Vast numbers of Asian family-owned companies have spawned a massive market capitalization and are generating huge wealth, according to a recent report by Credit Suisse Research Institute (CSRI). Mainland China and Hong Kong, in particular, dominate the non-Japan Asia family-owned business space.

"This year we find family-owned businesses are continuing to outperform their peers in every region, every sector, whatever their size," says Eugène Klerk, head analyst of thematic investments at Credit Suisse.

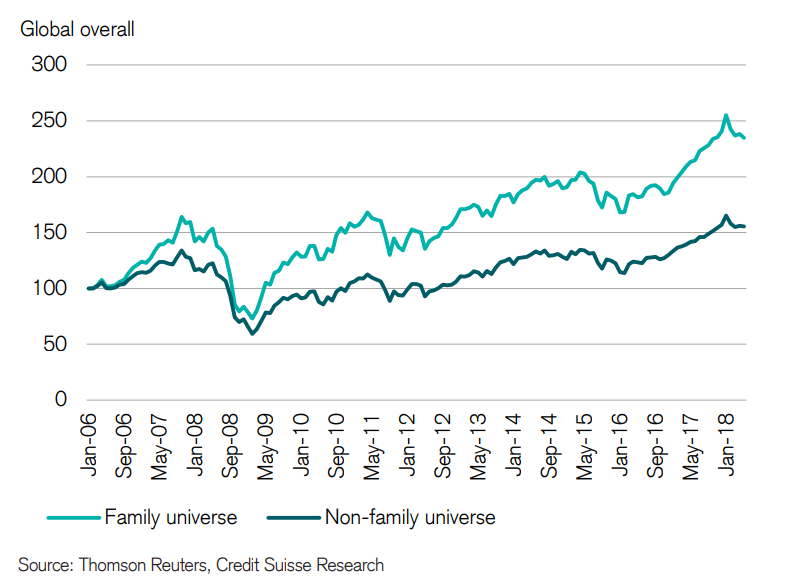

According to the report, family-owned businesses outperform broader equity markets across every region and sector on a long-term basis. Family-owned businesses deliver stronger revenue growth in all regions and higher levels of profitability, which in turn supports the relative strong share price appreciation seen since 2006.

Family-owned companies have outperformed non-family owned companies since 2006

"We believe this is down to the longer-term outlook of family-owned businesses relying less on external funding and investing more in research and development," says Klerk.

The financial performance of family-owned companies is superior to that of non-family-owned businesses, the report reveals. Revenue growth is stronger, earnings before interest, tax, depreciation and amortization (EBITDA) margins are higher, cash flow returns are better and gearing is lower.

In 2017 alone, non-Japan-Asia-based family-owned companies generated 25.63% greater cash flow return on investment (CFROI) than their non-family owned counterparts, and delivered 4.2% outperformance in annual average share price return since 2006.

Out of the top 50 most profitable family-owned companies globally, 24 were from Asia, according to the report. Asia-based family-owned companies generated much higher returns than their global peers, with an annual average revenue growth of 19.5% over the past 10 years, compared to 6.3% in North America and 7.4% in Europe.

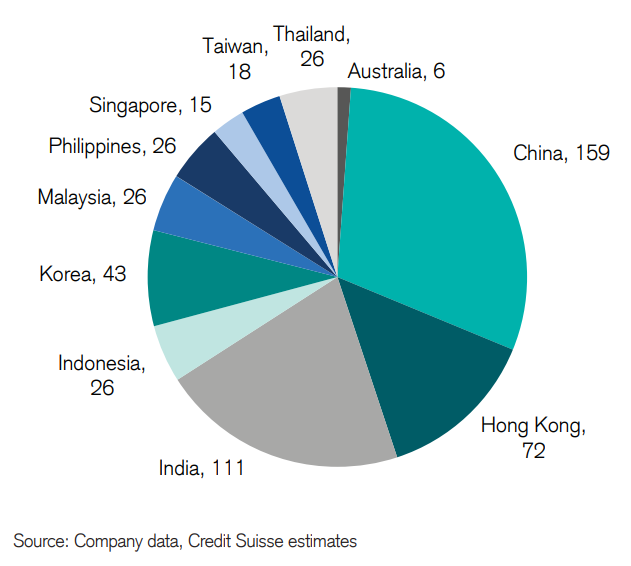

In non-Japan Asia, China and Hong Kong family-owned businesses dominate, making up 44% of the universe. Among the top 50 most profitable family-owned companies, China takes seven of them with a total market capitalization of US$522.5 billion.

It may sound like a cliché but China is pivotal to the financial performance of the Asian region regarding the family-owned business sector. For instance, Chinese family-owned companies top the chart among their Asian peers, with a 21.7% annual average share price return since 2006.

Furthermore, with the highest representation in terms of the number of family-owned companies, China (159 companies) tops the chart globally, followed closely by the US (121 companies) and India (111 companies).

Number of family-owned companies by country

In terms of market capitalization, China, India and Hong Kong dominate Asia, with a combined market capitalization of US$2.85 trillion (or 71%) of the market share of the Asia universe. Korea comes in fourth place, with 43 companies (US$434.1 billion market capitalization), followed by Indonesia, Malaysia, the Philippines and Thailand, each with 26 companies. Australia has the smallest representation in the family business universe in Asia, with six companies and US$39.5 billion in total market capitalization.

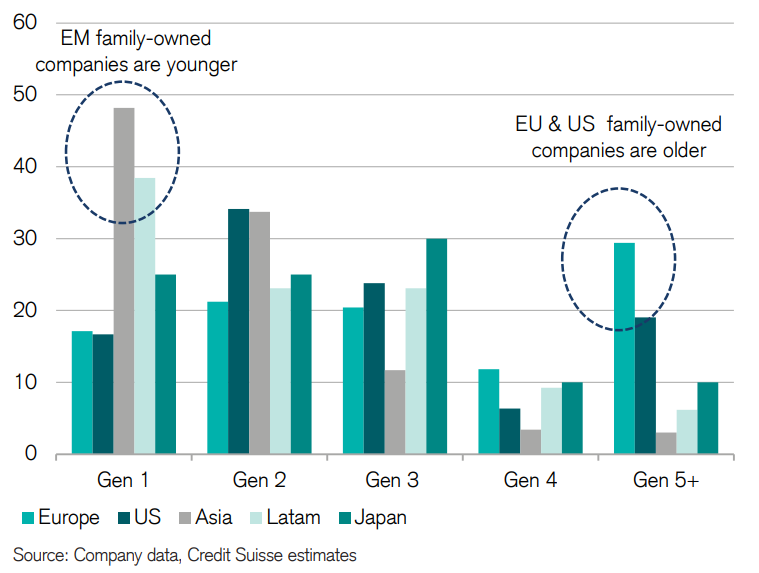

Another interesting finding from the report is that Asian family-owned companies are much younger. Companies in emerging countries - such as non-Japan Asia and Latin America - tend to be younger. Almost 50% of the companies in this region are first generation family or founder-owned, the report shows.

Companies in Europe and the US, on the other hand, tend to be older - about 30% of European companies are fifth generation family-owned or older.

Breakdown of family-owned companies by generation in different regions

The CSRI report covered 11 markets in the Non-Japan Asia region, which continue to dominate and represent a 53% share of the universe, with a total market capitalization of over US$4 trillion. The CSRI analyzed over 1,000 family-owned, publicly-listed companies, ranging in size, sector and region, looking at their performance over 10 years compared to the financial and share price performance of a control group consisting of more than 7,000 non-family owned companies globally.