While most high net worth individuals (HNWIs) worldwide strive for consistent financial gains, Asia-Pacific HNWIs, in particular, are looking to balance healthy returns with social beneficial investments.

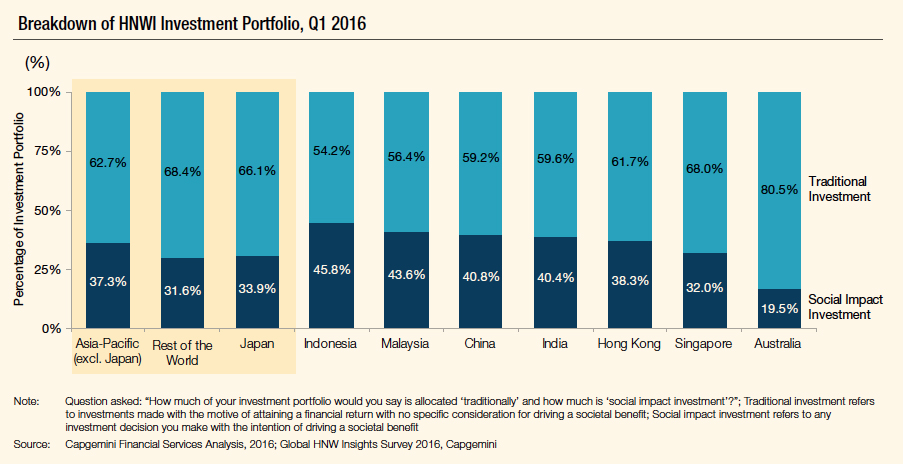

According to Capgemini’s Asia-Pacific Wealth Report 2016, affluent investors in the region tend to have around 37.3% of their portfolio geared towards social impact investing compared to 31.6% in portfolios seen elsewhere in the world.

Within the region, emerging countries such as China, India, Malaysia and Indonesia are seeing the most interest with this type of investment style. Capgemini’s report states that close to 60% of Asian HNWIs surveyed will gradually aim to increase their allocation to social impact investing within the next two years compared to 50% elsewhere.

Over 70% of survey participants from Indonesia, India and Malaysia are planning to move capital towards socially good causes.

The relatively young population of Asia’s HNWI is being cited as one of the main drivers for growth in social impact investing. The majority (63.2%) of HNWIs under-40, for example, has their sights set on increasing this style of investment over the next two years. While only 46.8% of HNWIs over the age of 60 are looking into this.

“Some young multinational billionaires are inspired by philanthropy. Growing up at a time of rapid social change, they are eager to put their resources to work for social good,” notes UBS/PwC’s billionaires report.

Social impact investing can take various different forms but they tend to revolve around investment into charities, social impact bonds, SRI (socially responsible investing) funds etc. Social impact bonds (SIB) in particular have been earmarked for their potential to allow additional capital into the nonprofit sector.

However, their popularity has been stagnant. In the US, only 12 SIB deals have been launched since 2012 raising only around US$140 million in initial private investment compared to the estimated US$1.7 trillion US-based non-profit institutions receive on an annual basis.

SRI funds on the other hand which seeks to invest into a publically traded ethical company have been quite popular in the wealth management realm. In the United States, the SRI funds industry assets under management (AUM) has tripled in size over the past several years from US$641 billion to close to US$2 trillion in size.

Overall, it is clear that social impact investing is here to stay as Asian HNWIs aim to deploy their wealth for useful purposes. “The growing interest puts the onus on wealth management firms to make social impact investment discussions an integral part of a holistic approach to wealth management,” comments the Asia-Pacific Wealth Report 2016.