As the US initiates a trade investigation into China, tensions are rising between the world’s two largest economies. If this leads to a trade war, as some have once again suggested, China still has its defensive weapons.

The investigation, launched last Friday, is on the legal footing of Section 301 of the US’ Trade Act 1974, which authorizes the US president to take appropriate action, including retaliation, in order to convince a foreign government to remove a policy that violates an international trade agreement, or that is unjustified or discriminatory to US interests. In other words, the Section 301 investigation could result in US tariffs against Chinese interests.

In an official response, China’s Ministry of Commerce (MOFCOM) says the charges against China are not objective. “China expressed strong dissatisfaction with the unilateralism and protectionism of the US,” says a spokesperson from MOFCOM. “We urge the US to respect the truth, and US corporates to show the willingness to strengthen collaboration and bilateral trade rules. China will keep a close eye on the progress of the investigation and take all proper actions to protect the rights of China.”

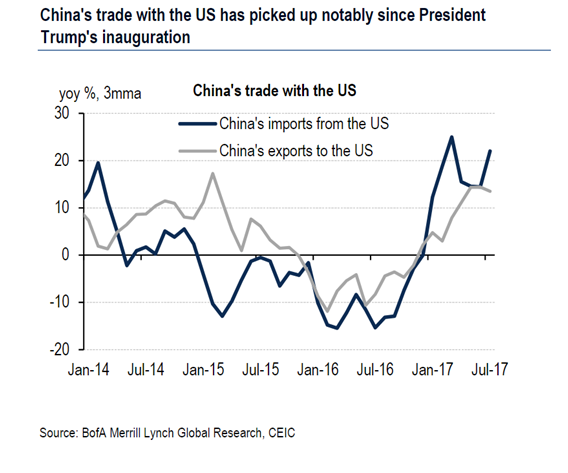

MOFCOM’s position could be attributed to China’s increasing trade activities with the US since the Trump administration’s inauguration. In the event of a trade war, it’s likely that China would place quotas, tariffs or non-tariff barriers to trade on US imports. Data from MOFCOM show that for the past ten years, exports from the US to China have increased at an annual rate of 11%. From the US, 62% of soybeans, 14% of cotton, 25% of Boeing airplanes, 17% of the automobiles and 15% of integrated circuit are exported to China.

As a world-leading aircraft manufacturer, Boeing has been selling a sizeable number of their aircraft to China, and plans to sell over 6,000 additional aircraft to China over the next 20 years. “If China decides to retaliate, not only Boeing will suffer, but also the whole manufacturing industry in US,” notes Ping Lian, chief economist of the Bank of Communications.

On the other hand, the potential restrictions on exports to the US are also a powerful strike to Trump. Data from the US China Business Council show that in 2015 the typical US household earned about US$56,500, and trade with China saved these families up to US$850 that year. According to a study from Oxford Economics earlier this year, at an aggregate level, US consumer prices are 1% - 1.5% lower because of cheaper Chinese imports.

“US citizens are expecting Trump’s trade policy to bring more wealth to them, however, a trade war could cause losses. Given the strong expectations for improvements in wealth, even a small loss to their [US citizens] wealth is unacceptable to them,” notes Lian.

In the financial world, China overtook Japan as the largest creditor to the US in June, following five consecutive months of on-loading US Treasuries. Once a trade war begins, there is the chance that China could dump US government bonds. That would be detrimental not only to the stability of US financial system, but also to the global markets.

“There is no winner in a trade war,” says Chunying Hua, a representative for China's foreign ministry, in a press conference last Thursday, echoing President Xi Jinping’s comments at the World Economic Forum in January this year, when the prospects of a trade war were first raised as Trump ascended to the White House. “We hope the relevant people can refrain from dealing with a problem in the 21st century with a zero-sum mentality from the 19th or the 20th century,” adds Hua.

“[The investigation] will likely take at least several quarters to finish and reach any conclusions,” according to research from BofA Merrill Lynch. “In our view, given the large-size of the bilateral trade between the US and China and hence the high-cost of trade disruption to both countries, the risks of a trade war remain limited.”

Derrick Hong is a staff writer for The Asset

Port of Shanghai photo: Alex Needham/Wikipedia