Blockchain, API (application programming interface), big data, these are just a small sample of the new technology being made available to CFOs and treasurers over the last few years as they aim to improve efficiency.

Yet despite the constant push from service providers and technology firms to provide digital solutions, a significant number of CFOs and treasurers are still using manual processes.

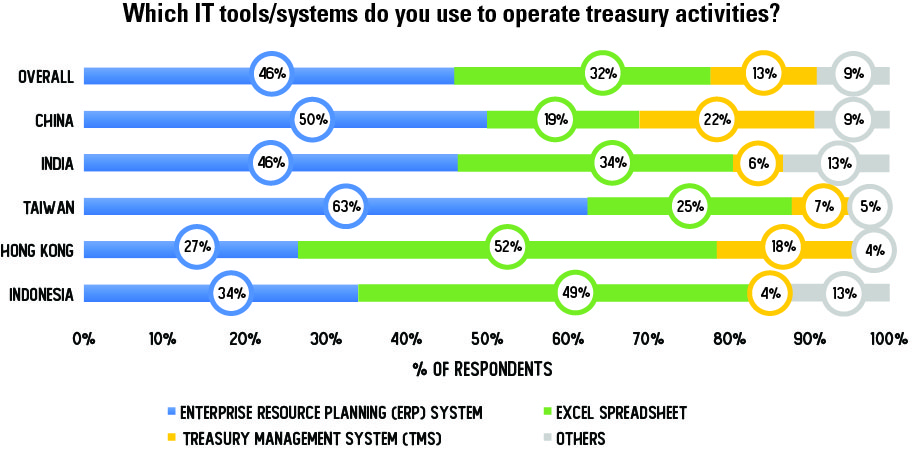

That’s according to Asset Benchmark Research’s (ABR) 2019 Treasury Review survey of close to 800 participants, which found that almost a third (32%) of respondents were still primarily relying on Excel spreadsheets as opposed to a formalized treasury management system (TMS) or enterprise resource planning (ERP) system.

Moreover, only 10% of respondents believed that their day-to-day finance processes were more than 90% digitalized. In contrast, most (34%) respondents felt that their day-to-day finance processes were less than 50%, empathizing the fact that physical paper and manual processes are still prevalent in many treasury departments today.

Of the participants that did have an ERP system in place, many (60%) of them mentioned that they had already implemented such a system regionally or globally. Highlighting the divergence of determination when it came to approaching treasury management technology, some firms are keen to try it first-hand while others prefer to take a wait-and-see approach.

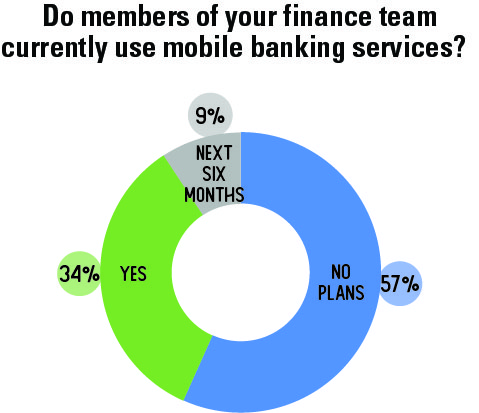

That appears to be the case for respondents when it comes to adopting mobile technology for treasury management usage.

More than half (56%) of respondents mentioned that they were not planning to use mobile banking services for corporate treasury with only 9% stating that they would adopt it in the next six months. This apparent lack of interest in mobile treasury management is more evident for larger companies with 61% of respondents from that segment saying they had no plans to use a corporate mobile banking service.

Of the survey participants that did use corporate mobile banking, most of them said account and transaction inquiry was the most common task they used the service for followed by the transfer of funds.

In fact, China-based respondents were more likely to use corporate mobile banking while Indian-based respondents would rather opt for the transfer of funds on a mobile device compared to other markets.

