The People’s Bank of China (PBoC) has issued a circular among Chinese banks and third-party payments platforms which is set to radically change the online payments landscape in China by introducing a sole intermediary clearing house to handle all transactions between payments companies and banks.

The new document requires all third-party platforms, such as WeChat Pay, Alipay and others, to connect with Wang'lian (网联), an independent clearing house jointly established by PBoC, other Chinese regulatory bodies and some payments companies.

Here The Asset highlight the top five things you need to know about the new clearing house and how it will change the market:

1. What is Wang’lian?

Wang’lian, whose official name is “online payment clearing platform for non-banking payment institutions”, was set up in March. The two largest shareholders of Wang’lian are PBoC subsidiary, China National Clearing Center, and State Administration of Foreign Exchange subsidiary, Wutongshu Investment Platform. Noticeably, Alipay and Tenpay are also shareholders of Wang’lian.

2. How does the new model work?

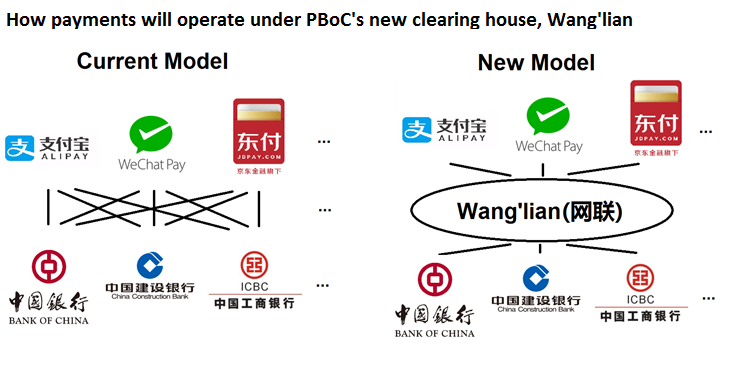

Currently, each third-party payment platform connects directly to the banks and each transaction is cleared by the third-party platforms themselves. The new model adopts a centralized clearing procedure where Wang’lian will act as the sole intermediary clearing entity to handle all transactions between payments companies and banks.

3. How will it affect financial institutions?

According to Chinese media, the document from PBoC requires that banks and payments companies be ready with the internal infrastructure changes required for the new model by October 15. From June 30 2018, all payments and transfers will be processed by Wang’lian.

According to a government official at the State Council, Wang’lian will weaken the bargaining power of third-party payments platforms in China when they are in negotiations with banks, given that payments companies no longer have exclusive possession over user data. Under the new model, it is possible that banks will have access to user data and even transaction data in collaboration with Wang’lian.

It is widely believed that the new clearing entity will have a direct impact on UnionPay, the state-owned clearing company within the Chinese banking system. As third-party payments platforms continue to take market share from banks, UnionPay, as the sole clearing house in the banking system, is likely to become marginalized.

4. How will it affect retail customers?

Data from online transactions, for instance transactions through WeChat’s red packet function, will be monitored by PBoC. However, despite a clearing fee that payments companies are charged by Wang’Lian, customers may still have lower average transaction costs due to the economies of scale, according to a recent study from George Washington University.

5. What is the objective of setting up Wang’lian?

Under the new model, PBoC will be able to access the data for each payment or transfer. PBoC will have better oversight on potential money laundering activities and illegal cross border transactions through third-party payments companies, which cannot be detected under the current model.