Real estate remains a key institutional asset class, with global assets under management standing at US$4.1 trillion, a new survey finds.

The average AUM per manager rose 10% to US$35.7 billion in 2022, from US$32.5 billion in the previous year, according to the annual fund manager survey published by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), the European Association for Investors in Non-Listed Real Estate Vehicles (INREV), and the National Council of Real Estate Investment Fiduciaries (NCREIF).

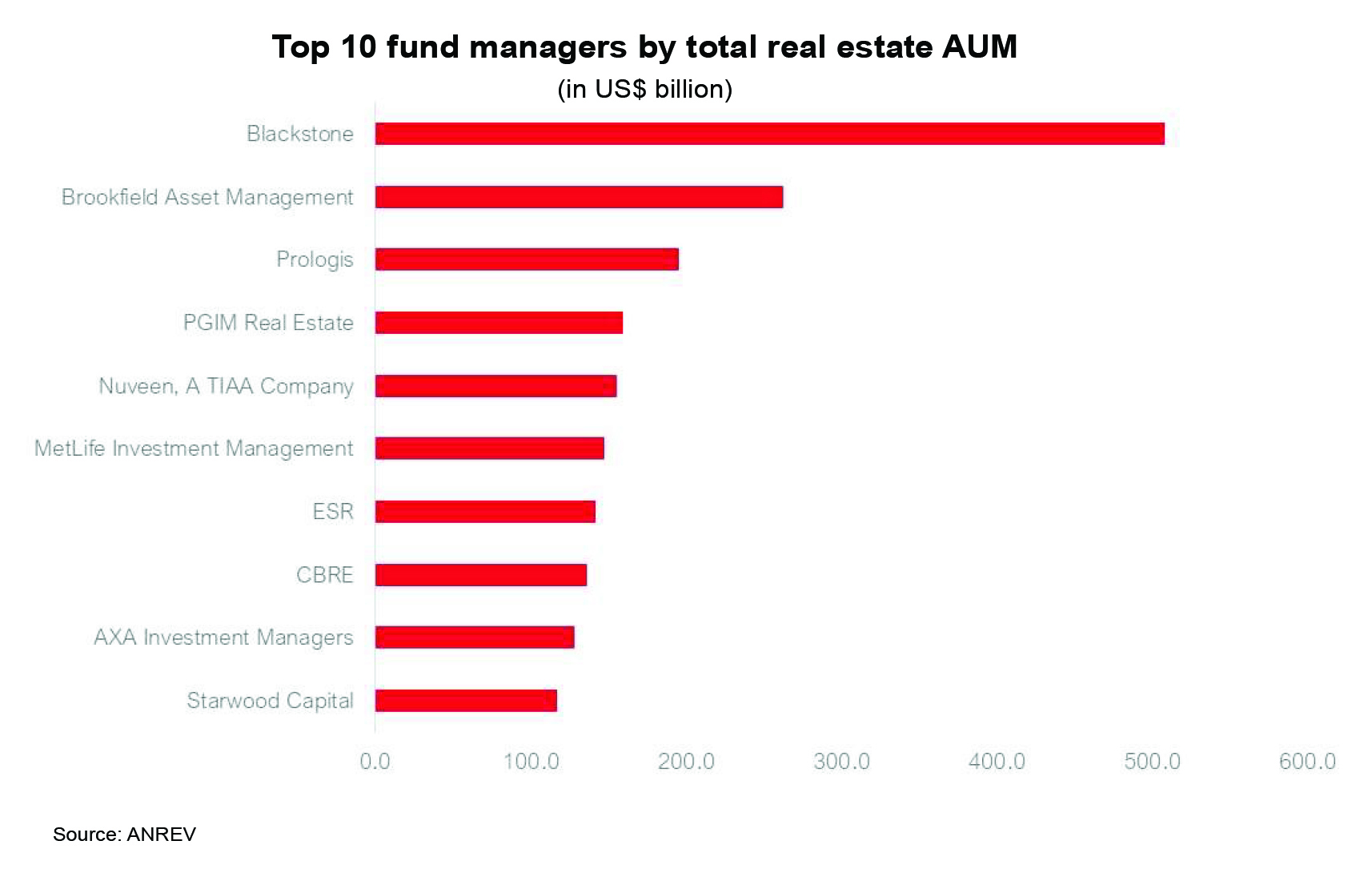

This comes amid a trend of consolidation in the industry, where the upper quartile of survey respondents accounts for 80% of total global AUM (US$3.3 trillion). The total AUM of the top 10 managers exceeded US$1.9 trillion, with the average top 10 fund managers' AUM at US$195.3 billion.

The top five managers – Blackstone, Brookfield, Prologis, PGIM and Nuveen – have all maintained their positions in 2022. The top 10 reported total real estate allocations of above US$100 billion, with the largest player Blackstone crossing the US$500 billion mark after increasing its total AUM by over US$33 billion.

The combined AUMs of the top four managers account for almost 27% of the total real estate capital in this year's survey.

