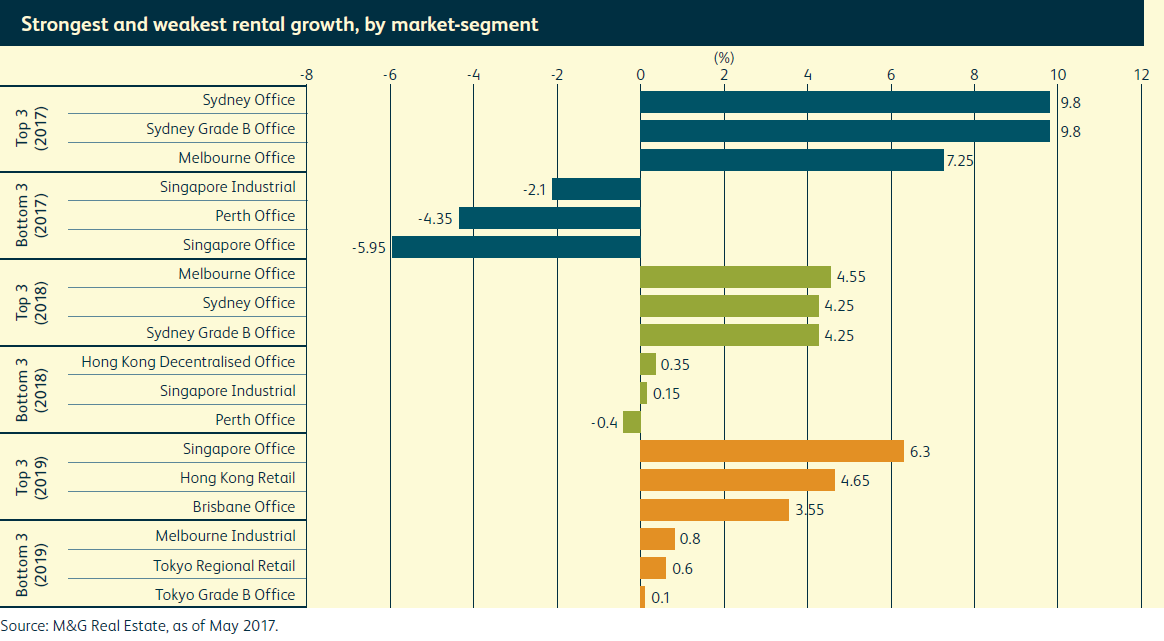

In the Asia-Pacific property markets, the Sydney and Melbourne office markets are expected to outperform in terms of rental growth over the next two years. Singaporean industrial and Perth office markets are expected to lag behind, although the Singaporean office market is expected to recover in 2019.

This is according to the recent M&G Real Estate Asia-Pacific Outlook report. According to the report, rental growth is anticipated to remain modest for the majority of markets, given most sectors are expected to be in the mid-to-late part of the rental upcycle, and the Brisbane office market may be best positioned for a cyclical recovery, while offering relatively higher spreads to government bonds.

Rental growth in Sydney office is expected to be 9.8% in 2017 and Melbourne office at 7.25%. This slows to around the 4.25%, 4.5% mark, respectively, in 2018. The Singapore office market is expected to recover in 2019, with a predicted growth of 6.3% up from a contraction in 2017. Other markets expected to perform well in 2019 are Hong Kong Retail (4.65%) and Brisbane office (3.55%).

Among risks for the Asia-Pacific, M&G consider a Japanese post-Olympic recession and quickening pace of a US Federal Reserve interest rate hike as most likely, above an early US recession, China credit shock or Korean war, which are seen as less likely.

M&G identify different trends across property sub-sectors, as summarised below:

The office sector is expected to be driven mainly by domestic corporate demand as tech-related industries and business services remain active. Occupiers are expected to demand a high-standard of amenities.

In retail, suburban malls are likely to remain relatively resilient, e-commerce will likely drive increases in food and beverage and experience-based retail, with continued demand from retailers for established prime locations.

In the logistics market, e-commerce should continue to drive demand from third-party logistics providers. Ageing populations will increasingly demand delivery services, and automation of warehousing should help reduce labour costs.

.jpg)