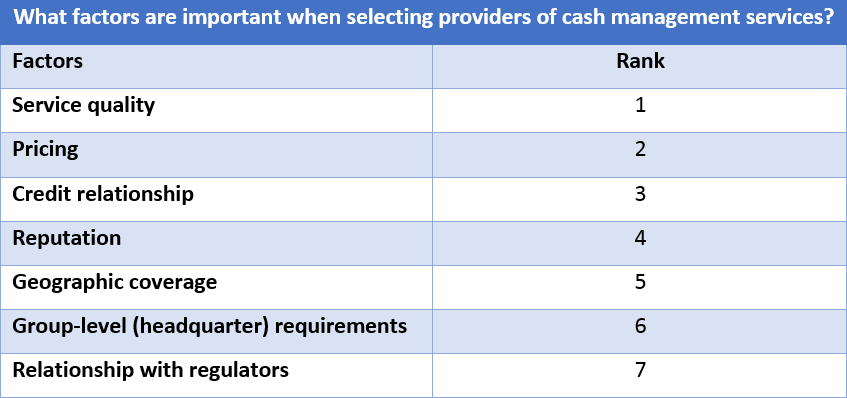

WHEN choosing a cash management provider, the number one criterion CFOs and treasurers look for is service quality. And what is more, a greater number of CFOs and treasurers increased the number of primary cash management banks they work with in the past year, than those which reduced transaction banking partners.

This is according to the latest data snapshot from Asset Benchmark Research’s (ABR) ongoing Treasury Review 2018, which has canvassed the views of 288 CFOs and treasurers so far.

One South Asian treasurer explains how over a two-year period a financial institution slowly replaced their legacy bank as a provider of cash management services. “We thought because we liked their approach and their access we started moving maybe 30% of our overall transaction value with them,” says the treasurer.

Source: Treasury Review 2018, Asset Benchmark Research

Twenty percent of CFOs and treasurers said they had increased the number of primary cash management banks they work with in the past year, while only 13% had decreased transaction banking partners. For large companies the numbers are more pronounced. Thirty percent worked with more banks over the past twelve months, and none had decreased the number of banks they worked with.

.png)

Source: Treasury Review 2018, Asset Benchmark Research

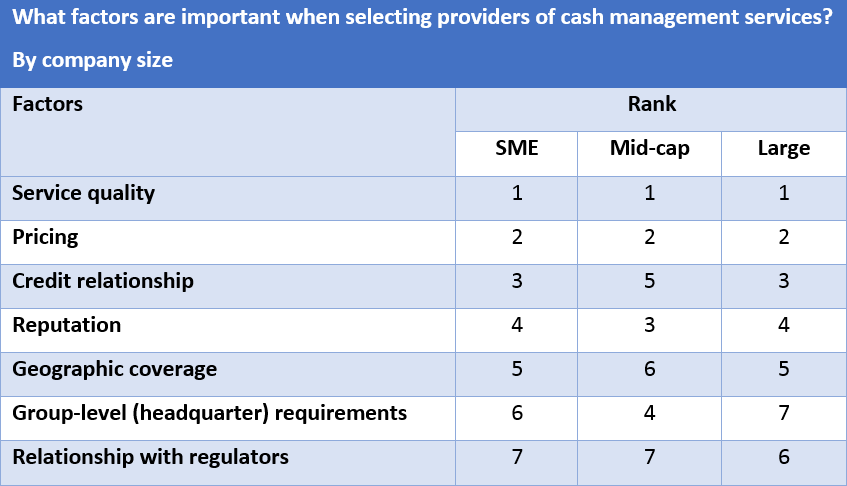

The data also show that mid-cap companies rank reputation and group level (headquarter) requirements higher than their SME and large counterparts. Mid-caps also value credit relationship less than SMEs and large companies.

In part, this may be because smaller companies tend to face tighter financing conditions and higher interest rates than mid-caps or large corporates, making the credit relationship even more important. “It’s important that we have available credit and credit facilities in place to facilitate our business,” says one treasurer.

Source: Treasury Review 2018, Asset Benchmark Research

However, SMEs, mid-caps and large companies uniformly rank service quality and pricing as the top two factors. A treasurer at a large US-headquarter MNC explains the importance of pricing and how they are concerned that banks may come back and raise prices at a later date: “We don’t want the bank coming to me in a year’s time and saying this product that we’ve offered you is unprofitable. There should be a win-win on both sides. The relationship can only work if both sides have some skin in the game,” the treasurer says.

These data are part of ABR’s ongoing Treasury Review 2018. To participate, please click here.

Find out more about The Asset 4th Asia Treasury & Trade Summit please click here

Background

Since 2014, Asset Benchmark Research has gathered the views of corporate treasurers and CFOs in Asia on their current and planned treasury activities in the annual Treasury Review.

The survey asks about a range of topics such as their treasury set up, bank relations; risk management; review of treasury solutions and their outlook for the year ahead. Corporates are asked about the challenges they face in their treasury operations both from a daily operational and long-term strategic perspective.

There is also an emphasis on reviewing how corporates leverage technology in their business either to automate payables, improve reconciliation or rationalize banking connectivity. The review is conducted in the first half of the year.