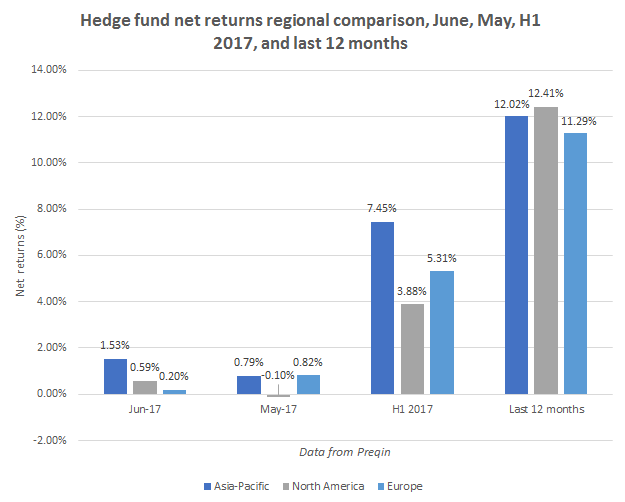

Hedge funds in Asia-Pacific saw net returns of 7.45% in the first six months of 2017, outperforming North American (3.88%) and European (5.31%) hedge funds, according to recent data from Preqin.

This was spurred on by a strong performance in June in Asia-Pacific of 1.53% net returns, compared to just 0.59% in North America and 0.20% in Europe. North America still saw the highest net returns for the last 12-month period (12.41%), although Asia-Pacific (12.02%) still pulled ahead of Europe (11.29%).

Overall, in 2017 the hedge fund industry continued its recent run of consistent gains, returning 0.57% in June, and six-month returns of 4.87%, making it the highest H1 performance since the first half of 2009 (16.94%).

It is also the first time since 2007 in which the first six months of the year have all recorded positive returns, and the eighth consecutive month of positive performance for the industry, surpassing the seven-month period recorded in March-September 2016.

“Despite negative investor sentiment at the start of the year, over the past six months the hedge fund industry has recorded one of its strongest H1 performance periods since the Global Financial Crisis. Although we have not seen large monthly gains, consistent performance has bolstered the asset class’ returns, and 12-month performance is now in double digits,” comments Amy Bensted, head of hedge fund products at Preqin.

Equity strategies funds saw the highest returns for the last six months (6.47%), followed by event driven strategies (5.07%) and multi-strategy funds (5.03%). Conversely, CTAs saw negative returns of -0.57% over the last six months. Discretionary funds continued to outperform systematic vehicles, with returns of 5.99% and 3.17% respectively in the first six months of 2017.

“Despite growing interest from hedge funds in AI and machine learning technology, the gap between the performance of discretionary and systematic funds continues to widen: over the past 12 months, discretionary funds have now made twice the gains seen by systematic vehicles. Continued investment themes globally – including a more hawkish attitude from central banks, as well as more settled markets in Europe and Asia – have allowed discretionary fund managers to pull ahead of their systematic counterparts,” adds Bensted.