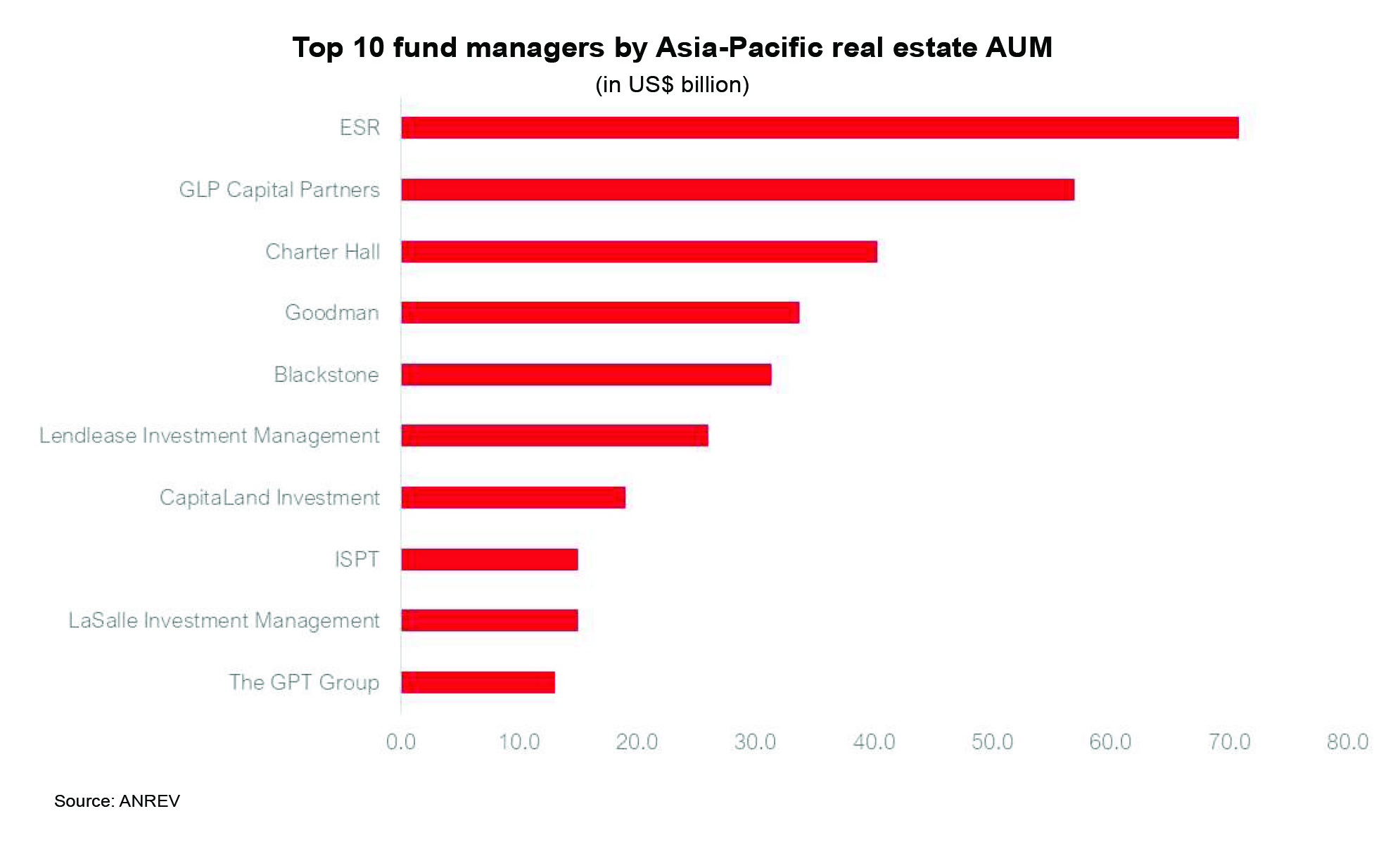

In Asia-Pacific, industrial and logistics players are emerging as the top managers. Topping the list in the region is Hong Kong-based ESR, whose merger and acquisition growth has propelled it way ahead of the next player, GLP Capital Partners. The firm has also entered the global top 10 list, taking the seventh position in the survey.

With Charter Hall completing the top three and Goodman at fourth place, three out of the top four are noticeably pan-Asian industrial and logistics players.

"The ongoing consolidation in the non-listed real estate industry is evident as the concentration of AUM in larger fund managers persists in 2022,” says Amélie Delaunay, senior director of research and professional standards at ANREV. “It is interesting to observe that non-listed real estate AUM in APAC is dominated by single-sector industrial and logistics investment managers, ESR, GLP and Goodman, which is a shift from five years ago where more diversified managers figured in the top three."

North American real estate AUM are by far still the largest allocations by top fund managers on average across the globe. North American strategies remain dominant among other strategies, accounting for 39% of the total AUM at US$1.6 trillion. European strategies are the second biggest and account for 29% of the total allocations at US$1.2 trillion. Asia-Pacific strategies represent around 18% (US$754 billion), followed by global strategies with a 14% share (US$565 billion), the survey shows.