In an ever-changing world, staying on top of your currency exposures will be critical for any CFO/Treasurer in 2017. With the US dollar expected to rise and the renminbi expected to weaken further, financial professionals within Asia are re-evaluating their hedging strategies in the new year.

For most Asian companies, their hedging strategy typically involves forward contracts/swaps where the exchange rate payment amount is locked in. Other forms of hedging involve natural hedging, that is, the matching of payments and receivables in the same currency at roughly the same time and the same amount. Money market hedging via the use of highly liquid and short-term instruments, such as commercial paper, is also another tool used by companies.

Companies tend to use either manual processes (e.g. phone-based broking) or automated processes (e.g. bank-proprietary systems/multi-dealer electronic platforms) as hedging methods. Multi-dealer electronic platforms in particular are growing in popularity due to their ability to provide a treasury team with various foreign-exchange (FX) quotes from a range of counterparties.

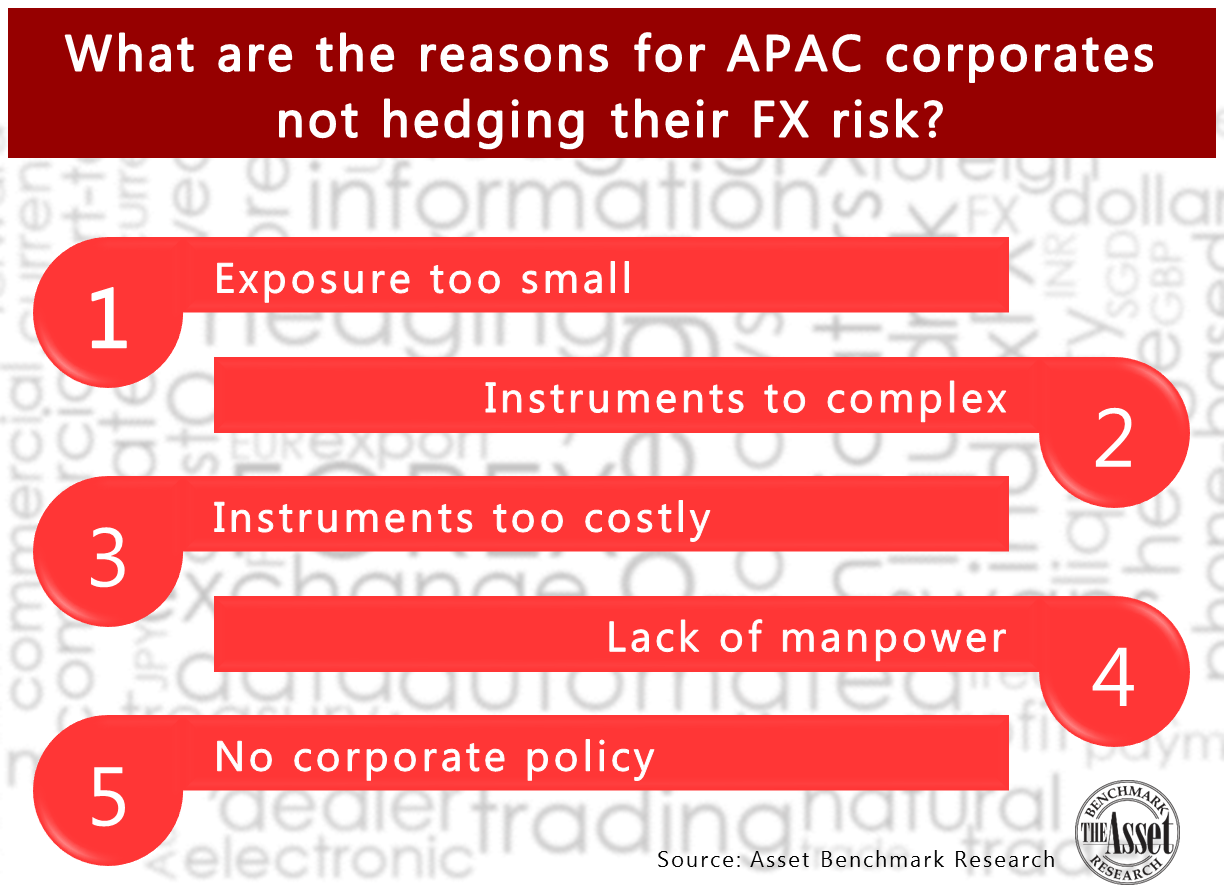

Despite the benefits of having an FX hedging solution, there are companies within Asia that don’t actively prepare for FX fluctuations. According to a survey last year, conducted by Bank of Communications and the Asset Benchmark Research, most companies shared that they didn’t hedge FX risk because their exposure was too small. This was followed by the complexity of hedging instruments and the cost of such instruments.

Nonetheless, negative FX exposure has significantly affected the bottom line of some Asian companies. Data from the survey reveals that 39% of companies surveyed had their income statements affected by currency movements, while 51% stated that there was no effect either indicating that their exposure was limited, or that they had put in place the necessary FX risk management tools. Another 10% were not sure if FX exposure had affected their revenue.

Additional reporting by Jacky Fung.