Brazil’s government is taking encouraging steps to overhaul the country’s increasingly unsustainable social security system, whose costs are close to 40% of government spending. The pension reform plan now before the Lower House of Brazil’s Congress forms a crucial part of that overhaul, and passage of the sweeping legislation is looking more and more likely.

The pension reform may allow the Brazilian central bank to cut its key Selic rate, which should provide a tailwind to equity and fixed income local markets, boosting portfolio flows and adding to an already-robust external balance picture.

In recent months we have become more optimistic on the prospects for Brazil taking steps toward getting its fiscal house in order. Our expectations for the passage of a pension reform bill this year were reinforced last month at a meeting with Lower House Speaker Rodrigo Maia and a small group of investors. This major legislation includes an increase in the retirement age, which will require amendments to the country’s constitution and needs bipartisan congressional support to become law.

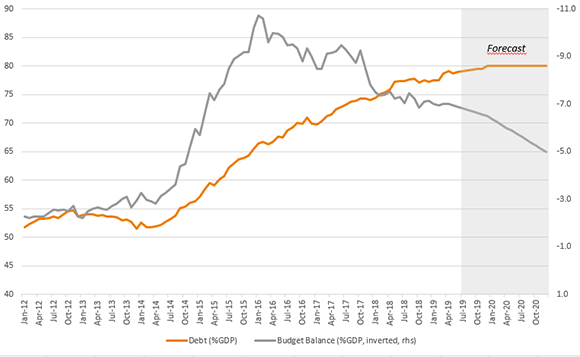

The importance of fiscal reform for Brazil cannot be overstated. As the chart shows, several years of increasing deficit spending have pushed public finances to their limit, risking the crowding-out of other spending such as investment and education and breaches in existing spending cap rules in coming years. Pensions are the largest component of social security spending, which already accounted for almost 40% of public sector spending last year.

The government has responded with a draft bill that was approved by the Lower House’s Special Committee earlier this month. A full floor vote on the main text was quickly passed by a far wider margin than analysts had expected. Following votes on amendments, the second-round vote is expected in the first week of August. A similar process will be followed in the Senate before a final bill can be signed by Brazilian President Jair Bolsonaro.

For investors, two factors so far have been reassuring. First, the dilutive process of amending the government’s proposal has been relatively benign, preserving the bulk of expected savings. We now expect a final figure of between BRL 850 billion (US$225.90 billion) and BRL 900 billion over the next 10 years, with annual savings increasing over time as retirees transition to the new structure. This would be considerably higher than our previous BRL 500-700 billion forecast and would equate to approximately 2% of GDP by 2027.

Brazil Public Sector Debt & Budget Balance

Source: Banco Central do Brasil, NN IP estimates

Secondly, the unexpectedly broad support for the bill demonstrates that the various factions within the legislature and the government can still work together to solve major issues. While President Bolsonaro’s relation with Congress is often perceived as somewhat antagonistic, he is likely to find continuing support for his economic agenda. As fiscal deficits will remain large in the foreseeable future, even after pension reform is passed, this support will remain critically important for further efforts such as tax reform and government asset privatizations.

We should also add a note of caution on the outlook. The Brazilian economy is likely to grow at a meagre sub-1% rate this year and will struggle to accelerate in 2020, as fiscal tightening and weak global markets override the effects of monetary easing. Assuming pension reform passes by the end of Q3, the central bank may cut by as much as 100bp by early next year, bringing its key Selic rate to 5.5%. This should provide a tailwind to equity and fixed income local markets, boosting portfolio flows and adding to an already-robust external balance picture. But the scope for acceleration in growth or an appreciation of the real is limited. The key test will be how quickly the fiscal balance can be reduced to more sustainable levels and whether the government will be able to stabilize the debt at around 80% of GDP, which is our base case for now.

These expectations have impacted positioning in our global EMD portfolios. In hard-currency space, we prefer debt issued by corporates and state-owned enterprises (SOEs) to sovereign debt, primarily owing to Economy Minister Roberto Guedes’ micro-reforms that have benefitted the private sector. Unattractive sovereign valuations also play a role.

In local debt, we have reduced exposure in rates after an extended period of flattening but are maintaining an overweight in the real. Further reform progress and signs of green shoots in the economic data could push the currency back below 3.6 to the US dollar. We have also been positive on the corporate sector with the expectation that reforms will support consumer and business sentiment, benefitting issuers with higher exposure to domestic demand. Technical factors should also help and we expect offshore eurobond issuance to be limited in the near term.

Marcelo Assalin is head of emerging market debt at NN Investment Partners.