The “S” component of ESG remains of lesser concern among Asian investors when compared to environmental issues, despite growing awareness and urgency of social issues in the region where the gap between the rich and the poor is wide.

The chief reason is that regulation and governments are currently more focused on addressing environmental issues because factors affecting climate change are more measurable than those affecting social issues.

This was the consensus among sustainable finance experts during a panel discussion at The Asset’s 5th ESG Summit held today (November 9) at The Westin, Singapore.

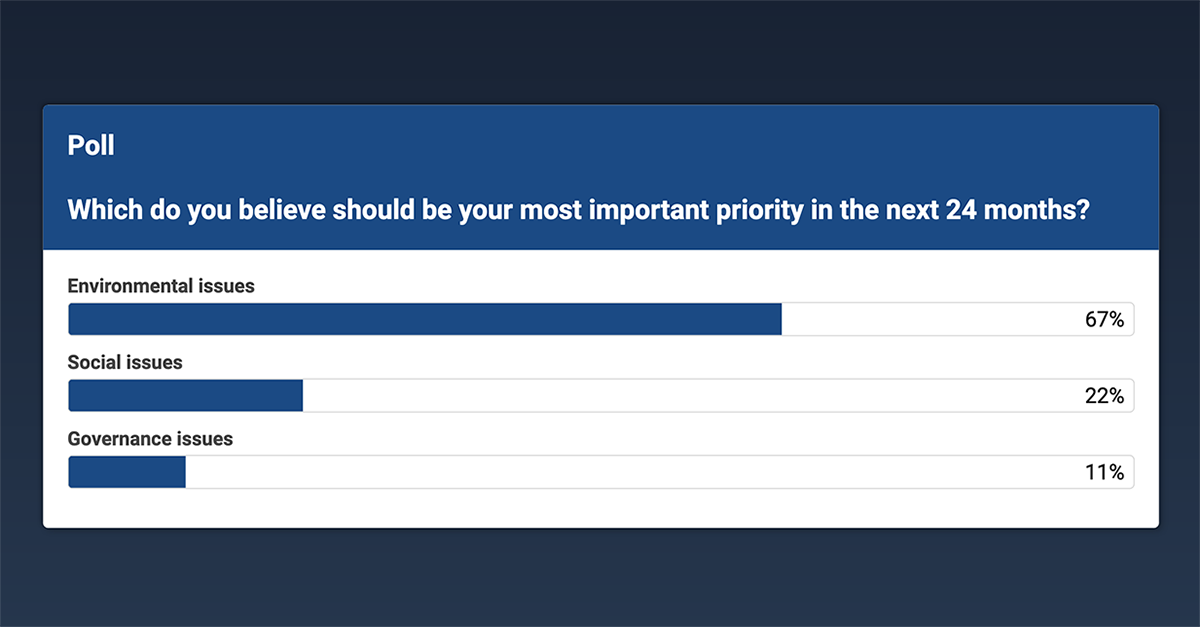

The issue was raised by Mark Watson, senior managing director and head of ESG Advisory (APAC) at Teneo, who expressed surprise at the fairly low score that social issues received in response to a poll question.

“I was quite surprised to see social issues were reflected fairly low down [in the poll]. From a practitioner’s perspective, I think we're seeing that social issues, particularly in Asia, is so important in terms of the huge gulf between rich and poor and livelihoods. Why aren’t social issues more on the agenda and more mainstream particularly when it comes to sustainable finance?” Watson asks.

In response, Melissa Cheok, associate director of ESG research at Sustainable Fitch, says that while a lot of action on social issues has taken place over the years, particularly for corporates and investors, this has come largely from regulations and government initiatives.

“A lot of focus is now paid to reducing carbon emissions, decarbonization, net zero and things like that. So ‘social’ tends to fall through the cracks a little bit,” Cheok says. “We are seeing some companies integrate that as part of their entire strategy, but I think there's still some way to go in Asia, versus maybe in Europe and the US.”

Her view is echoed by Nelson Huang, director, fixed-income and multi-asset product management, Asia-Pacific, FTSE Russell. He says while existing regulation, as well as governments’ attention, is more focused on climate change, that doesn't mean the social pillars aren't important.

“All these [social issues such as] ageing population, expensive housing prices, and all these have to be addressed. But I think the government couldn't be focused on two things at the same time. So right now, they’re focused on decarbonization first. But the ADB (Asian Development Bank) and World Bank are issuing some social bonds, and I wish governments could issue social bonds to support their people,” Huang says.

Dhananjay Phadnis, portfolio manager at Fidelity International, says the lack of focus on the social component of ESG can also be attributed to the difficulty of measuring factors affecting social issues.

“I would say that underlying this lack of focus, the simple answer in my mind is measurability. I think as we get towards better metrics of measuring what a social impact looks like, that focus can come back. So, there's also a practical issue there. Whereas environment is so completely measurable, and that's why a lot of focus goes on to that. But I think in time that will change,” Phadnis says.

Panel one: Committed to change, ready for action at The Asset's 5th ESG Summit.

Panel one: Committed to change, ready for action at The Asset's 5th ESG Summit.

Yee May Leong, managing director of Equinix South Asia, notes that in Singapore there has been a heightened awareness of the importance of social issues as they pertain to ESG, driven by the launch of the Singapore Green Plan, which is not just environmental but social as well.

“Awareness makes a difference. I think the industry is coming together to raise that awareness and really hold ourselves true to that social impact and how enterprises play a key role in that will continue to make a key difference,” Leong says.

Social bonds accounted for 15% (US$63.8 billion) of total bond issuance in the first half of this year, down from 57% (US$90.5 billion) in the same period in 2021, while green bonds grew to US$1.9 trillion, a growth rate of over 50% since market inception in 2007, according to the Climate Bond Initiative.

“The Russian invasion of Ukraine in February and the subsequent European energy crisis exacerbated post Covid-19 inflation, impacting bond market dynamics. Rising interest rates and high volatility resulted in decreased bond issuance,” according to CBI.

For more information about the event please go here.