Financial technology undoubtedly heralds the future in China, and of late the idea of receivable finance is making its way into China's cross-border e-commerce space, which has recently seen increasing offshore funding needs from suppliers.

For e-commerce players that import from overseas countries and sell goods into mainland China, Hong Kong is an ideal funding and sourcing hub. Overseas subsidiaries of the registered vendors on Tmall, JD.com or NetEase Kaola are able to raise US dollars through third-party receivable finance platforms in Hong Kong.

"Large Chinese e-commerce platforms have strong demand to help their suppliers find funding sources. However, offshore banks are less likely to accept these e-commerce suppliers," says Andy Chan in an interview with The Asset and who is co-founder of Qupital, a Hong Kong based invoice finance company in which Alibaba has invested.

As of Q3 2018, over US$130 million financing has been granted to SMEs through Qupital since August of 2016.

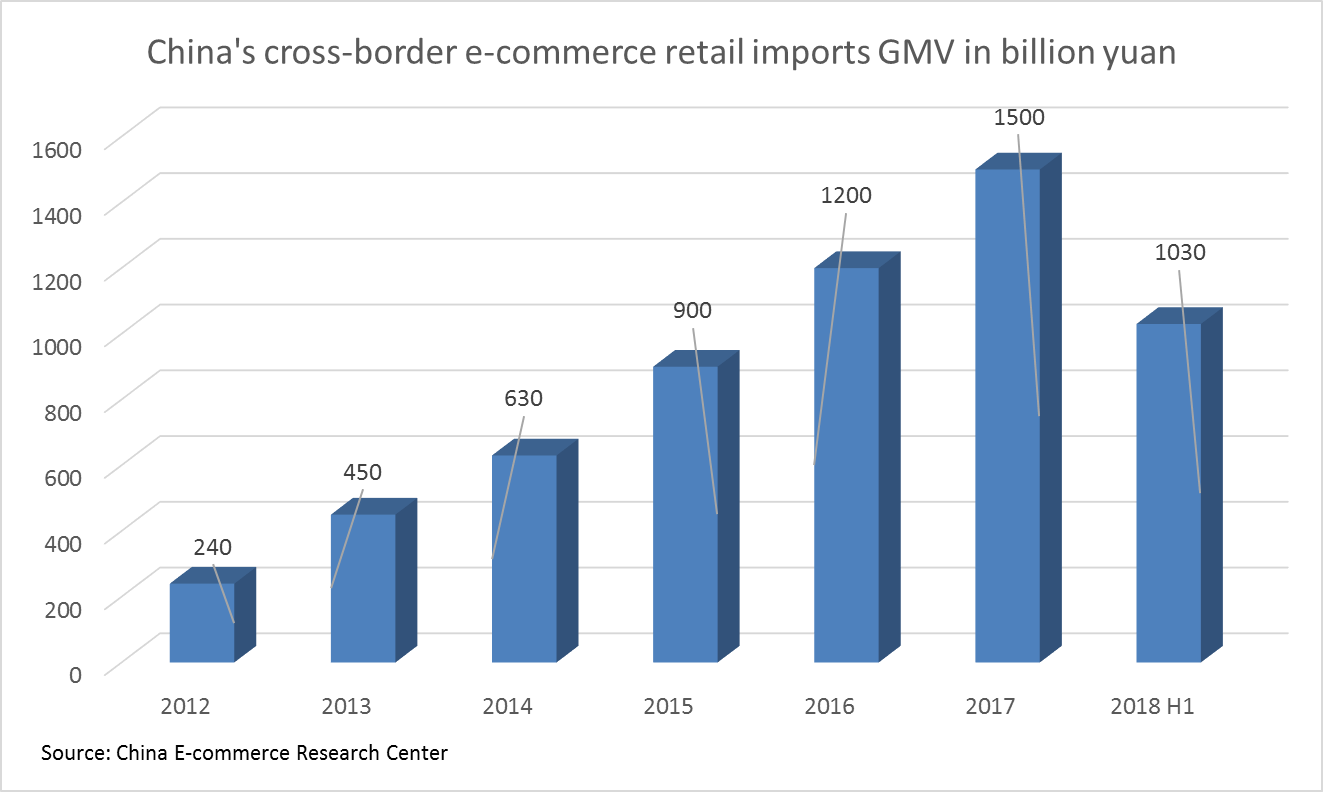

The market is still growing mainly on the back of robust consumer demand for overseas products. According to China's Ministry of Commerce, cross-border imports through e-commerce exceeded US$43.2 billion gross merchandise volume (GMV) during Nov 1st to Nov 11th. Over 19,000 international brands from 75 countries participated in Tmall's Singles' Day Festival.

As a major lender in trade finance, banks have been cautious in granting facilities to the suppliers over the past few years. With the emergence of the third-party receivable finance platforms, the financing gap has been filled to some extent and professional investors such as private banks and asset managers are now able to access the trade assets with shorter maturity.

In mainland China, trade assets are generally sold to institutional investors through securitization. In 2018 H1, 54 supply chain finance ABS were issued, totalling 49.6 billion yuan. Yet in Hong Kong, trade assets, as a relatively new asset class, have yet to deeply penetrate the market. Chan told The Asset that some investment banks have just recently pitched to Qupital to outline structuring ideas suitable for the trade assets.

On top of invoice finance, suppliers with a large number of inventories but short day sales outstanding (DSO) have also shown increasing interest in inventory finance, which is relatively risker as the liquidity and value of the inventories are the key factors, whereas receivable finance depends mainly on buyers' credit.

However, through its strategic partnership with Cainiao Logistics and Alibaba.com in 2018, Qupital has access to a vast data pool in sales, payment and logistics authorized by Alibaba, to better assess the credit of the suppliers.

"You need various types of technology to digitalize invoices and bills of lading (B/L) and the process is relatively slow for the time being. But e-commerce speeds up the whole development and helps us find out more possibilities in other areas," says Jacky Cheung, president at Qupital in an interview with The Asset.