|

A leading independent research and consultancy firm reveals that assets invested in ETFs and ETPs listed globally reached a new high of US$ 5.12 trillion in July. This was on the back of net inflows of US$41.13 billion, which marks the largest monthly net inflows since January, when the global ETF/ETP industry experienced net inflows of US$105.73 billion. These startling insights were gleaned from ETFGI's July 2018 Global ETF and ETP industry landscape insights report. Major revelations contained in the report include:

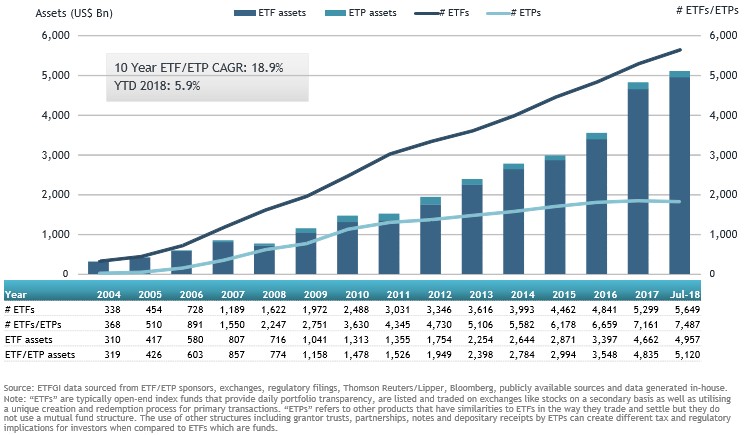

"Investors favoured equities over fixed income and commodities as equity markets have performed positively in July. The S&P 500 gained 3.72%, international markets ex US were up 1.93% and emerging markets up 2.81%. Investors are still concerned about the impact of trade wars and Brexit," says Deborah Fuhr, managing partner and a founder of ETFGI. At the end of July 2018, the Global ETF/ETP industry had 7,487 ETFs/ETPs, with 14,427 listings, assets of $5.12 trillion, from 375 providers listed on 70 exchanges in 57 countries. Due to net inflows and market moves the assets invested in ETFs/ETPs listed globally increased by 2.69%, from $4.99 trillion in June 2018 to $5.12 trillion. Growth in Global ETF and ETP assets as of the end of July 2018 July marked the 54th consecutive month of net inflows into ETFs/ETPs listed globally. The majority of net inflows in July can be attributed to the top 20 ETFs by net new assets, which collectively gathered $25.86 billion during 2018. The SPDR S&P 500 ETF Trust (SPY US) gathered $6.54 billion, the largest net inflows in July. |

now loading...