A growing number of retail investors and small enterprises in the Greater Bay Area, particularly those in the mainland, are looking beyond their borders to transfer assets and grow their wealth, but issues regarding buying and maintaining cross-border financial products remain a major concern.

According to a recent study by the Hong Kong Trade Development Council and accounting major PwC, about 80% of GBA enterprises surveyed are interested in looking at cross-border financial products in the coming 12 months, with a strong demand for asset transfer and wealth management services.

However, investors remain concerned about the inconvenience of maintaining cross-border assets. This is particularly evident among mainland respondents who are interested in tapping the Hong Kong market.

“For wealth management, this inconvenience means that it is still very difficult to set up trading accounts and transfer funds in [large amounts] remotely. In the wealth management space, unless [Hong Kong] financial institutions offer more attractive returns that are competitive to what mainland customers could get from local institutions, there is limited upside there for these customers,” says Priscilla Dell’Orto, leader in Bain’s financial services and customer strategy & market practices, adding that the same issue exists in the insurance space.

But the strong demand is there. On top of the outstanding 8% GDP growth the GBA recorded for 2020, which indicates huge opportunities in further developing the wealth management industry, there is actually substantial demand for cross-border financial products in the area.

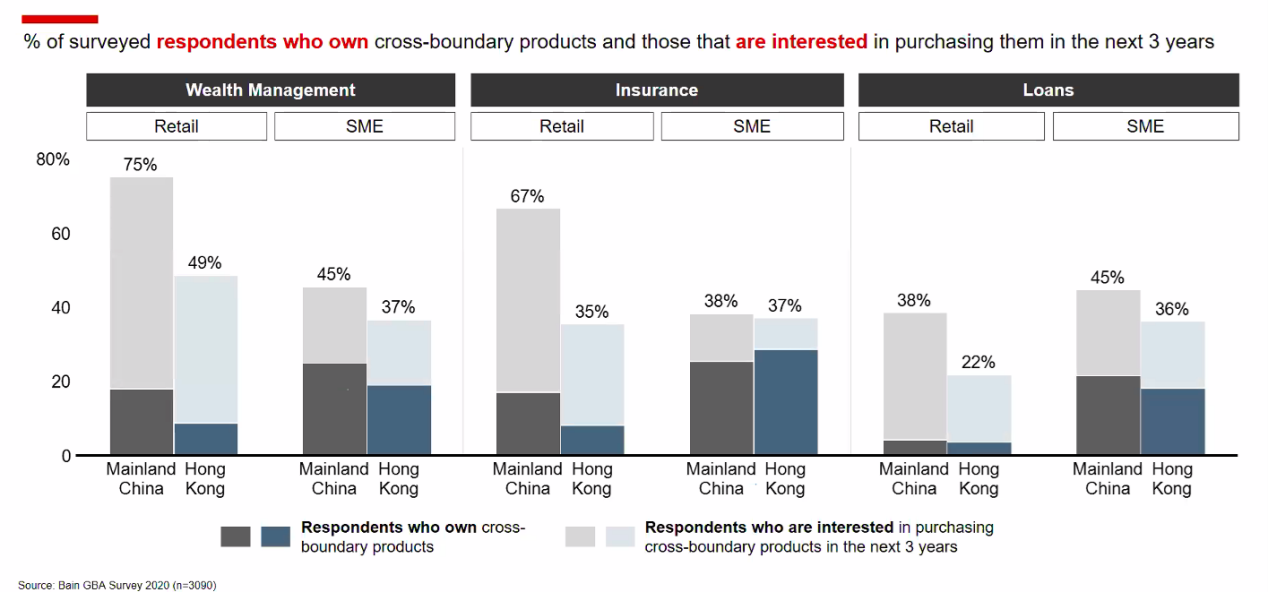

Mainland retail investors and small and medium enterprises are generally holding more cross-border products than their Hong Kong counterparts, and expect to increase their investment in wealth management and insurance products in the next three years, according to Bain’s recent GBA survey.

The main reasons given by mainland retail investors include the ability to gain exposure to international markets, better advice, and better trust in products and regulations. In the insurance space, they expect Hong Kong to offer better product features and customer experience, plus they have greater trust in the territory’s products and regulations, the survey finds.

On the other side of the border, there is notable demand for mainland insurance services such as cross-border medical care, life insurance and auto insurance. “Close to 70% of Hong Kong customers are interested in cross-boundary insurance products and 20% of them are interested in savings and retirement products,” says Herbert Lee, leader in Bain’s financial services practice, noting that this is related to their plans of retirement in mainland Chinese GBA regions.

Though several pilot schemes for cross-border financial products have been introduced and despite the strong market demand, many financial institutions are still waiting for further plans to be announced under the GBA scheme, especially detailed rules for a “Wealth Connect”. But given the market demand and potential opportunities, financial institutions should take action now, according to Bain. It suggests that banks and insurers in the GBA should now take “no-regrets” moves such as launching marketing campaigns, staying attuned to regulatory announcements, and engaging in the pilot schemes if possible.

“It is now a good time, especially after the political actions that have taken place in 2020, to think through more strategic mid-term topics on the product side, sales side and operating side,” says Henrik Naujoks, head of Bain’s Asia-Pacific and Greater China financial services practices. These mid- to long-term topics could include innovative products and services tailored to the needs of the GBA market, cross-boundary digital and omnichannel experiences, and an operating model that fits the growth of the bay area.