THE Taiwanese government under Tsai Ing-wen’s leadership has explicitly urged financial institutions to expand in Southeast Asia in line with its policy to ease the sector’s exposure to China. But this hasn’t dampened ambitions of many Taiwanese banks to pursue business in the mainland.

Many of Taiwan’s banks heeded the government’s call to expand in the south. Cathay United has representative offices in six Southeast Asian countries including Malaysia and Vietnam. It runs branches in some of these markets and is opening more over the coming years under its expansion plan.

“China is difficult, but important to us,” says Alan Lee, president at Cathay United Bank. Of Cathay United Bank’s 12 overseas branches in Asia, four are in China.

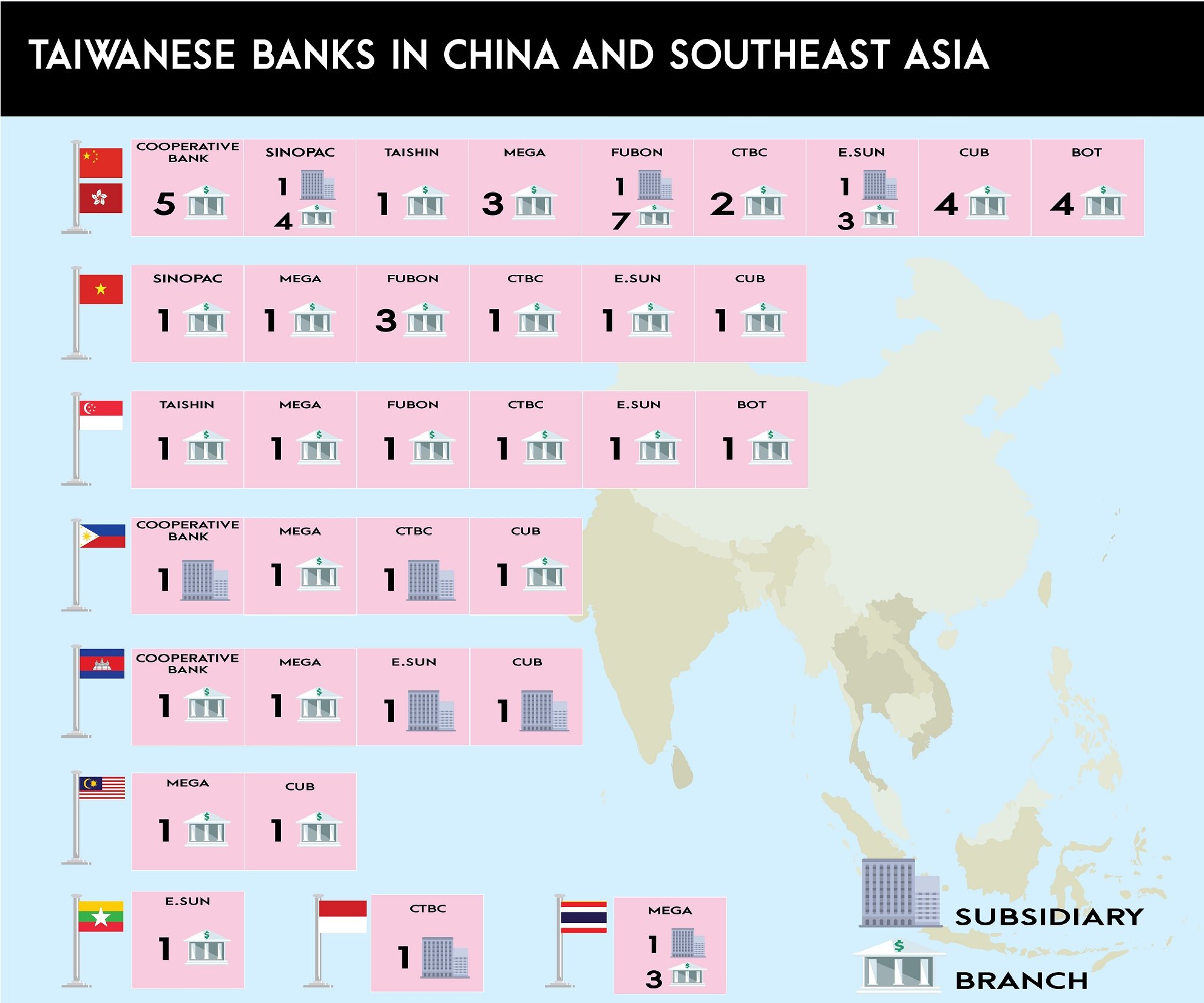

In expanding southbound, many Taiwanese banks have risen to become major Asian regional players. State-controlled Mega International Commercial Bank has about 11 branches spread across Asia including China. E.Sun Bank and CTBC have also extended their businesses to a number of Southeast Asian countries over the last five years.

But China’s allure appears difficult for any Taiwanese bank to resist. China is making banking regulations easier for foreign-registered banks to do business there. Moreover, Beijing’s Belt and Road initiative has fanned excitement across Taiwan’s business community.

John Huang, CEO at Cathay United Private Bank, believes China is a market that is too important to ignore. The bank’s clients are seeing the value of the Belt and Road initiative that is centred on infrastructure development along an ancient trade path that spans Asia and Europe. Clients will require their banks to help them navigate this infrastructure plan.

China’s move to ease restrictions for foreigners to do business in the financial sector is also attracting the attention of Taiwanese financial institutions. In March 2017, China Banking Regulatory Commission (CBRC) further liberalized regulations for foreign banks, allowing them to underwrite Chinese government bonds, run custodian businesses and provide financial advisory services without having to submit formal applications with CBRC.

This article is an abridged version of Banks seek access to China’s Belt and Road initiative, which is part of the Taiwan Report, available to subscribers on The Asset Plus and in the print edition of The Asset Magazine. Please contact us for details on how to subscribe.