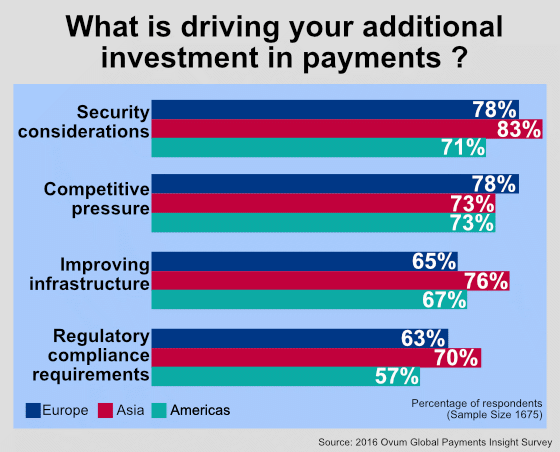

Asian corporates are increasing spending in payments more than their Western counterparts to boost infrastructure and security.

In a recent survey, four in five corporates in Asia (about 80%) are focussing on security and payment infrastructure improvements. That is higher compared those in the Americas with 67% and Europe, 65%, a global payments report by Ovum revealed.

The spending by Asian corporates and banks indicate the rapidly evolving nature of the payments ecosystem in Asia, where new players like China’s online payment platform Alipay – a unit of e-commerce giant Alibaba – are transforming business relations among players, says Ovum.

An example of this would be DBS Bank, which recently eliminated the use of physical tokens for corporate transactions and replaced them with digital ones.

Corporate treasurers often have to carry several security tokens to conduct their business banking, with some having up to six physical tokens with them at any one time. DBS’ launch of its IDEAL Mobile feature that sends digital tokens through an app allows for easier and more convenient banking for clients on the go.

Security considerations is also an issue for regional banks and corporates, the survey reveals, and are driving spending in global payments.

Earlier this year, Bangladesh’s central bank was attacked by hackers who were able to successfully transfer around US$101 million from the bank’s account. Financial regulators within the Asia-Pacific region have started to put in place safeguards against these threats. Hong Kong’s financial regulator the HKMA (Hong Kong Monetary Authority) announced that local bankers would be trained and certified to deal with cyber-security issues starting this December.

Moreover, Singapore’s Prime Minister Lee Hsien Loong recently stated that the government was looking to strengthen its financial systems. According to the Singaporean government, around 8% of the country’s Infocomm technology budget will be redirected for cyber-security spending. In 2014, Singapore reported spending US$408.6 million on cyber-security.

Banks as well have also been focused on fortifying their transaction processes. Standard Chartered Bank last month signed an agreement with CyberSecurity Malaysia to develop cyber-security talent and collaborate on areas such as threat intelligence and forensic technique.

“The number of connective devices per individuals will jump significantly. We think that the average devices per user will jump to 6.5 by the end of the next decade. With rising connective devices you also become more vulnerable. There will be increasing threats on the security level,” says Sundeep Gantori, equity analyst at UBS CIO Wealth Management. “There will be more spending on cyber-security in the future. We have identified cyber-security as one of the longer-term investment themes.”