Emerging into the limelight several years ago, blockchain technology has captivated the financial services industry with its ability to reduce compliance costs and speed up transactions via a distributed ledger system based on cryptography. Since 2013 investment into blockchain-focused companies has blossomed. From US$136.4 million in 2013, annual investment has risen to US$543.6 million in 2016, as noted in KPMG’s recent The Pulse of Fintech report.

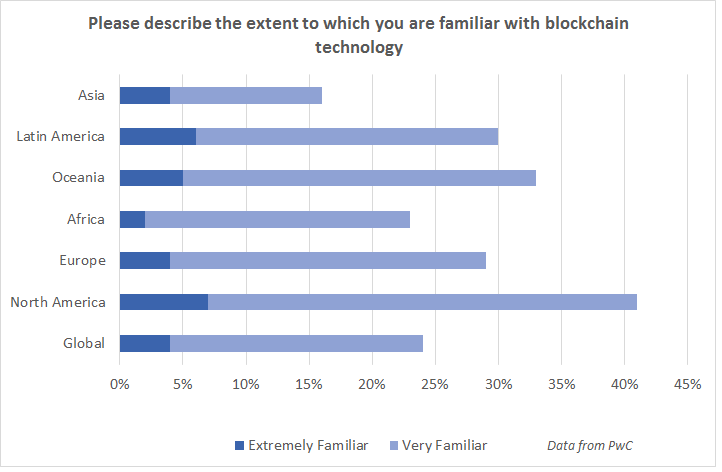

Despite the buzz around blockchain, Asia lags behind the rest of the world when it comes to familiarity with the technology. That’s according to data from PwC’s Global FinTech Survey 2017. The survey found that only 16% of participants from Asia were familiar with blockchain technology in contrast with 41% of North American participants, including 7% who reported being extremely familiar with the technology.

Nevertheless Asia-based entities have started to step up their focus on blockchain by pushing forward with additional regional proof of concepts. Blockchain is also attracting interest from regional financial regulators. Earlier this month the Smart Dubai Office announced that it had partnered with Avanza Solutions to provide a blockchain-based payment platform for Dubai government entities.

In Singapore, the Monetary Authority of Singapore revealed that it had completed a proof of concept involving blockchain for domestic inter-bank payments. This trend was subsequently followed by Hong Kong’s Monetary Authority who together with Bank of China (Hong Kong), the Bank of East Asia, Hang Seng Bank, HSBC and Standard Chartered (Hong Kong) developed a blockchain solution for trade finance issues.

Ripple, a San Francisco-based blockchain solutions provider, recently announced that it had added ten more financial institutions to its global payments network including some Asian banks: Axis Bank, MUFG and Yes Bank.

“Remittances have been a key strategic area for us. We at Axis are excited with the tie-up and the potential that use of blockchain technology could deliver in enabling real-time affordable money transfers,” states V Srinivasan, deputy managing director at Axis Bank.

In terms of the future usage of blockchain globally, PwC’s report has a bright view on the technology. Around 55% of respondents stated that they would adopt it as part of a production, system or process by 2018, and 77% reporting the same, but by 2020. Regarding business use cases, over half of the participants stated that blockchain would be used for enhancing payments infrastructure, followed by fund transfer infrastructure and digital identity management.