Institutional investors plan to maintain their allocations for real estate globally this year amid the market uncertainties, a new report finds.

With a narrow gap of 20bp between current (10.2%) and target (10.4%) allocations to real estate, institutional capital looks set to maintain stickiness to the asset class, according to the 2023 Investment Intentions Survey published January 18 by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), the European Association for Investors in Non-Listed Real Estate Vehicles (INREV), and the Pension Real Estate Association (PREA).

Approximately half of all investors expect their allocation to real estate to remain unchanged with an even split among the rest of investors to increase or decrease their allocation.

Asia-Pacific investors indicated raising real estate allocations from the current 6.3% to a target 8.3% while allocations for the other regions remain relatively flat with a more subdued outlook, especially in Europe.

A key theme is the increased importance of inflation hedging as a reason for investing in real estate in 2023. Nonetheless, diversification benefits of real estate in a multi-asset portfolio, risk-adjusted performance over other asset types, and income return are the top reasons for investing in real estate.

Investors are also flagging rising liquidity risks with 38% of institutional investors now placing liquidity among the top three obstacles in non-listed real estate funds investment this year. While survey results reveal investors are moving on from the pandemic, macroeconomic headwinds are affecting investors globally.

Environmental, social and governance (ESG) principles are now well established in investment decisions. Globally, 71% of investors surveyed consider a net-zero carbon commitment to be an important feature when investing in a non-listed real estate fund, and 81% of respondents pay close attention to a fund's environmentally and/or socially responsible investments.

Asia-Pacific investors stand out with the highest proportion (75%) indicating that “promoting ESG is important”. For investors in Europe and North America the scores are 73% and 44%, respectively.

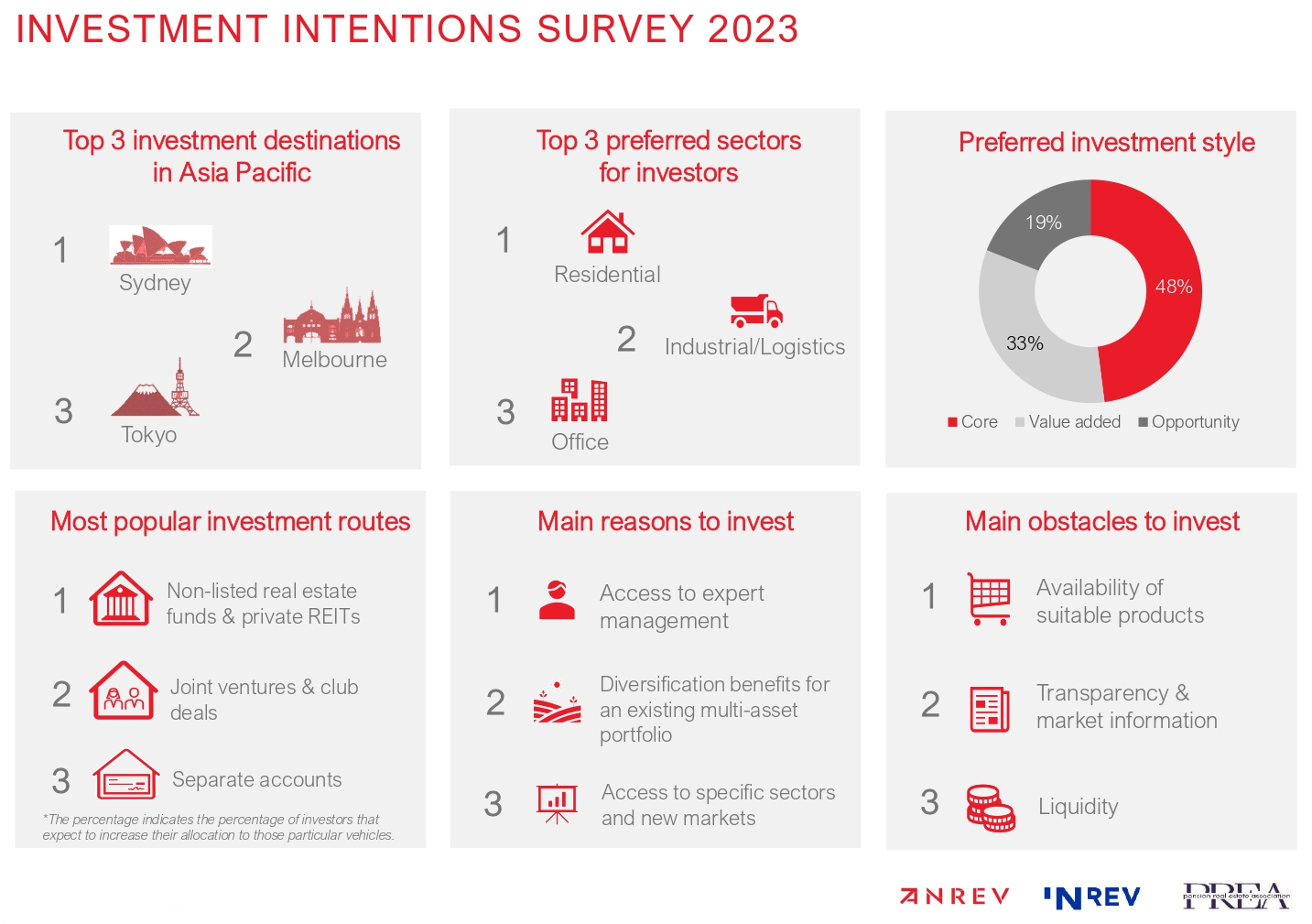

Global investors favour core strategy (48%) as the preferred investment style for Asia-Pacific real estate, the highest level since 2014 as investors lean towards a defensive stance amid a shift in risk appetite. However, investors in Asia-Pacific are shifting their preference away from core strategy, which is supported by 25% of respondents, towards value-added strategy, which is favoured by 63%. Opportunistic strategy is preferred by 13% of investors in the region.

Preferred destinations

Sydney and Melbourne have edged Tokyo among the top three investment destinations for institutional investors in the Asia-Pacific region. Sydney is now in top spot with 86% of investors intending to invest there, followed by Melbourne in second place (83%). Tokyo now sits in third spot at 66%. Outside the top three spots, Seoul replaces Osaka in fourth position, pushing Osaka down to fifth position.

Residential has become the most preferred sector for institutional investors with 83% of respondents indicating they will invest there in 2023. It is followed by industrial/logistics in second place (76%) and office in third (72%). While interest in the industrial/ logistics and office sectors remains high, the drop in preference for these sectors may reflect an adjustment in investor preference towards residential.

The Australia market dominated the top three positions for preferred city/ sector. Sydney residential takes over Tokyo residential in the first spot, with 62% of investors indicating this preference. Melbourne residential (59%) and Sydney office (55%) are in second and third place, respectively. They are followed closely by the tie among Tokyo industrial/ logistics, Melbourne office, and Seoul industrial/ logistics at 52%.

Amélie Delaunay, ANREV director of research and professional standards, says: "The 2023 Investment Intentions Survey is reflecting institutional investors' reaction to the global economic and geopolitical turmoil. The denominator effect is affecting investors in their allocation, but it is reassuring to see that still 88% of them are expecting to deploy capital in 2023.

“Investors are also refocusing their investment on fewer geographies in the region with China being excluded. ESG considerations, including environmentally and/or socially responsible investments and net-zero carbon commitments, are now well-established considerations when investing in the Asia-Pacific region."