Risk management reporting has been boosted among Hong Kong-listed companies, a PwC survey has found, following significant changes made by the Hong Kong Exchange (HKEx) to the corporate governance code last year.

A recent study by PwC revealed that there has been a substantial increase in the number of Hong Kong-listed companies which publicly disclose the process by which they manage significant risks, from 45% in 2015 to 78% in 2016. Moreover, the report highlighted that 97% of listed companies in 2016 had an internal audit function, up from 82% in 2015.

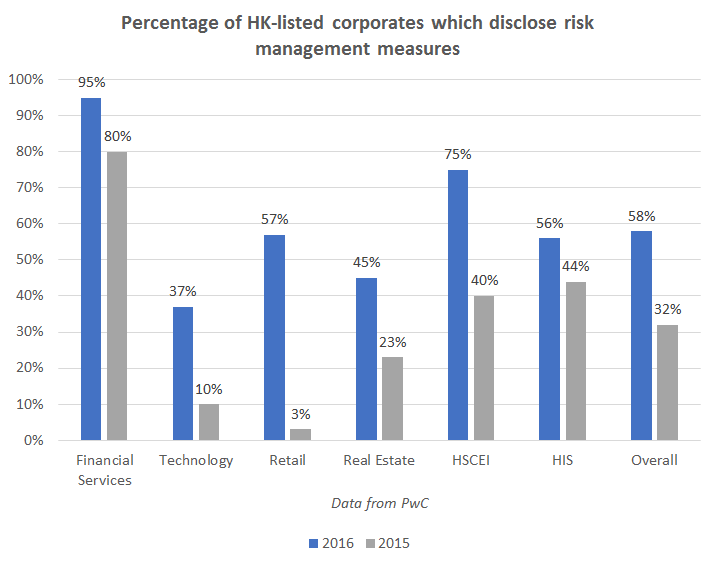

However, there were noticeable differences between companies in different industries. In the technology sector, for example, only 37% of companies were able to show that they had institutionalized risk management measures. Conversely, around 95% of financial service firms were able to show that they had some sort of risk management plan in place.

“It’s probably the nature of the industry and the company within that industry. In the technology sector, for example, usually the nature of the industry is diversified and change happens quite often,” observes Cimi Leung, internal audit service leader, Hong Kong and China South at PwC. “The companies are usually smaller in scale or very young so they do not have the internal resources.”

Although some sectors lagged behind, such as technology, retail, and real-estate, all sectors made significant increases in the level of those willing to disclose their risk management measures in their annual reporting: overall, 58% of listed companies disclosed their risk management measures in 2016, nearly doubling from 32% in 2015.

In terms of further developments of risk management and internal control reporting, Leung is upbeat and believes that companies will not see this as just another compliance task that needs completing. “The senior management of companies have found that this [risk reporting] is good for them, to be able to settle down everything they have on hand and make it systematic, so that they can focus on emerging risk,” she says.