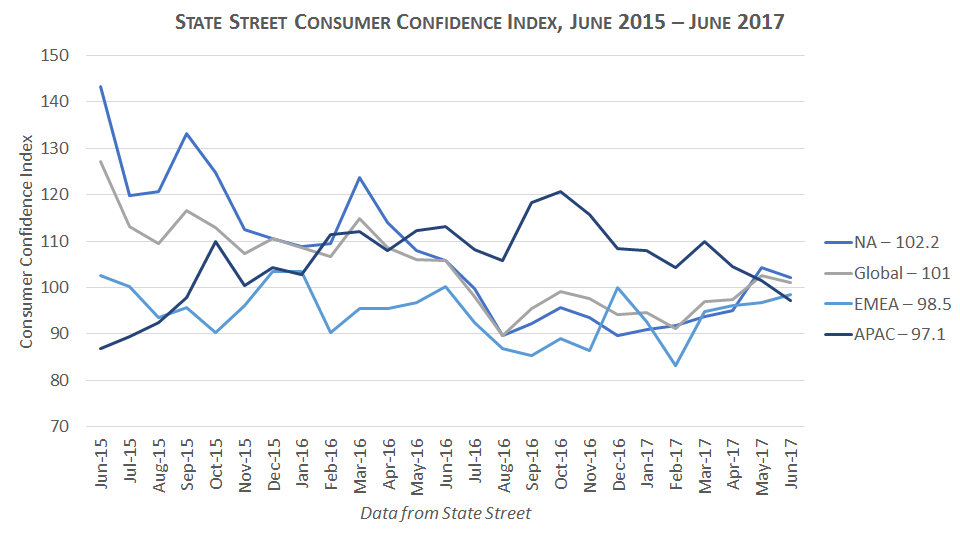

The State Street Asian Investors Confidence Index declined to its lowest reading since August 2015, and now stands at 97.1 points, down from 101.5 points in May.

The Asian ICI was consistently higher than Europe and America for over a year going back to May 2016, but has recently plummeted from its position of consistently having the highest confidence, to now the region with the lowest confidence.

The trend follows a steady decline in Asian investor confidence since a peak of 120.7 in September last year. The Asian ICI now also represents a reading below the neutral score of 100, at which investors are neither increasing nor decreasing their long-term allocations to risky assets.

The Investor Confidence Index measures investor confidence or risk appetite quantitatively by analyzing the actual buying and selling patterns of institutional investors. The index assigns a precise meaning to changes in investor risk appetite: the greater the percentage allocation to equities, the higher risk appetite or confidence.

Confidence among investors globally and in North America also declined with the Global ICI standing at 101.0, down from May’s revised reading of 102.6, and the Northern American ICI falling 2.0 points to 102.2. Meanwhile, the European ICI increased by 1.7 points, from 96.8 to 98.5.

“May's note of optimism after months of de-risking did not strengthen in June, with the Global ICI numbers hovering over the neutral 100-level mark,” comments Ken Froot, developer of the ICI, at State Street. “Even in North America, while the index remains in a ‘risk-on’ territory, the decline in investor confidence was likely driven by intensified concerns around overvaluation, oil prices and the US energy policy, as the Fed delivered its second rate hike in 2017.”

“Sentiment remains rather subdued across regions as investors do not appear to enthusiastically endorse the steady climb of risky asset valuations,” adds Timothy Graf, head of Macro Strategy, EMEA, State Street Global Markets. “The neutral read on investor behaviour disproves the notion of market complacency in the face of many latent risks.”