EMERGING market (EM) debt is on track to deliver yet another year of strong returns after facing a period of significant headwinds.

The macroeconomic picture looks much brighter and credit spreads have tightened through post-crisis averages to reflect the positive fundamentals. Do emerging market bonds still offer value despite the rally? This article will delve into the asset class to help readers understand where the opportunities lie.

Global GDP growth is expected to pick up in the next two years from the 3.2% yoy that we experienced in 2016, providing a positive macro backdrop for EM economies, which are expected themselves to grow at 4.8% in 2018, according to the IMF.

Besides positive growth dynamics, EM economies have become healthier, moving from a BB rating 10 years ago to a BBB- in aggregate. They have reduced current account deficits by 2% as a percentage of GDP since the ‘fragile five’ period, with the exception of the oil-dependent Middle East.

Currency reserves remain steady at 31% as a percentage of GDP and inflation remains in check. On the corporate side, fundamentals are improving as well, with defaults halving from the 5% recent peak levels last year, and leverage is falling. All in all, the EM asset class is in better shape to withstand any external shocks, such as rising US rates or a stronger USD.

EM debts continue offering attractive value and yield

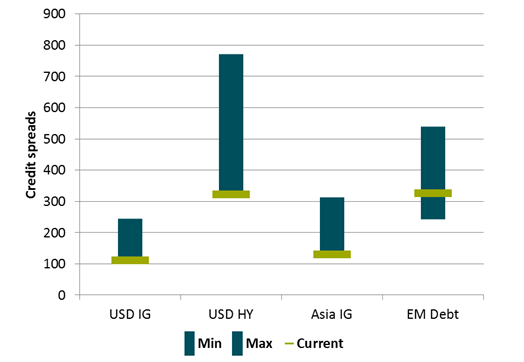

Looking at the historical range and current credit spreads of several fixed income asset classes (Figure 1), we can see that many markets are trading very close to the tightest levels that we’ve experienced in the post-global financial crisis period. Hard currency emerging market debt (EMD), on the other hand, still has room to tighten.

Figure 1: Historical range and current credit spreads of several fixed income asset classes

Source: M&G, Bloomberg, March 30 2010 to July 28 2017

Do these tigher spreads signal that the EMD asset class is no longer attractive? No, we believe with these diminished risks, spreads can tighten further on the whole and choosing the right mix between government and corporate bonds, local and hard currency, together with careful country and security selection, can help to maximise returns and mitigate capital loss; a flexible approach to EMD investing provides the widest opportunity set.

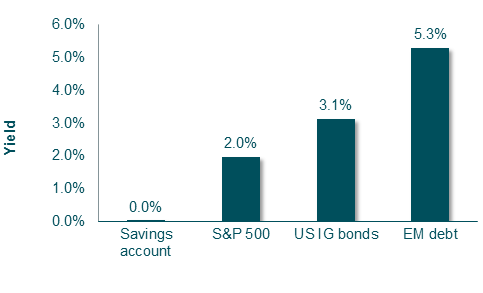

Furthermore, tighter spreads should not be an automatic sell trigger as the yield earned on these bonds can continue to compound month after month even if spreads trade sideways going forward. On top of all of these reasons, EM debt remains one of the only areas in the investment universe that can deliver investors a healthy relative yield, as shown below.

Figure 2: Average yield in different asset classes

Source: M&G, Bloomberg, July 31 2017

Flexible and selective approach minimises investment risks

In contrast to these opportunities, there are clear risks in the market and we are careful about our exposure to these areas. The first is higher US rates. While this risk is less challenging than in the past as current account positions have improved and EM countries are less reliant on US dollar-denominated debt.

However, rising US interest rates can cause a headwind for other emerging economies, such as the heavily dollarized Sub-Saharan Africa region. We believe countries with lower debt levels or higher reliance on domestic funding, such as Russia, Brazil, and selectively in Eastern Europe, should be able to better navigate this environment.

Other risks in the outlook for emerging bond markets that still need to be monitored closely include fluctuating oil and commodity prices, China’s economic deceleration, as well as Brexit and its impact on Europe. While weighing up such relevant considerations, we think attractive opportunities can still be found through a flexible and globally diversified approach to emerging market bond investing.

The EMD universe provides an incredibly diverse, global set of opportunities to invest. While Asia tends to have higher quality economies, this is very much reflected in valuations and thus are not highly attractive. EM Asia, as a whole, trades on a spread of 160bp over US Treasuries, not offering a significant yield pick up.

On the other hand, while Latin American or African economies have more significant issues, the spread pick up is more than double around 390bp. EM Europe is benefiting from the continued recovery in the Eurozone and thus spread of 225bp reflect that good news. We are finding high conviction ideas within each region, but are broadly overweight in South America and Africa and underweight in EM Europe and Asia.

Latin America

Within South America, we’re overweight Argentina and Peru, but underweight Brazil. Argentina may raise some eyebrows as the country has defaulted four times since the 1980’s, however the new market-friendly government is making progress. The recent century bond sale is a attestation to the improvement of external investor relations, growth is slowly picking and the very inflationary environment is coming down with the new floating exchange rate in place. The country still has significant challenges ahead, including addressing its weak fiscal position, however with yields around 7% and the positive momentum, we have conviction in Argentina.

Asia

Although we are underweight in Asia, we’ve been increasing our exposure this year, and are positive on the domestically oriented country of India. We like its solid economic performance, encouraging momentum on reforms and local currency yields of 7%. The country also has a low correlation to increases in US rates. We also like Indonesian local currency bonds, but prefer to stay away from Malaysia, which has a high level of external debt (66% of GDP) compared to the average in EM Asia (17%) and significant off-budget spending that may not be consolidated at the government level. Our internal credit analysis puts Malaysia a couple of notches lower than its current A- rating.

Soft currency

We currently do like select local currency bonds, although we carefully balance the risk and volatility of choosing to do so over hard currency bonds. Although many EM currencies have recovered after the severe falls in 2014 and 2015, we believe there still in value and like the Indian Rupee, Indonesian Rupiah, Peruvian Sol and Polish Zloty.

In conclusion, while the emerging market debt has had a strong showing in the past 18 months, emerging market countries have improved and we are optimistic about the balance of opportunities and risks we see in the market. On a relative basis, spreads look like there is room for further tightening despite the potential for further rate hikes in the US.

We continue to believe that flexibility remains key for successfully investing in the emerging bond markets, with the freedom to hold bonds and currencies that offer the best relative value and avoid countries or industries where the outlook is unfavourable.

Jeik Sohn is investment director for Asia at M&G Investments