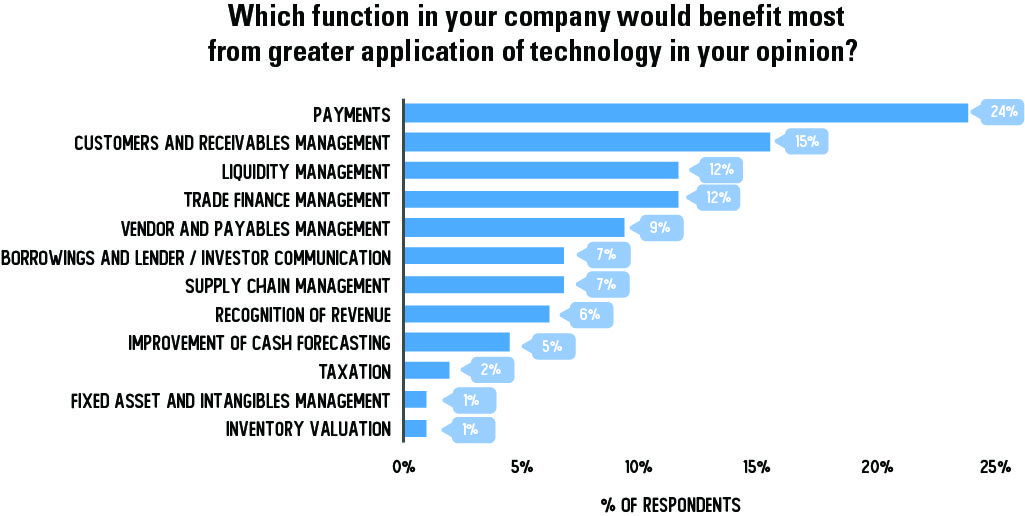

When asked which treasury technology could have the greatest impact on their operations, there were a number of answers ranging from liquidity to trade finance.

However, the improvement of payments was the most common answer. Banks such as Standard Chartered have attempted to address this issue by working with a number of mobile wallet providers such as Momo in Vietnam and GCash in the Philippines to make it easier for businesses to carry out cashless payments and collections.

Cybersecurity and the safeguarding of sensitive information is still top of mind for businesses and is currently the main hindrance when it comes to implementing digital treasury solutions according to ABR. Lack of awareness was also another prevalent obstacle holding back companies from incorporating emerging technology.

“Our business units had to quickly learn what blockchain was. It was very difficult to explain what blockchain is as it is a different way of working and getting money immediately,” says the treasurer of a Thai-based industrials company, which started incorporating blockchain in its supplier finance programme. “We need to spend more time to learn about this technology. We have to try any technology without fear.”

While there is still inaction when it comes to implementing digital treasury solutions, interest in new solutions remains strong. Among the topics CFO and treasurers want to hear about are big data, artificial intelligence and cloud computing, according to ABR.

“At the moment the technology solutions we see are not quite relevant to us. It’s about how we get the house in order before we talk about technology solutions,” explains the Asia head of treasury of a multinational chemical company regarding the prospects of emerging treasury technology.

About Asset Benchmark Research’s annual Treasury Review

Conducted since 2013, Asset Benchmark Research surveys corporates across Asia on an annual basis to understand the challenges faced by corporate treasurers and CFOs and the solutions they consider best suited to navigate financial markets. In 2019, almost 800 corporate finance representatives participated in the survey, led by decision-makers in Greater China, India and Indonesia. Based on annual turnover, 54% of respondents are small and medium-sized enterprises, 27% are mid-caps and 19% large corporations (>US$1bn turnover per annum).

Treasurers may face several challenges in embarking on the transformation journey. These challenges range from legacy infrastructure and fragmented ERP / TMS deployment to lack of awareness on how to leveraging technologies. In addition, treasurers are having to deal with the growing cost of compliance, geo-political unrests and fluctuating interest rates. These tactical priorities push transformational initiatives and corporate IT investments down the priority list. As a result, treasurers often refrain from making transformational changes to their systems and business processes. So how shall treasurers strike a balance between transformation and business continuity?