All eyes were on the Fed in July, as investors eagerly anticipated a US interest rate cut. The month ended with little sign of progress in US-China trade talks and negotiators agreed to meet again in September, prolonging an uneasy truce.

Global equities eked out positive gains in July, despite falling on the last day of the month on Fed interest rate guidance. The MSCI All Countries World Index has delivered over 15% so far this year. Performance across regions was mixed in July. US equities rallied as reporting season started.

With almost 70% of the S&P 500 having reported earnings, over 75% have so far surprised to the upside. This follows a significant reduction in earnings expectations going into the quarter. Japan finished the month in positive territory while Europe and Emerging Markets lagged.

Sterling came under significant selling pressure against major currencies, as comments from the UK’s new Prime Minister Boris Johnson ramped up concerns for a “no deal” Brexit. The US dollar rallied, sending the pound to a 30-month low.

Elsewhere, central bank purchases of gold lifted demand to three-year highs. As global trade tensions continue to simmer and economic growth slows, authorities have been seeking to diversify their reserves away from the US dollar.

From a sector perspective, technology continued to lead, with semi-conductors outperforming by a significant margin. Energy and materials performed the worst.

Markets had been expecting a US rate cut as the July Fed meeting drew to a close. And that’s what they got, a 25-basis point rate cut, the first cut for over a decade.

In the current rate-hike cycle, all nine increases were done in 25-basis point increments. Some observers had, however, hoped for a 50-basis point cut, which would have been a positive catalyst for stock markets.

Markets looked to the Fed’s forward guidance for clarity on whether the committee sees the cut as a one-off or as the beginning of a rate-cutting cycle. Fed Chair Jerome Powell described the move as a “mid-cycle adjustment to policy” suggesting this was likely an insurance policy against global risks.

With the Fed delivering its much-anticipated rate cut, the interest rate differential between the US dollar and other currencies continues to fall. While the news was already priced in, it confirms the transition from divergent monetary policy to a more homogeneous one, with US growth and bond yields converging to those of the rest of the world.

What does this mean for the US dollar? In the wake of Powell’s comments, the dollar rose to a two-year high. There has been no reversal of the US dollar’s strength from 2018, merely a slowing of its appreciation.

The Fed is easing to support growth against a backdrop of still fairly resilient domestic data, while the ECB looks to be easing to counter a continued shortfall in domestic demand. These still-divergent fundamentals should spur further dollar strength. For decades, the most consistent driver of the dollar has been the difference in growth between the US and the rest of the world.

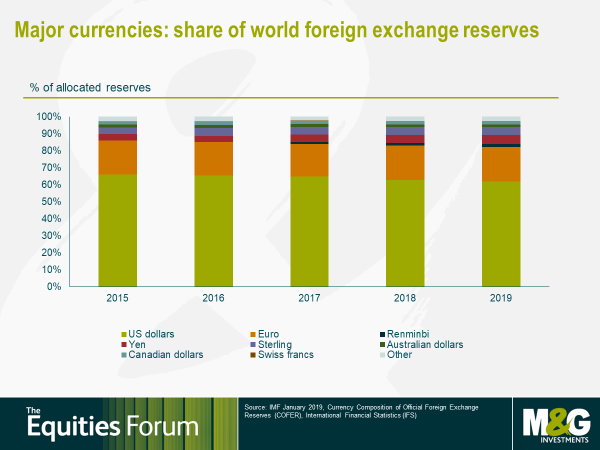

However, in an environment of weak global growth, investors will continue to favour the US currency as a safe haven, especially if we see any tremors in risk assets. The dollar’s share of global foreign exchange reserves has slipped in the 10 years since the financial crisis, but at 62% of the total, it still dwarfs rivals.

The dollar’s resilience has caused considerable frustration in the Trump administration. Against a well-performing US economy and sustained rate hikes, the broad trade-weighted measure of the US dollar is up 22% in the past decade, touching a 17-year high in June.

The president is keenly focused on supporting the domestic economy ahead of elections in 2020 and has been pushing for rate cuts for some time. While not permitted to directly influence the Fed, he continues to urge the central bank to lower rates to help weaken the US dollar.

There is speculation about whether the US Treasury could resort to direct FX intervention, if Fed cuts alone do not suppress dollar strength. Unilateral intervention cannot be ruled out. The US Treasury does have the authority to do so and has done so in the past. While this may be effective in the short term, it could raise volatility and signal that “trade wars” have broadened to “currency wars”.

It's hard to identify a major trading partner that would be willing to cooperate in multilateral intervention in the absence of a global economic shock. Arguably though, the first round of the currency war started more than five years ago, when the Bank of Japan unleashed massive asset purchases and the ECB introduced negative interest rates, indirectly weakening their currencies.

Currency manipulations can distort trade and growth, while their ultimate success is uncertain. Politically driven intervention to help lower the dollar could be successful, but it could also trigger a risk-off period - a new chapter in the trade war. Fears of retaliation would only add to the risks.

The dollar has a unique position in the global economic system – its strength is driven by several variables, in particular global growth. As growth struggles to find firmer ground, the dollar could continue to hold up well, as the dominant store of value.

Ritu Vohora is investment director, equities, M&G Investments.