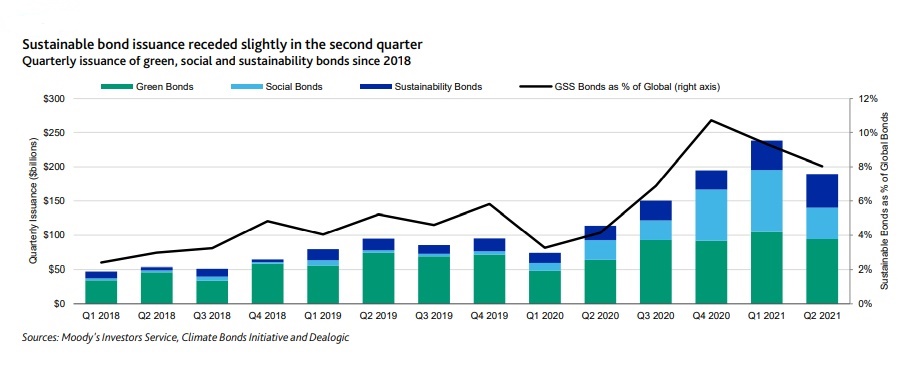

Global issuance of sustainable bonds in the second quarter jumped 66% from a year earlier to US$189 billion. This consisted of US$94 billion of green bonds, US$46 billion of social bonds and a quarterly record US$49 billion of sustainability bonds. The quarterly issuance total was the third-highest on record, indicating that market momentum is still exceptionally strong.

Sustainability-linked bond and loan volumes also continue to surge. After a quarterly record of US$31 billion in the second quarter, sustainability-linked bond volumes could top US$100 billion in 2021. Taken alongside use-of-proceeds sustainable bonds, this means overall sustainable bond volumes could approach US$1 trillion in annual issuance this year, Moody’s says.