The Hongkong and Shanghai Banking Corporation Limited (HSBC HK) and Bank of China (Hong Kong) Limited (BOC HK) recently announced that they would no longer charge certain fees on personal saving accounts in Hong Kong, effective August 1.

These fees include maintenance fees applied to accounts below the banks' minimum balance requirements and counter transaction fees. HSBC HK said the change would benefit more than 3 million of its retail banking customers in Hong Kong.

The development is credit negative for the banks because it will reduce their revenue and profit. Based on our estimate using HSBC HK's 2018 full-year results, removing the fees will reduce its net profit by less than 1%.

The development is also negative for other Hong Kong banks because we expect more banks to follow HSBC HK and BOC HK's lead and discontinue account service fees on customer deposits. HSBC HK and BOC HK are the two largest banks in Hong Kong, with deposit shares of around 30% and 14%, respectively.

We expect that the financial effect of the fees' removal will be greater for BOC HK than HSBC HK because BOC HK's retail business is concentrated in Hong Kong, while HSBC HK's retail banking business is spread across the Asia-Pacific region.

The development reflects increased competition for retail customers and deposits in Hong Kong's retail banking industry ahead of the entrance of eight new virtual banks in the second half of this year. For new entrants, capturing customer deposits and securing funding will be among their primary challenges once they begin operations.

As such, we view the fees' removal as a preemptive move aimed at forestalling the erosion of the banks' deposit base. The move will help them defend their market share, particularly among younger and technology-savvy retail banking customers, who we expect the virtual banks to target as customers when they launch their operation. The move also aligns with the banking regulator's stated objective of financial inclusion in granting licenses for the new virtual banks.

While the development is negative for the banks from a profit perspective, it also reflects efficiency gains in the industry in recent years, which have reduced banks' costs of serving retail customers. Hong Kong banks have been encouraging customers to conduct more transactions and banking services through online, mobile and other automated channels, and this has allowed them to reduce their traditional counter services.

Banks are instead revamping their branches and devoting more staffs and retail space to providing higher-net-worth customers with more personalized services, such as wealth management and mutual fund sales. Because of regulatory requirements, the new virtual bank entrants will face higher barriers to entry in the sale of wealth management products.

Besides the effect on account service fees, increased competition will also likely weigh on HSBC HK and BOC HK's foreign exchange trading income derived from retail customers and remittance fees. Nevertheless, these two banks derive fee income from diverse retail banking services, including credit cards, stock brokerage, and mutual fund and insurance sales, and we expect them to retain profitable retail banking franchises.

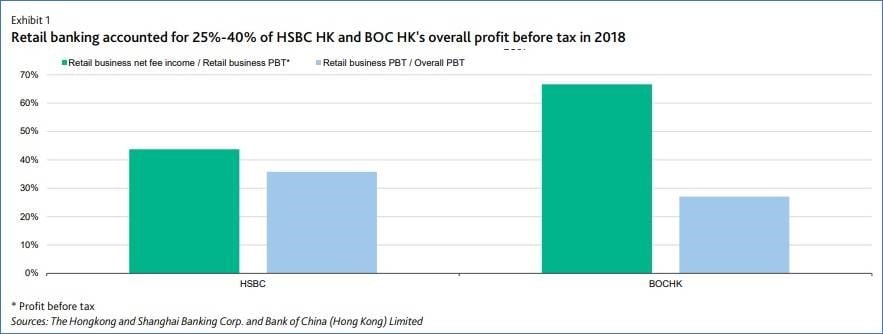

As the exhibit below shows, retail banking net fee and commission income accounted for 40%-70% of the two banks' total retail banking profit before tax in 2018, while their retail banking businesses accounted for 25%-40% of their overall full-year pre-tax profit.

Ivy Lam is an associate analyst, Sonny Hsu is a VP-Sr Credit Officer, and Stephen Long is an MD, all with the Financial Institutions Group, Moody's Investors Service.